- Fed continues to see three rate cuts for 2024

- Investors add back to the June cut probability

- Focus shifts to next week’s core PCE index

- The data comes out on Friday at 12:30 GMT

Fed appears more dovish than expected

The Fed appeared more dovish than expected at its highly anticipated March gathering on Wednesday, with the updated dot plot still pointing to three quarter-point rate cuts for 2024.

Despite the upgrades in growth and inflation forecasts, officials just removed only one 25bps cut from their 2025 rate projections, while at the press conference following the decision, Fed Chair Powell said that recent high inflation readings had not changed the narrative of slowly easing price pressures.

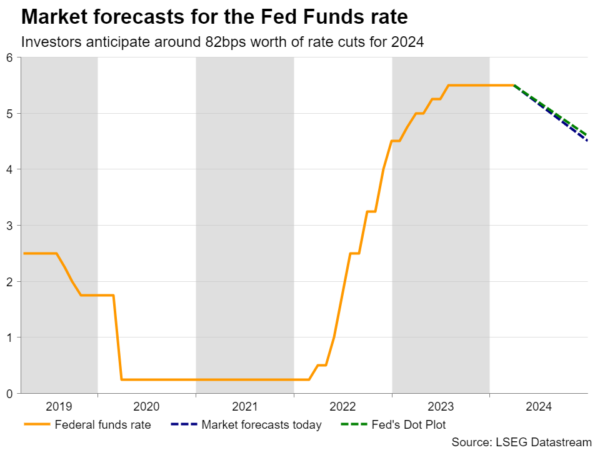

The outcome came as a disappointment to those expecting the Fed to signal two rate reductions by the end of the year, and thus the dollar tumbled in the aftermath of the decision as market participants added back to their rate cut bets. According to Fed funds futures, the probability of a first cut in June has risen to around 80%, with the total number of basis points worth of reductions expected by December increasing to 82.

Dollar bulls stay in the game, await PCE data

That said, dollar bulls did not abandon the game, initiating new long positions after the Swiss National Bank (SNB) surprisingly cut interest rates on Thursday and as the Bank of England appeared more dovish than expected, with Governor Bailey repeating that they are not yet at the point where they can cut interest rates, but adding that with inflation coming down, things are moving in the right direction.

Investors are now assigning the same 80% chance for all three major central banks – the Fed, the ECB, and the BoE – to deliver their first 25bps cut in June. As they try to clear the picture, the data point that may attract investors’ attention next week is the core PCE price index for February, the Fed’s favorite inflation metric, which is accompanied by the personal income and spending figures for the same month.

Risks may be tilted to the upside

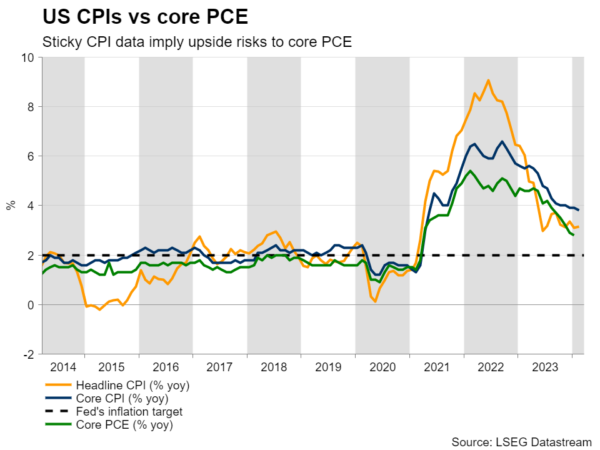

Core CPI inflation ticked down to 3.8% y/y in February from 3.9%, but that was higher than the 3.7% projection, suggesting that core PCE may also prove to be higher than anticipated. Although Powell has already mentioned that the stickiness in recent inflation data is not a reason for the Fed to alter its plans, a higher-than-expected core PCE rate accompanied by strong income and spending prints could raise fears of accelerating inflation in the months to come.

After all, the S&P Global PMIs revealed that selling prices rose at the fastest pace in just under a year, corroborating that notion. On top of that, the Atlanta Fed GDPNow model points to a solid 2.1% seasonally adjusted anneal growth rate for the first quarter of 2024, while both the University of Michigan and New York Fed 1-year inflation expectations remain at 3.0%, suggesting that consumers believe that the Fed’s 2% will not be met even in a year’s time.

Sticky inflation could further boost the dollar

With the US economy continuing to fare better than its major peers, data pointing to sticky inflation may slowly start convincing market participants again that the Fed may not need to rush into cutting interest rates in June. Even if this is not the case, anything pointing to earlier rate reductions elsewhere may allow the dollar to continue recovering ground.

Euro/dollar came under strong selling pressure on Thursday, after it hit resistance at 1.0943. The slide continued on Friday with the pair now hovering near the 200-day exponential moving average (EMA), slightly above the 1.0795 support zone, marked by the lows of February 28 and 29.

A decisive break below that area could encourage the bears to dive all the way down to the 1.0695 barrier, marked by the low of February 14, or even the next key support at around 1.0665. For the near-term outlook of this pair to change, the bulls may need to lift the price above the round figure of 1.1000.