Japanese Yen and Swiss Franc are seeing significant upward momentum today. As news flow has been very slow, these safe-have currencies’ are likely partly supported by the extended decline in benchmark treasury yields across the US and Europe. This movement also suggests an underlying risk aversion among investors, although the downturns in European indices and US futures remain relatively moderate.

The development raises speculation about whether traders are preemptively positioning themselves in anticipation of the upcoming ISM Services and US Non-Farm Payroll data later this week. Another pivotal arises: will the markets interpret negative surprises in the upcoming data as genuinely unfavorable, or will the recent “bad news is good news” scenario continue to prevail? In any case, June promises to be a turbulent month, closing out the first half of the year with potentially significant volatility.

In the broader currency markets, Dollar is trailing behind as the distant third strongest, outpaced by the appreciating Yen and Swiss Franc by a mile. Australian Dollar is notably weaker, leading New Zealand and Canadian Dollars as the worst, while Euro and Sterling are positioned in the middle of the pack.

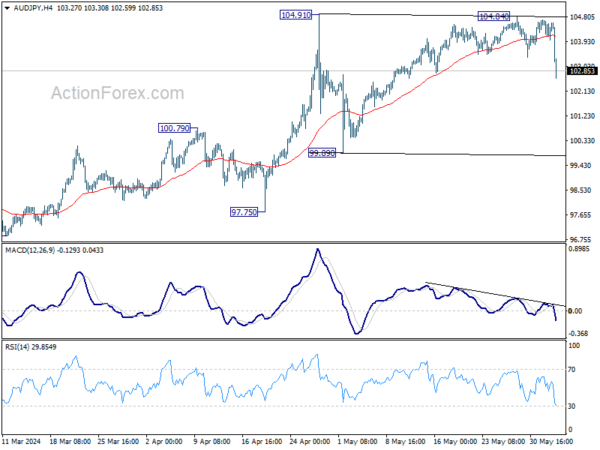

Technically, AUD/JPY’s steep decline suggest that a short term top was formed at 104.84 already, on bearish divergence condition in 4H MACD, ahead of 104.91 resistance. Fall from 104.84 is seen as the third leg of the corrective pattern from 104.91. Risk will now stay on the downside as long as 104.84 resistance holds, even in case of recovery. Further fall should be seen towards 99.89 support.

In Europe, at the time of writing, FTSE is down -0.28%. DAX is down -0.63%. CAC is down -0.34%. UK 10-year yield is down -0.0268 at 4.196. Germany 10-year yield is down -0.032 at 2.547. Earlier in Asia, Nikkei fell -0.22%. Hong Kong HSI rose 0.22%. China Shanghai SSE rose 0.41%. Singapore Strait Times fell -0.30%. Japan 10-year JGB yield fell -0.031 to 1.037.

Swiss CPI unchanged at 1.4% yoy in May, core CPI at 1.2% yoy

Swiss CPI was steady at 1.4% yoy in May. Core CPI was also unchanged at 1.2% yoy. Domestic product inflation was unchanged at 2.0% yoy. Imported products inflation fell from -0.4% yoy to -0.6% yoy.

Comparing with the prior month, CPI rose 0.3% mom in. Core CPI rose 0.2% mom. Domestic product rose 0.5% mom while imported products rises was flat for the month.

BoJ’s Ueda: Monetary policy adjustments possible if inflation rises

BoJ Governor Kazuo Ueda addressed the parliament today, indicating that the central bank is prepared to adjust its level of monetary support if underlying inflation accelerates as forecasted. Ueda added, “If our economic and price outlook, or risks, change, that will also be reason to change the level of interest rates.”

Discussing long-term interest rates, Ueda mentioned that the central bank’s fundamental approach is to allow market forces to determine these rates. However, he also emphasized that BoJ would conduct “nimble” market operations if long-term interest rates were to spike, highlighting the bank’s readiness to increase bond buying when necessary.

Japan’s Suzuki confirms impact of market intervention to support yen

Japan’s Finance Minister Shunichi Suzuki confirmed today that recent interventions in the currency market had a notable impact on stabilizing Yen. During a press conference following a regular cabinet meeting, Suzuki explained that the interventions at the end of April and early May were specifically targeted to counteract excessive currency market movements.

According to data released by the Ministry of Finance last Friday, Japan spent JPY 9.79T over the past month to bolster Yen. This data confirmed traders’ and analysts’ suspicions that Tokyo conducted significant dollar-selling interventions.

These interventions occurred shortly after Yen plummeted to a 34-year low of 160.245 per dollar on April 29 and again in the early hours of May 2 in Tokyo.

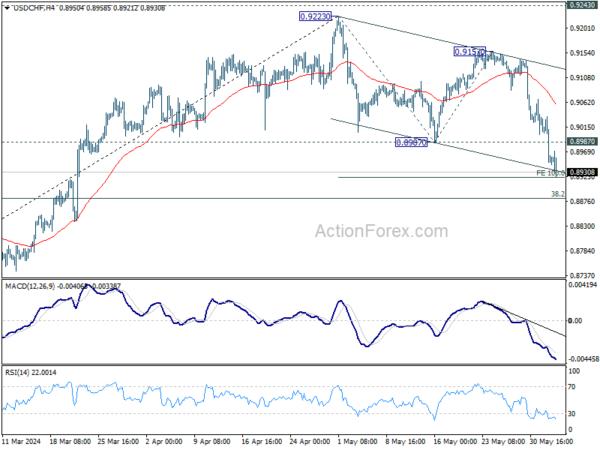

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8926 (P) 0.8983; (R1) 0.9016; More….

USD/CHF accelerates to as low as 0.8921 so far today, touching 100% projection of 0.9223 to 0.8987 from 0.9157 at 0.8921. There is no sign of bottoming yet and intraday bias stays on the downside. Break of 0.8921 will target 0.8883 fibonacci level. On the upside, above 0.8987 support turned resistance will turn intraday bias neutral first.

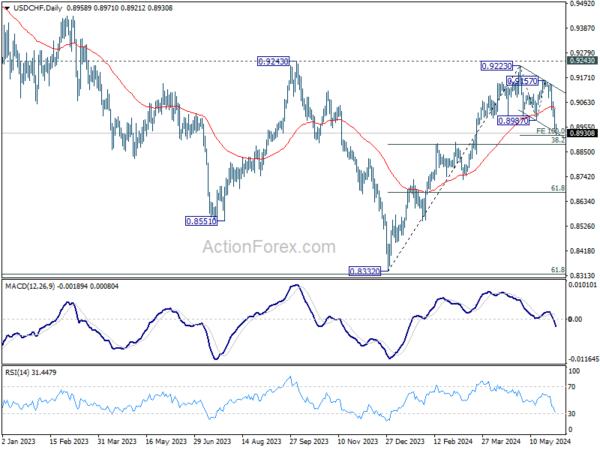

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y May | 0.90% | 2.20% | 2.10% | |

| 01:30 | AUD | Current Account Balance (AUD) Q1 | -4.9B | 5.9B | 11.8B | 2.7B |

| 06:30 | CHF | CPI M/M May | 0.30% | 0.40% | 0.30% | |

| 06:30 | CHF | CPI Y/Y May | 1.40% | 1.40% | ||

| 07:55 | EUR | Germany Unemployment Change May | 25K | 7K | 10K | |

| 07:55 | EUR | Germany Unemployment Rate May | 5.90% | 5.90% | 5.90% | |

| 14:00 | USD | Factory Orders M/M Apr | 0.70% | 1.60% |