Yen’s decline persisted in Asian session, continuing to reverse its strong gains from earlier in the month. Traders seem confident that Japan will not intervene as long as Yen remains above 160 level against Dollar, with no apparent determination to push it through 150. This range appears to be set for the near term.

Japan’s response to Yen’s selloff has been restrained. Finance Minister Shunichi Suzuki reiterated his commitment to closely monitoring the currency markets and taking all possible measures against excessive, speculative moves. He emphasized the importance of close communication and coordination BoJ.

Elsewhere in the currency markets, Sterling ranks as the second strongest currency of the day after Dollar. The Pound is anticipating today’s UK employment data, with particular attention on wage growth. BoE Governor Andrew Bailey has left the door open for a June rate cut, but some economists believe the central bank will not rush into a decision until the risk of wage-driven inflation resurgence is mitigated. Currently, Aussie follows Yen as the second weakest currency, with Loonie trailing behind. Euro and Swiss Franc are positioned in the middle.

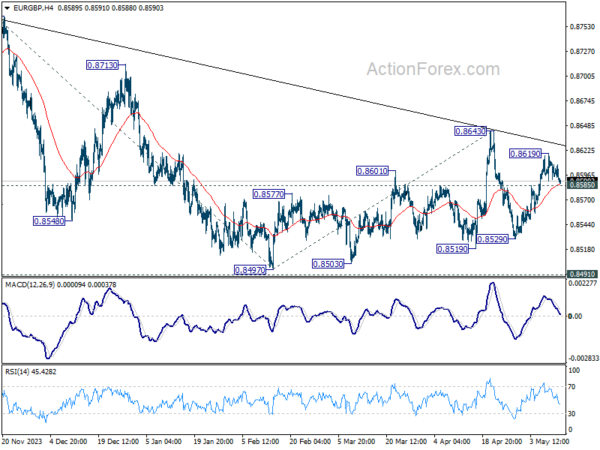

Technically, EUR/GBP’s rebound from 0.8529 stalled ahead of 0.8643 resistance as well as medium term falling trend line. Price actions from 0.8497 are seen as a corrective pattern. Break of 0.8585 support will add to the case that larger down trend is ready to resume and target 0.8529 support first.

In Asia, at the time of writing, Nikkei is up 0.09%. Hong Kong HSI is down -0.13%. China Shanghai SSE is down -0.12%. Singapore Strait Times is down -0.06%. Japan 10-year JGB yield is up 0.0176 at 0.959. Overnight, DOW fell -0.21%. S&P 500 fell -0.02%. NASDAQ rose 0.29%. 10-year yield fell -0.023 to 4.481.

Fed’s Jefferson: Restrictive rates necessary amid slow disinflation progress

Fed Vice Chair Philip Jefferson indicated that with the economy showing robust job growth, Fedcan focus “even more so” on ensuring that inflation returns to its 2% target. Jefferson acknowledged the slow progress in reducing inflation, asserting that it justifies keeping the policy rate elevated.

“In light of the attenuation in progress, in terms of getting inflation down to our target, it is appropriate that we maintain the policy rate in restrictive territory,” Jefferson noted.

He reiterated that the Fed is vigilant in seeking clear evidence of inflation decreasing to the desired level before considering any policy rate adjustments.

Fed’s approach is influenced by the varied perspectives among policymakers, which Jefferson believes enriches policy discussions. However, he cautioned that increased communication from Fed might sometimes lead to greater uncertainty about its policies, rather than clarity.

IMF recommends gradual approach for future BoJ rate hikes

IMF projects Japan’s economic growth to continue, with a noticeable increase in consumption anticipated later this year. According to a report, Japan’s growth rate is expected to decelerate to 0.9% in 2024, largely due to the fading impact of one-off factors that boosted growth in 2023.

The report highlights that consumption will pick up in the latter half of 2024 and into 2025, driven by rising nominal wages following a strong Shunto settlement in 2024 and a decrease in headline inflation that will boost real wages.

IMF foresees core inflation gradually declining as the impact of higher import prices diminishes. However, core inflation is expected to remain above BoJ’s 2% target until the second half of 2025.

In light of these developments, IMF suggests that further increases in BoJ’s short-term policy rate should “proceed at a gradual pace” and be “datadependent”, considering the balanced risks to inflation and the mixed signals from recent economic data.

IMF emphasizes the importance of Japan’s adherence to a “flexible exchange rate regime”, which will play a crucial role in absorbing economic shocks and supporting the central bank’s focus on maintaining price stability.

Looking ahead

UK employment data is a major focus in European session. Swiss PPI, Germany ZEW economic sentiment and CPI final, will be released too. Later in the day, US PPI will be the highlight.

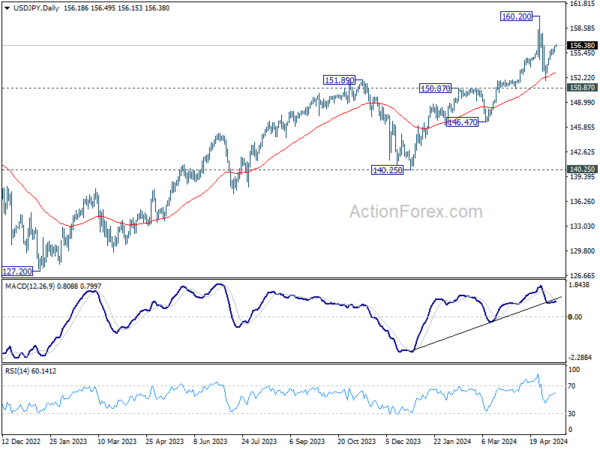

USD/JPY Daily Outlook

Daily Pivots: (S1) 155.74; (P) 156.00; (R1) 156.47; More…

Intraday bias in USD/JPY stays mildly on the upside at this point. Rebound from 151.86, as the second leg of the corrective pattern from 160.20, is in progress for 157.98 resistance. On the downside, break of 155.25 minor support will suggest that the third leg has started, and turn bias back to the downside for 151.86 support.

In the bigger picture, a medium term top might be formed at 160.20. But as long as 150.87 resistance turned support holds, fall from there is seen as correcting rise from 150.25 only. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Apr | 0.90% | 0.90% | 0.80% | 0.90% |

| 06:00 | GBP | Claimant Count Change Apr | 13.9K | 10.9K | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Mar | 4.30% | 4.20% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 5.30% | 5.60% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 6.00% | |||

| 06:00 | EUR | Germany CPI M/M Apr F | 0.50% | 0.50% | ||

| 06:00 | EUR | Germany CPI Y/Y Apr F | 2.20% | 2.20% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Apr | -3.80% | |||

| 06:30 | CHF | Producer and Import Prices M/M Apr | 0.20% | 0.10% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | -2.10% | |||

| 09:00 | EUR | Germany ZEW Economic Sentiment May | 44.9 | 42.9 | ||

| 09:00 | EUR | Germany ZEW Current Situation May | -75 | -79.2 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment May | 46.1 | 43.9 | ||

| 10:00 | USD | NFIB Business Optimism Index Apr | 88.1 | 88.5 | ||

| 12:30 | USD | PPI M/M Apr | 0.20% | 0.20% | ||

| 12:30 | USD | PPI Y/Y Apr | 2.20% | 2.10% | ||

| 12:30 | USD | PPI Core M/M Apr | 0.20% | 0.20% | ||

| 12:30 | USD | PPI Core Y/Y Apr | 2.40% | 2.40% | ||

| 12:30 | CAD | Wholesale Sales M/M Mar | -0.90% | 0.00% |