Yen is showing broad-based strength in today’s Asian session, particularly against the generally weakening Dollar. This move has also put pressure on the Nikkei, which turned lower as Yen gained momentum. While there’s no clear catalyst for these movements, it appears that Yen’s recent pullback may have run its course. Meanwhile, Dollar continues to extend its decline from last week, driven by risk-on sentiment and falling treasury yields. With Fed Chair Jerome Powell’s upcoming speech at Jackson Hole this week, traders are also likely positioning themselves in anticipation of his remarks.

As we approach the final third of August, Yen stands out as the strongest currency of the month, followed at a distance by Australian Dollar and New Zealand Dollar. In contrast, Dollar has been the worst performer, while European currencies and Loonie are mixed, with the Euro holding a slight edge.

On the technical front, Gold capitalized on the Dollar’s weakness last week, surging to a new record high. Further rally is now expected as long as 2450.60 support holds. Next target is 100% projection of 2293.45 to 2483.52 from 2364.10 at 2554.17. The question is whether Dollar’s selloff would intensify and prompt upside acceleration in Gold to 161.8% projection at 2671.63.

In Asia, at the time of writing, Nikkei is down -1.79%. Hong Kong HSI is up 0.89%. China Shanghai SSE is up 0.42%. Singapore Strait Times is down -0.10%. Japan 10-year JGB yield is up 0.0127 at 0.888.

Fed’s Daly advocates for gradual rate cuts to avoid overtightening

San Francisco Fed President Mary Daly said in an FT interview that it’s time to consider lowering interest rate from the current level gradually. She emphasized, “Gradualism is not weak, it’s not slow, it’s not behind, it’s just prudent,”

Daly said the Fed wanted to loosen the “restrictiveness” of its policy, while still maintaining some restraint to “fully get the job done” on inflation. The Fed did not “want to overtighten into a slowing economy”, she said.

Fed’s Goolsbee cautions against prolonged tightness in monetary policy

Chicago Fed President Austan Goolsbee stated in a CBS interview that a rate cut in September is not a foregone conclusion. But he pointed out that current economic conditions differ significantly from when Fed initially set rates at their present levels.

Goolsbee highlighted the impact of maintaining high rates while inflation decreases, noting that this approach effectively tightens monetary policy further. He warned that “if you keep too tight for too long, you will have a problem on the employment side of the Fed’s mandate.”

NZ BNZ services rises to 44.6, modest improvement, but remains under pressure

New Zealand BNZ Performance of Services Index saw a modest rise in July, climbing from 40.7 to 44.6. However, the PSI has averaged only 46.5 for 2024, a stark contrast to its historical average of 53.2.

Breaking down the details, there were slight improvements across most categories. Activity/sales increased from 36.2 to 39.1, and employment ticked up from 45.7 to 46.6. New orders/business rose from 38.9 to 45.3, and stock/inventories edged higher from 43.9 to 45.1. On the downside, supplier deliveries slipped slightly from 41.4 to 41.0.

Despite these gains, the overall sentiment remains cautious, with 67.0% of respondents expressing negative views about the current economic climate, unchanged from June. High living costs and rising interest rates were frequently cited as significant challenges.

BNZ’s Senior Economist Doug Steel provided a sobering perspective, noting that “the increase in the PSI does not even get the index back to the level it was during the depths of the GFC back in 2008/09.”

Powell’s upcoming address to clarify Fed’s stance on rate cuts and recession risks

This week’s spotlight will be on Fed Chair Jerome Powell as he prepares to deliver his highly anticipated speech at the annual Jackson Hole Symposium. Markets are already expecting Powell to set the stage for a September interest rate cut, a move that has been largely priced in. However, investors are looking beyond the expected cut and focusing on several pressing concerns that could shape Fed’s future actions.

A key concern of investors is the risk for a sudden and severe deterioration in the employment market, which could tip the US economy into a recession. Powell’s speech will be closely watched for his view on the issue, and indication of how Fed plans to respond if such a downturn materializes.

Another critical issue is Fed’s approach if inflation remains persistently high while the economy shows signs of significant weakness. This scenario would put the Fed in a difficult position, balancing the need to control inflation with the risk of exacerbating an economic slowdown. Powell’s views on this potential dilemma will be of great interest to market participants.

In addition to Powell’s speech, the release of monetary policy meeting minutes from key central banks will provide further insights into the global economic outlook. The minutes from the FOMC are expected to reveal a cautious stance, with Fed signaling that while a rate cut is likely on the horizon, policymakers are waiting for more data to confirm the timing.

Meanwhile, RBA is expected to reiterate its stance that a rate cut is not on the immediate agenda, while keeping the option open for further hikes if necessary. ECB minutes will be closely watched for any signs that the ECB is considering another rate cut in September, following its decision to pause in July.

On the economic data front, inflation reports from Canada and Japan will be in focus, alongside PMI data from several major economies.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index

- Tuesday: New Zealand trade balance; RBA minutes; Swiss trade balance; Germany PPI; Eurozone CPI final, current account; Canada CPI, new housing price index.

- Wednesday: Japan trade balance; Canada IPPI and RMPI; FOMC minutes.

- Thursday: Australia PMIs; Japan PMIs; Eurozone PMIs, ECB accounts; UK PMIs; US jobless claims, PMIs, existing home sales.

- Friday: New Zealand retail sales; Japan CPI; Canada retail sales; US new home sales.

USD/JPY Daily Outlook

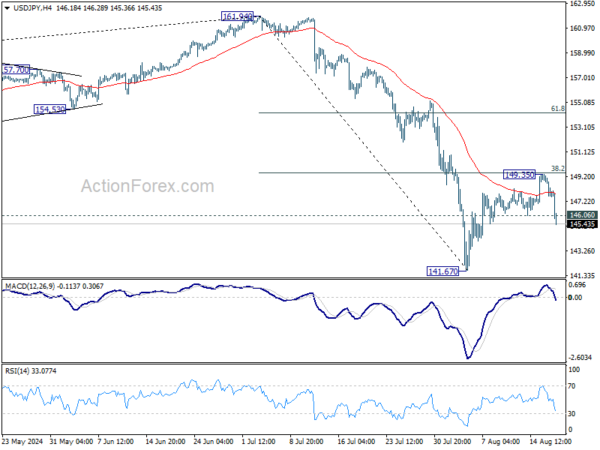

Daily Pivots: (S1) 147.00; (P) 148.20; (R1) 148.83; More…

USD/JPY’s break of 146.06 support argues that rebound from 141.67 has completed at 149.35 already, after rejection by 38.2% retracement of 161.94 to 141.67 at 149.41. Intraday bias is back on the downside for retesting 141.67. Firm break there will resume the whole fall from 161.94 to 139.26 fibonacci level next. For now, risk will stay on the downside as long as 149.35 resistance holds, in case of recovery.

In the bigger picture, fall from 161.94 medium term is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.63) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Jul | 44.6 | 40.2 | 40.7 | |

| 23:50 | JPY | Machinery Orders M/M Jun | 2.10% | 0.90% | -3.20% |