Japanese Yen had a modest recovery in Asian session, accompanied by an uptick in 10-year JGB yield and Nikkei. This comes as BoJ Governor Kazuo Ueda continued to prepare the markets for more tightening ahead, by reiterating that another rate hike in July is a possibility. Additionally, Ueda emphasized the impact of the weak Yen on import prices and overall inflation. However, opinions are divided on the timing of BoJ’s next rate hike after the historical move in March. Thus, Yen’s recovery might remain limited until there is more clarity.

Simultaneously, Australian Dollar edged higher following RBA’s decision to keep interest rates unchanged at 4.35%, a move that was widely anticipated by the markets. RBA maintained its flexible stance, stating it is “not ruling anything in or out” regarding future rate changes. It believed that the board would need to wait at least until when Q2 inflation data is available before having a clearer idea on even the direction of the next move in interest rate, not to mention the timing.

Across the broader currency markets, trading remains relatively subdued, with most major currency pairs and crosses confined within the previous day’s ranges. New Zealand Dollar is the weakest performer today so far , followed by Canadian Dollar and Euro. In contrast, Yen and the Australian Dollar are showing the most strength, while Dollar, Swiss Franc, and British Pound are trading in a mixed manner.

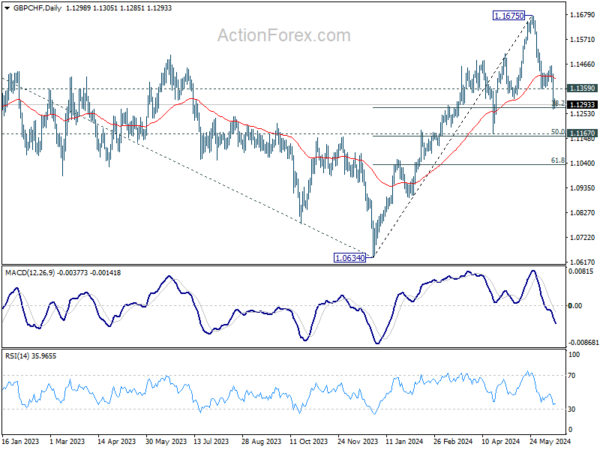

Technically, GBP/CHF’s correction from 1.1675 medium term top extended lower last week and it’s now pressing 38.2% retracement of 1.0634 to 1.1675 at 1.1277. Strong support could be seen from current level and bring of 1.1359 support turned resistance will bring more sustainable rebound. However, firm break of 1.1277 will bring deeper decline to 1.1167 cluster support next (50% retracement at 1.1155). With a combination of events of UK CPI tomorrow, BoE and SNB rate decision on Thursday, the next move will be revealed soon.

In Asia, at the time of writing, Nikkei is up 0.76%. Hong Kong HSI is up 0.02%. China Shanghai SSE is up 0.48%. Singapore Strait Times is up 0.16%. Japan 10-year JGB yield is up 0.015 at 0.946. Overnight, DOW rose 0.49%. S&P 500 rose 0.77%. NASDAQ rose 0.95%. 10-year yield rose 0.066 to 4.279.

RBA stands pat, still not ruling anything in or out

RBA left its cash rate target unchanged at 4.35%, as widely anticipated. It maintained its stance of “not ruling anything in or out,” indicating a cautious approach and open stance amid ongoing economic uncertainties.

While inflation is easing, RBA noted that it is doing so “more slowly than previously expected,” and inflation “remains high.” The central bank acknowledged that it will be “some time yet” before inflation is sustainably within the target range.

RBA added that recent economic data have been “mixed,” reinforcing the need to remain “vigilant to upside risks to inflation.” Consequently, the path of interest rates “remains uncertain”.

BoJ’s Ueda reiterates possibility of July rate hike

BoJ Governor Kazuo Ueda reiterated today that the central bank could raise interest rates again in July, stressing that this decision would be independent of the plan to taper bond purchases.

Speaking to parliament, Ueda clarified, “Our decision on bond-buying taper and interest rate hikes are two different things.” He emphasized that a rate hike at the next policy meeting will depend on the economic, price, and financial data available at the time.

A recent Reuters poll on Monday revealed that 31% of economists surveyed expect BoJ to raise interest rates at its next policy meeting on July 30-31. Another 41% predict the next hike will occur in October, while slightly more than 20% anticipate a September increase. The remaining economists do not foresee a rate hike until 2025. This diversity of expectations underscores the uncertainty in forecasting BoJ’s policy move.

Fed’s Harker sees one rate cut by year-end, stresses data dependence

Philadelphia Fed President Patrick Harker indicated overnight that his base case scenario includes one interest rate cut by the end of the year, contingent on several more months of improving inflation data.

Harker emphasized the need for ongoing assessment, stating, “If all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end.”

However, he also left room for adjustments based on new economic data, noting, “I see two cuts, or none, for this year as quite possible if the data break one way or another…we will remain data dependent.”

Harker believes that the current policy interest rate, which has been steady for nearly 11 months, remains effective in maintaining restrictive conditions to bring inflation back to target and mitigate upside risks.

His outlook includes slowing but above-trend economic growth, a modest rise in the unemployment rate, and a gradual return to target inflation, which he describes as a “long glide.”

Looking ahead

German ZEW economic sentiment is the main focus in European while Eurozone CPI final will be released too. Later in the day, US retail sales will be on the spotlight, industrial production and business invesntories will be released.

USD/JPY Daily Outlook

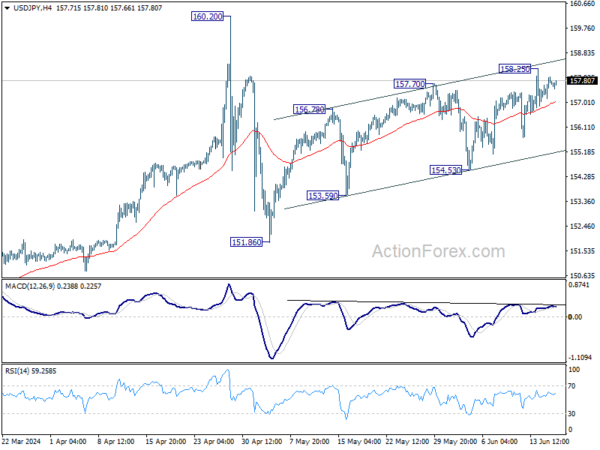

Daily Pivots: (S1) 157.27; (P) 157.62; (R1) 158.07; More…

USD/JPY is staying in tight range below 158.25 temporary top and intraday bias remains neutral. Further rally would be in favor as long as 154.53 support holds. Break of 158.25 will resume the choppy rise from 151.86 towards 160.20 high. But upside should be limited there, at least on first attempt.

In the bigger picture, price actions from 160.20 medium term top are seen as a corrective pattern to rise from 150.25 only. Another rally is still expected at a later stage through 160.02 to resume the larger up trend. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 09:00 | EUR | Eurozone CPI Y/Y May F | 2.60% | 2.60% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y May F | 2.90% | 2.90% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Jun | 50 | 47.1 | ||

| 09:00 | EUR | Germany ZEW Current Situation Jun | -69 | -72.3 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | 47.2 | 47 | ||

| 12:30 | USD | Retail Sales M/M May | 0.30% | 0.00% | ||

| 12:30 | USD | Retail Sales ex Autos M/M May | 0.20% | 0.20% | ||

| 13:15 | USD | Industrial Production M/M May | 0.40% | 0.00% | ||

| 13:15 | USD | Capacity Utilization May | 78.60% | 78.40% | ||

| 14:00 | USD | Business Inventories Apr | 0.30% | -0.10% |