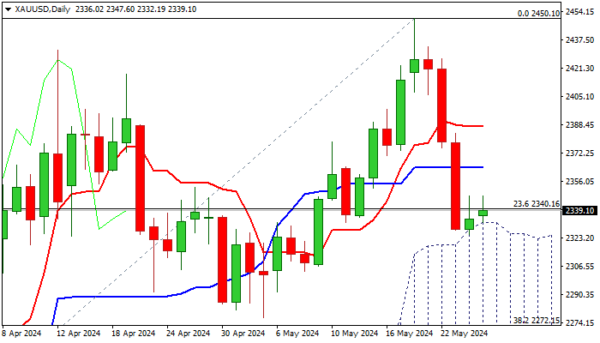

Gold price edges higher in early trading on Monday after last week’s 5% pullback from new record high found solid ground at $2327/25, provided by the top of thick rising daily Ichimoku cloud.

Partial profit taking lifted the price, although recovery was mild so far and facing headwinds from initial barrier provided by 20DMA ($2348).

Technical studies on daily chart show positive momentum and oversold stochastic, which is supportive for recovery, but MA’s are in mixed setup and partially cloud bullish outlook.

Recovery needs to register close above upper pivots at $2373/76 (Fibo 38.2% of $2450/$2325 / 10DMA) to firm the structure and open way for attack at next key barriers at $2387 (50% retracement) and $2400/02 (psychological / Fibo 61.8%) above which to signal an end of a healthy correction and shift near-term focus. fully to the upside.

On the other hand, the downside remains vulnerable in the current configuration, but daily cloud provides good support and near-term action is expected to remain biased higher while the price stays above the cloud.

Lower volumes due to US holiday likely to keep the metal’s action in a quieter mode on Monday, while traders await release of US PCE Index, Fed’s preferred inflation gauge (due on Friday, May 31) which will provide more details about Fed’s action in coming months and generate stronger direction signals.

Caution on penetration of rising daily cloud which would increase downside risk and expose key support at 2300 (psychological / 55DMA) and $2277/72 (recent range floor / Fibo 38.2% of $1984/$2450).

Res: 2348; 2363; 2376; 2387.

Sup: 2332; 2320; 2300; 2277.