Yen is trading broadly higher in otherwise sluggish Asian session today. The central focus remains on whether BoJ will implement another interest rate hike at its upcoming announcement on July 31. Media reports suggest that some BoJ officials are concerned about weak consumer spending, which complicates their decision-making. The possibility of postponing the rate decision until the July meeting to gather more data is being considered by some officials, as they look to see if this year’s strong wage growth will indeed boost consumer spending. Either way, this month’s decision is expected to be down to the wire, with key economic indicators such as this week’s Tokyo CPI and next Wednesday’s retail sales data playing crucial roles in the final determination.

In other market developments, the selloff in commodity currencies continues, with Australian Dollar and New Zealand Dollar facing significant pressure. Canadian Dollar, however, is faring slightly better. Following Yen’s lead, Swiss Franc and Dollar are also showing strength, while he Euro and Sterling positioned in the middle of the pack. It’s noted that European majors and Dollar are trading within a narrow range against each other, suggesting that their positions could shift easily depending on upcoming market dynamics. However, the stalled recovery in both EUR/USD and GBP/USD suggests that Dollar may be gearing up for another potential rebound, especially if global risk sentiment deteriorates.

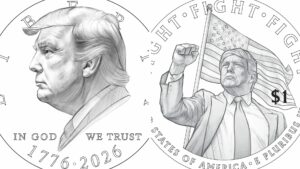

Technically, NZD/USD’s fall from 0.6621 extends further and takes out 61.8% retracement of 0.5851 to 0.6221 at 0.5992 with conviction. Also, the break of near term falling channel support indicates downside acceleration. Decline from 0.6221 is likely resuming whole fall from 0.6368. Near term outlook will stay bearish as long as 0.6047 support turned resistance holds. Deeper fall should be seen through 0.5851 support, and possibly through 0.5771 too, to 100% projection of 0.6368 to 0.5851 from 0.6221 at 0.5694.

In Asia, at the time of writing, Nikkei is up 0.05%. Hong Kong HSI is down -0.16%. China Shanghai SSE is down -0.62%. Singapore Strait Times is up 0.54%. Japan 10-year JGB yield is up 0.0028 at 1.068. Overnight, DOW rose 0.32%. S&P 500 rose 1.08%. NASDAQ rose 1.58%. 10-year yield rose 0.021 to 4.260.

AUD/CAD struggles as impact of interest rate policies sidestepped

Australian Dollar continues to face significant headwinds, largely due to ongoing worries about the Chinese economy—the most significant trading partner. Despite the possibility of RBA raising interest rates while other global central banks are adopting easing policies, this potential policy divergence is currently providing little support for the Aussie. Market focus has shifted away from these interest rate considerations, at last for the time being.

Recent developments, including China’s Third Plenum last week, have left investors disappointed due to the lack of substantial measures announced to revitalize the slowing Chinese economy, currently grappling with deflation risks and a troubled housing market. The People’s Bank of China’s unexpected rate cut yesterday, although aimed at addressing these issues, was perceived as too modest to make a significant impact.

Adding to the complexity is the uncertainty surrounding the upcoming US presidential election. Overnight reactions in the US stock market to Joe Biden’s withdrawal from the presidential race—and Kamala Harris stepping in as the Democratic candidate—were initially positive. However, the realistic possibility of Donald Trump securing a victory poses concerns, particularly regarding his trade tariff policies, which could exacerbate the economic slowdown in China

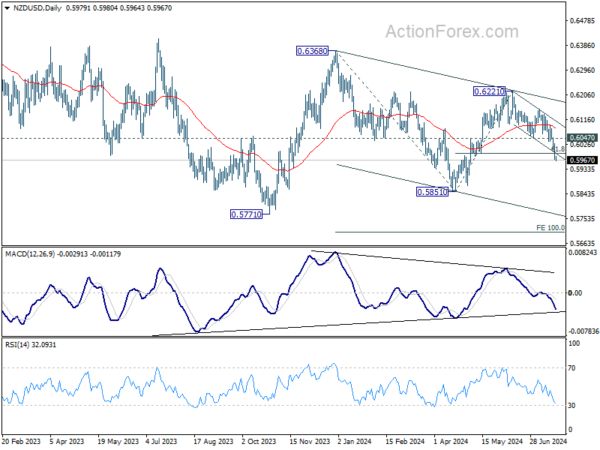

AUD/CAD’s decline starkly illustrates that interest rate policies are not the primary driver for the Aussie at this time. With BoC’s anticipated rate cut this week and uncertainty over whether RBA might hike rates again, the currency pair should theoretically have more room to rally. But the cross has indeed turned south.

Technically, considering bearish divergence condition in D MACD, a medium term top could have been formed at 0.9262, just ahead of 100% projection of 0.8562 to 0.9063 from 0.8779 at 0.9280. Near term focus is on 55 D EMA (now at 0.9108). Decisive break there would at least send AUD/CAD to 38.2% retracement of 0.8562 to 0.9262 at 0.8995, with risk of further fall to channel support (now at 0.8872).

Looking ahead

The economic calendar remains near empty today. US existing home sales and Eurozone consumer confidence are the only features.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 202.15; (P) 202.88; (R1) 203.86; More…

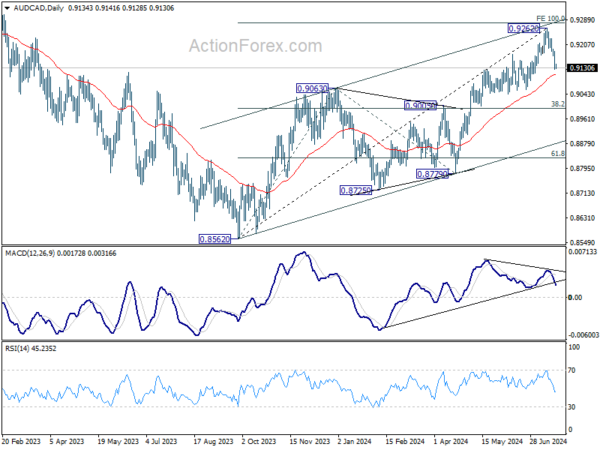

Intraday bias in GBP/JPY remains on the downside for the moment. Fall from 208.09, as a correction to whole rise from 178.32, is in progress. Sustained break of 55 D EMA (now at 201.13) will target 38.2% retracement of 178.32 to 208.09 at 196.71. Nevertheless, break of 204.20 resistance will retain near term bullishness and bring retest of 208.09 high.

In the bigger picture, medium term outlook will stay bullish as long as 188.63 resistance turned support holds. Long term up trend remains in favor to continue through 208.09 at a later stage. However, firm break of 188.63 will be a strong sign of bearish trend reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 14:00 | USD | Existing Home Sales Jun | 4.00M | 4.11M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul P | -13 | -14 |