- RBNZ among the few central banks maintaining a tightening bias

- ANZ prompts investors to place rate hike bets

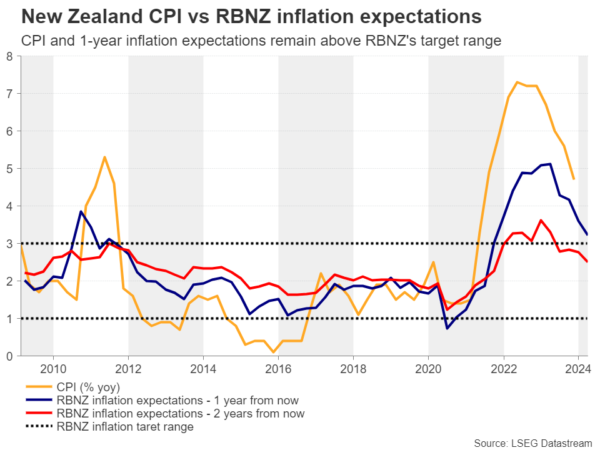

- Inflation slows but remains well above RBNZ’s target range

- The Bank meets on Wednesday at 01:00 GMT

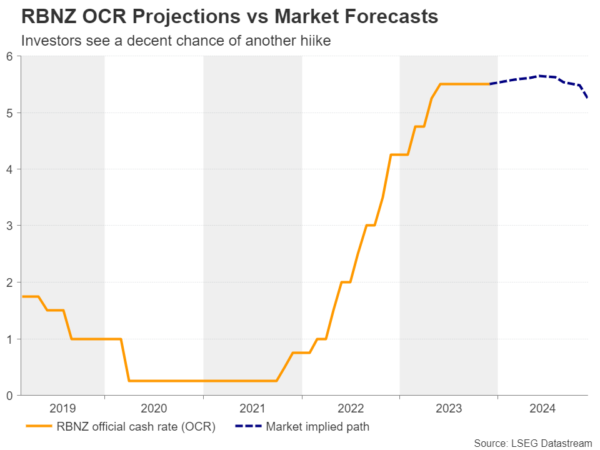

Investors see decent chance for another hike

The Reserve Bank of New Zealand (RBNZ) is among the few central banks that are maintaining a tightening bias on concerns about ongoing inflationary pressures. At its latest gathering, on November 29, the Bank kept interest rates steady at 5.5%, but noted that should inflation prove stickier than anticipated, the Official Cash Rate (OCR) would likely need to increase further. What’s more important is that they revised their OCR projections up to signal a high probability of another rate hike by the end of 2024.

Nonetheless, although the kiwi gained back then on policymakers’ hawkish stance, investors were not convinced that another hike could be on the cards. They only changed their minds a couple of weeks ago, after the Australia and New Zealand Banking Group (ANZ) said it expects the RBNZ to lift its official cash rate by another 50bps to 6%. They clarified that they believe a 25bps hike will be delivered this month and another one in April.

Currently, investors are assigning around a 30% probability for a quarter-point hike at next week’s gathering, with that percentage rising to around 60% in May. That’s still a more cautious approach than the ANZ’s projections, but is it justified? Could the RBNZ actually hit the hike button this coming Wednesday?

Economy contracts but inflation and wages remain sticky

Data after the November meeting revealed that the economy unexpectedly contracted 0.3% q/q in Q3, and that the CPI slowed notably to 4.7% y/y from 5.6% in Q4. However, not only does the CPI rate stand well above the upper bound of the RBNZ’s target range of 1-3%, but the Bank’s 1-year inflation expectations remain above that boundary. On top of that, the employment report for Q4 revealed a tighter than expected labor market, with the labor costs index accelerating to 1.0% q/q from 0.8%, driving the y/y rate only fractionally lower to 3.9% from 4.1%.

All these numbers, combined with recent remarks by RBNZ Governor Orr that there is still more work to be done to bring inflation to target, suggest that indeed there is a decent chance for policymakers to raise interest rates by another 25bps, even as soon as next week.

How may the kiwi respond to the decision?

With the market assigning a 30% chance for such a move, if a quarter-point hike is delivered, the kiwi is likely to add to its gains, especially if officials continue to signal that should inflationary pressures persist, interest rates could go even higher.

For the kiwi to fall notably and the outlook to turn bearish, not only does the Bank need to stand pat, but also to drop its hiking bias, a scenario that seems to be the least likely. Yes, the kiwi could still slide if officials stand pat but keep the bias untouched, but should upcoming data add to inflation concerns, the kiwi could rebound again on expectations that eventually the Bank will hike at one of its upcoming meetings.

From a technical standpoint, kiwi/dollar emerged above the key resistance (now turned into support) zone of 0.6155 on February 20, thereby completing a short-term triple bottom formation. This suggests that the bulls are likely to stay in the driver’s seat for a while longer.

The next obstacle on their way north may be the 0.6275 zone marked by the high of January 12. A break higher could put the 0.6370 barrier on their radar. That zone has been acting as a ceiling for more than a year. On the downside, the move signaling that the bears have stolen all the bulls’ weapons may be a dip below the recent lows of 0.6050, which acted as both support and resistance during the past year.