Yen surged significantly against all major currencies during European session, with speculation on whether Japan has intervened again in the markets. Last week, it was rumored that Japanese authorities had spent JPY 3.5 trillion to prop up Yen. Despite this, top officials have been tight-lipped, refusing to confirm any direct actions. Outgoing top currency diplomat Masato Kanda remarked today, “I have no choice but to respond appropriately if there are excessive moves caused by speculators,” further fueling speculation without providing concrete details.

Meanwhile, Sterling saw a slightly delayed yet robust reaction to the latest UK CPI data. The inflation figures, including headline, core, and services inflation, did not decline as some hoped. This has led the markets to reduce their bets on a BoE rate cut in August. Even though the headline inflation rate remained at BoE’s 2% target, the persistently high services inflation at 5.7% would keep the hawks within the MPC on alert for resurgence of inflationary pressures. Consequently, money markets now see less than 25% chance of an August cut, down from around 50% before the data release.

Overall, in the currency markets, Dollar has been the weakest performer for the day, facing significant selling pressure from both Yen and European majors. Canadian and Australian Dollars also exhibited weakness. Leading the pack is Yen, followed by Pound and Swiss Franc, while Euro and Kiwi find themselves in a middle-ground position.

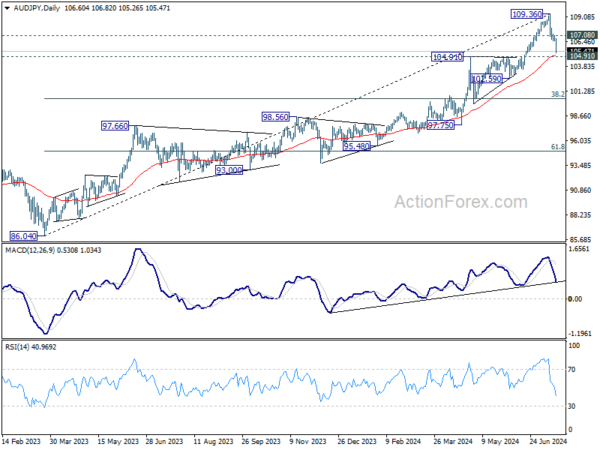

Technically, AUD/JPY dives sharply today and it’s now in proximity to a key support zone of 104.91 and 55 D EMA (now at 105.02). Strong bounce from current level, followed break of 107.08 resistance, will argue that the pullback has completed,. That would also keep the medium term up trend intact for another rise through 109.36 at a later stage.

However, decisive break of 104.91 will argue that AUD/JPY is probably already correcting whole rise from 86.04. Australian job data, expected in the upcoming Asian session, could significantly influence the chances of another RBA rate hike and trigger the next market move.

In Europe, at the time of writing, FTSE is up 0.08%. DAX is down -0.48%. CAC is down -0.47%. UK 10-year yield is up 0.0334 at 4.086. Germany 10-year yield is up 0.0115 at 2.441. Earlier in Asia, Nikkei fell -0.43%. Hong Kong HSI rose 0.06%. China Shanghai SSE fell -0.45%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield rose 0.0078 to 1.032.

Fed’s Williams sees positive signs in inflation trend, awaiting more data

New York Fed President John Williams, in an interview with the Wall Street Journal, indicated that recent inflation readings over the past three months are “getting us closer to a disinflationary trend that we’re looking for,” noting these as “positive signs.”

However, Williams emphasized the need for “more data to gain further confidence” that inflation is moving sustainably toward the Fed’s 2% goal. He expressed satisfaction with the current policy stance, stating, “I feel like the stance of policy right now is working well.”

Williams suggested that if the favorable data trend continues, he would gain “greater confidence that inflation is moving sustainably to 2%.”

Eurozone CPI finalized at 2.5% in Jun, core at 2.9%

Eurozone CPI was finalized at 2.5% yoy in June, down from May’s 2.6% yoy. CPI core (ex-energy, food, alcohol & tobacco) was finalized at 2.9% yoy, unchanged from prior month’s reading. The highest contribution to annual inflation rate came from services (+1.84 percentage points, pp), followed by food, alcohol & tobacco (+0.48 pp), non-energy industrial goods (+0.17 pp) and energy (+0.02 pp).

EU CPI was finalized at 2.6% yoy, down from May’s 2.7% yoy. The lowest annual rates were registered in Finland (0.5%), Italy (0.9%) and Lithuania (1.0%). The highest annual rates were recorded in Belgium (5.4%), Romania (5.3%), Spain and Hungary (both 3.6%). Compared with May 2024, annual inflation fell in seventeen Member States, remained stable in one and rose in nine.

UK CPI steady at 2% in Jun, core CPI unchanged at 3.5%

UK CPI was unchanged at 2.0% yoy in June, matched expectations. CPI core (excluding energy, food, alcohol and tobacco) was unchanged at 3.5% yoy, above expectation of 3.4% yoy. CPI goods annual rate fell from -1.3% yoy to 1.4% yoy. CPI services annual rate was unchanged at 5.7% yoy.

For the month, CPI rose 0.1% mom , matched expectations.

New Zealand’s CPI slows to 3.3% in Q2, vs exp 3.5%

New Zealand’s CPI for Q2 rose by 0.4% qoq, down from previous quarter’s 0.6% qoq and missing the expected 0.5% qoq.

Tradeable inflation, which includes goods and services that are subject to international competition, fell by -0.5% qoq, an improvement from previous -0.7% qoq. Conversely, non-tradeable inflation, covering domestic goods and services, rose by 0.9% qoq, down from prior 1.6% qoq.

Over the past 12 months, CPI growth rate slowed from 4.0% yoy to 3.3% yoy, falling short of anticipated 3.5% yoy. This marks the lowest level since Q2 2021 but remains slightly above RBNZ’s target band of 1-3%.

Tradeable inflation saw a significant decline from 1.6% yoy to 0.3% yoy, reflecting lower imported inflationary pressures. Non-tradeable inflation also eased, dropping from 5.8% yoy to 5.4% yoy, indicating some cooling in domestic price pressures.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2948; (P) 1.2965; (R1) 1.2992; More…

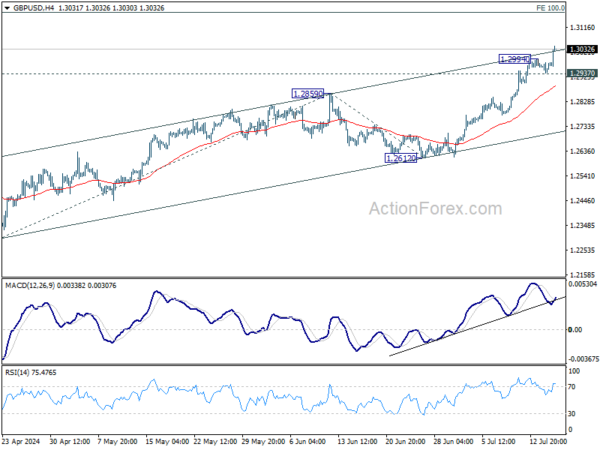

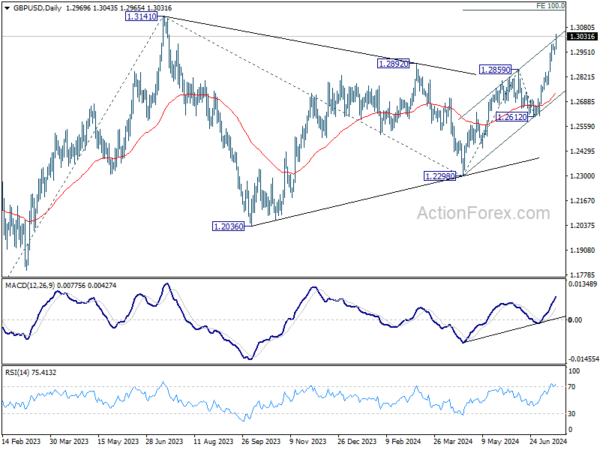

GBP/USD’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise from 1.2298 should target 100% projection of 1.2298 to 1.2859 from 1.2612 at 1.3173, which is slightly above 1.3141 key medium term resistance. On the downside, below 1.2937 minor support will turn intraday bias neutral again first.

In the bigger picture, corrective pattern from 1.3141 medium term top (2023 high) could have completed with three waves to 1.2298 already. This will now remain the favored case as long as 1.2612 support holds. Firm break of 1.3141 will target 61.8% projection of 1.0351 (2022 low) to 1.3141 from 1.2298 at 1.4022.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | 0.40% | 0.50% | 0.60% | |

| 22:45 | NZD | CPI Y/Y Q2 | 3.30% | 3.50% | 4.00% | |

| 01:00 | AUD | Westpac Leading Index M/M Jun | 0.00% | 0.00% | ||

| 06:00 | GBP | CPI M/M Jun | 0.10% | 0.10% | 0.30% | |

| 06:00 | GBP | CPI Y/Y Jun | 2.00% | 2.00% | 2.00% | |

| 06:00 | GBP | Core CPI Y/Y Jun | 3.50% | 3.40% | 3.50% | |

| 06:00 | GBP | RPI M/M Jun | 0.20% | 0.20% | 0.40% | |

| 06:00 | GBP | RPI Y/Y Jun | 2.90% | 2.90% | 3.00% | |

| 06:00 | GBP | PPI Input M/M Jun | -0.80% | 0.10% | 0.00% | -0.60% |

| 06:00 | GBP | PPI Input Y/Y Jun | -0.40% | -0.10% | -0.70% | |

| 06:00 | GBP | PPI Output M/M Jun | -0.30% | 0.10% | -0.10% | 0.00% |

| 06:00 | GBP | PPI Output Y/Y Jun | 1.40% | 1.70% | ||

| 06:00 | GBP | PPI Core Output M/M Jun | 0.10% | 0.20% | ||

| 06:00 | GBP | PPI Core Output Y/Y Jun | 1.10% | 1.00% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jun F | 2.50% | 2.50% | 2.50% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun F | 2.90% | 2.90% | 2.90% | |

| 12:30 | USD | Building Permits Jun | 1.45M | 1.40M | 1.40M | |

| 12:30 | USD | Housing Starts Jun | 1.35M | 1.30M | 1.28M | |

| 13:15 | USD | Industrial Production M/M Jun | 0.30% | 0.90% | ||

| 13:15 | USD | Capacity Utilization Jun | 78.60% | 78.70% | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | -3.4M | ||

| 18:00 | USD | Beige Book |