Yen and Swiss Franc weaken slightly in today’s subdued trading environment. With the economic calendar offering little in terms of market-moving events during the European and US sessions, currency movements have been minimal. Meanwhile, Australian and New Zealand Dollars are showing modest strength, though most other major currencies are trading within narrow ranges. Other financial markets are similarly quiet, with European stock indexes and benchmark treasury yields in both Europe and US remaining stuck in tight ranges.

Attention is now turning to the upcoming Asian session, where some Australian economic data will be released. This includes Westpac consumer sentiment, NAB business confidence, the wage price index. Among these, wage growth will be closely watched, given its significance for domestic inflationary pressures. RBA has made it clear that it remains uncertain about the need for another rate hike, and Governor Michele Bullock has effectively ruled out the possibility of a rate cut this year. Should the wage growth data come in strong, it would likely solidify RBA’s stance and diminish any speculation about rate cuts in the near future.

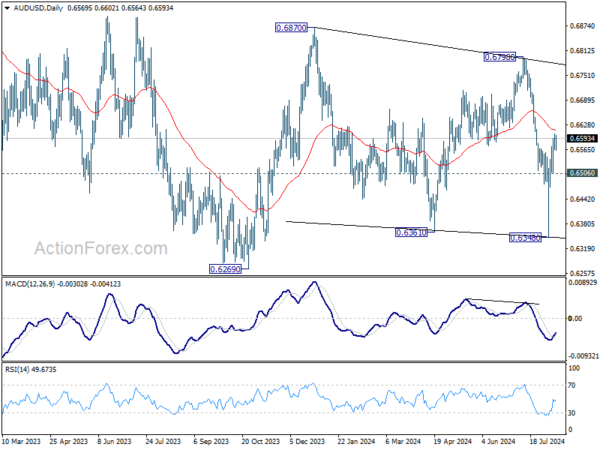

On the technical side, while AUD/USD’s rebound from 0.6348 was slightly stronger than expected, it’s starting to struggle as it approaches 55 D EMA. Rejection by the EMA, followed by break of 0.6505 support, will retain near term bearishness for another decline through 0.6340 to 0.6269 low. Nevertheless, sustained break of the EMA will pave the way back to 0.6798 resistance. Despite the current technical setup, the true driver of any substantial movement in AUD/USD is likely to come from the US CPI data scheduled for release on Wednesday.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 0.12%. CAC is down -0.16%. UK 10-year yield is up 0.0012 at 3.950. Germany 10-year yield is up 0.016 at 2.246. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.56%. China Shanghai SSE rose 0.13%. Singapore Strait Times fell -0.81%.

OPEC downgrades oil demand growth estimates for 2024

OPEC downgraded its global oil demand forecast for 2024, now expecting an increase of 2.11 million barrels per day (bpd), slightly lower than the 2.25 million bpd projected last month. The organization also adjusted its demand growth estimate for next year, lowering it to 1.78 million bpd from the previous forecast of 1.85 million bpd.

These adjustments reflect the actual data received for Q1 of 2024, and in some cases, the Q2, along with “. OPEC noted that while the summer driving season got off to a slower start compared to the previous year, transport fuel demand is anticipated to remain robust, supported by healthy road and air mobility.

WTI oil shrugs off the downgrade and extends its near term rebound from 72.42. Technically, the strong break of 55 4H EMA suggests that fall from 84.72 has completed already. Further rise is now in favor as long as 76.46 support holds, towards 55 D EMA (now at 79.23). Firm break there will solidify this near term bullish case and target top of the medium term range between 84.72 and 87.84.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 145.96; (P) 146.89; (R1) 147.49; More…

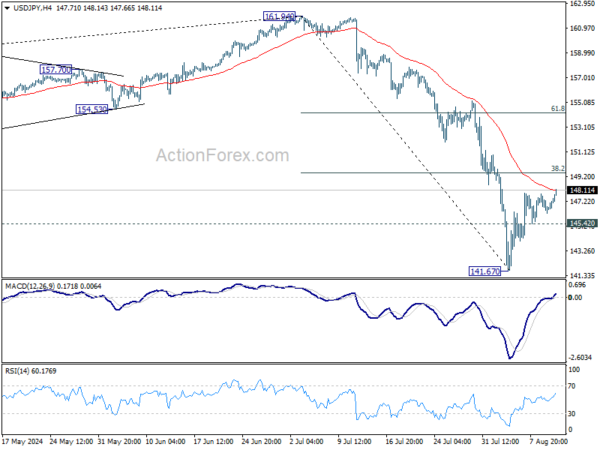

USD/JPY’s rebound from 141.67 extends higher today but stays below 38.2% retracement of 161.94 to 141.67 at 149.41. Intraday bias stays neutral and outlook remains bearish. Below 145.42 minor support will turn bias to the downside for 141.67. Break there will resume the fall from 161.94 to 140.25 support next. Nevertheless, decisive break of 149.41 will bring stronger rally to 61.8% retracement at 154.19, even as a corrective move.

In the bigger picture, fall from 161.94 medium term is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.77) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | CAD | Building Permits M/M Jun | -13.90% | 5.60% | -12.20% | -12.70% |