Gold price rose during early trading on Wednesday, after being stuck within a narrow congestion in past three days.

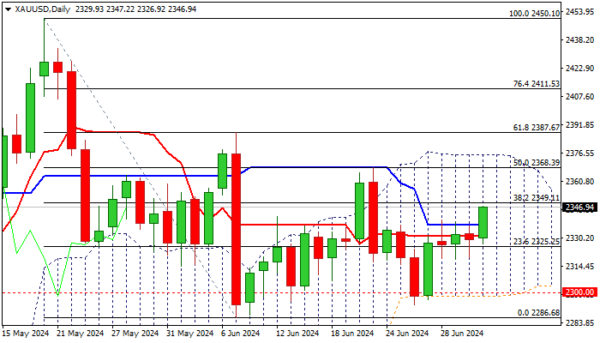

Fresh strength hit the highest in almost two weeks, though the wider picture shows the price moving within larger range ($2368/$2286) for the past couple of weeks.

Traders look for fresh direction signals, with Fed monetary policy and geopolitical situation being metal’s key drivers.

Markets await release of the minutes of FOMC last meeting (due later today) to get more information about Fed’s next steps, after the central bank’s Chairman Jerome Powell said on Tuesday that the US was in disinflationary path, but Fed needs more data before starts cutting rates.

The data from the US labor sector are also in focus, with ADP report from private sector due today and more significant NFP release on Friday.

Technical picture turned firmly bullish on lower timeframes and improved on daily chart, although no clear direction to be expected while the price action stays within current range (also defined by the boundaries of daily Ichimoku cloud).

This signals that traders could play the range as long as short-term action is in sideways mode, with violation of any of range boundaries $2368/75 (50% retracement of $2450/$2286 / daily cloud top) at the upside or $2300/$2286 (psychological / daily cloud base / June 7 low) at the downside, to generate initial direction signal.

Res: 2350; 2368; 2375; 2387.

Sup: 2325; 2319; 2300; 2286.