Yen weakened broadly in Asian session today, reversing some of its robust since the previous week. This shift in momentum comes amid tempered expectations for an imminent BoJ rate hike at next week’s meeting. Japanese Finance Minister Shunichi Suzuki’s comments that the country is not yet ready to declare victory over deflation, despite positive signs such as substantial wage hikes and record-high capital spending, prompted some traders to turn cautious. Meanwhile, BoJ Governor Kazuo Ueda’s comments in a parliamentary session offered no new hints towards monetary policy adjustments, focusing instead on the bank’s data-driven approach to confirming a wage-price spiral.

The currency market sees mixed movements elsewhere, with Dollar also leaning towards the weaker side as the market anticipates critical economic data. Today’s US CPI figures are expected to confirm a steady headline inflation rate of 3.1% for February, with core inflation slowing to 3.7%. Analysts suggest that this data might not provide Fed with sufficient confidence to alter its policy in the immediate next meetings (March 19-20, April 30-May 1). Expectations still point towards a pause until at least June. In the UK, BoE and Sterling traders are eagerly awaiting today’s wage data for analyzing underlying domestic inflation pressures.

Overall, Yen is currently the day’s weakest link, with Aussie and Dollar also underperforming. Conversely, Euro leads as the strongest, with Canadian Dollar and New Zealand Dollar close behind. Swiss Franc and Sterling occupy the middle ground. Yet, all major pairs and crosses are now trading inside last week’s ranges, suggesting that they’re staying in consolidation phase.

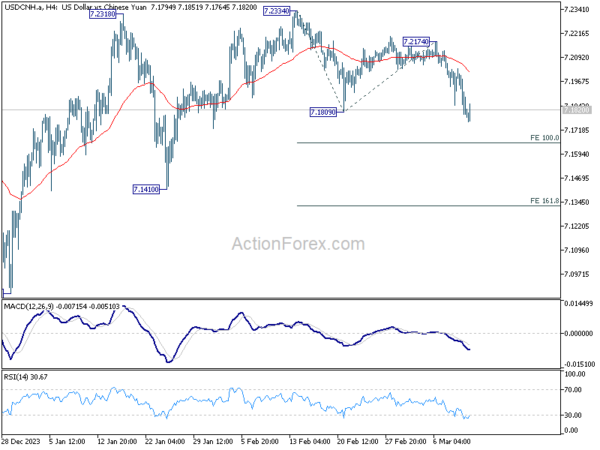

In China, Yuan’s near-term recovery persists despite the backdrop of negative news from the troubled property sector. Moody’s Ratings downgraded China’s Vanke, marking its credit status as speculative and highlighting substantial risks, or effectively “junk”.

Technically, USD/CNH’s fall from 7.2334 resumed by breaking through 7.1809 support earlier this week. For now, further fall is in favor as long as 55 4H EMA (now at 7.2016) holds. Decisive break of 100% projection of 7.2334 to 7.1809 from 7.2174 at 7.1649 will strengthen the case that USD/CNH is already reversing whole rebound from 7.0870. In this case, deeper fall would be seen to 161.8% projection at 7.132 next.

In Asia, at the time of writing, Nikkei is down -0.60%. Hong Kong HSI is up 1.70%. China Shanghai SSE is down -0.47%. Singapore Strait Times is up 0.32%. Japan 10-year JGB yield is up 0.0059 at 0.773. Overnight, DOW rose 0.12%. S&P 500 fell -0.11%. NASDAQ fell -0.41%. 10-yea ryield rose 0.015 to 4.104.

BoJ’s Ueda: Economy recovering gradually despite some signs of weakness

In a parliamentary address today, BoJ Governor Kazuo Ueda noted that Japan’s economy is “still recovering gradually”, despite acknowledging some recent “signs of weakness”.

Ueda highlighted a concerning trend of weakening consumption in food and daily necessities amid rising prices. However, he also pointed out a silver lining with moderate improvements in household spending, fueled by expectations of wage increases.

The anticipation around a rate hike by BoJ has garnered significant attention recently, with Ueda reiterating the bank’s focus on the emergence of a “positive wage-inflation cycle.” This perspective is crucial for determining the viability of reaching BoJ’s inflation targets sustainably and stably.

“Various data have come out since January and we’ll likely have additional data come out this week. We will look comprehensively at such data, and make an appropriate monetary policy decision,” he said.

Australia NAB business confidence falls to 0, cost pressures clearly remain elevated

Australia’s NAB Business Confidence ticked down from 1 to 0 in February. Business Conditions rose from 7 to 10. Trading conditions rose form 9 to 14. Profitability conditions rose from 6 to 9. Employment conditions rose from 5 to 6.

Cost pressures remain a significant concern. Labor (2.0% in quarterly equivalent terms) and purchase cost (1.8%) growth stayed constant. Product price growth rose from 1.1% to 1.3% while retail price growth surged from 0.9% to 1.4%.

Alan Oster, NAB’s Chief Economist, pointed out that cost pressures “clearly remain elevated”, and there’s scope for firms to pass this through to output prices.”

He emphasized the role of global supply improvements in driving the progress on disinflation so far, cautioning that future advancements is “unlikely to be linear.”

According to Oster, the path to returning inflation within RBA’s target band by 2025 is fraught with uncertainties. He predicts a “cautious approach” from RBA, with interest rates to be “on hold for most of this year.”

RBA’s Hunter: Data broadly in line with expectations

RBA Assistant Governor Sarah Hunter noted that the incoming data were “broadly in line with what we were anticipating.” Nevertheless, she emphasized that the central bank is “monitoring and looking” and will be updating the economic forecasts in May.

Hunter also touched on the challenges posed by interest rate hikes, particularly for households finding such adjustments difficult. However, she emphasized that “inflation is the single biggest drag”, highlighting RBA’s primary focus on managing inflation to ensure economic stability and growth.

BoE’s Mann: A long way to go on both services and goods inflation

BoE MPC member Catherine Mann delivered a stark message overnight, emphasizing that the UK has “a long way to go” in controlling both services and goods inflation.

“We’re nowhere near the historical relationship between services and goods that is consistent with headline at 2(%),” she added.

Highlighting the “deterioration in the supply side” as a crucial factor, Mann pointed to the tight labour market as a potential source of sustained inflationary pressures.

Mann, recognized for her hawkish stance on monetary policy, was one of two MPC members who advocated for an interest rate hike in the previous month.

Looking ahead

UK employment data is the main focus in European session. Germany will also release CPI final. Later in the day, UK CPI will take center stage.

USD/JPY Daily Outlook

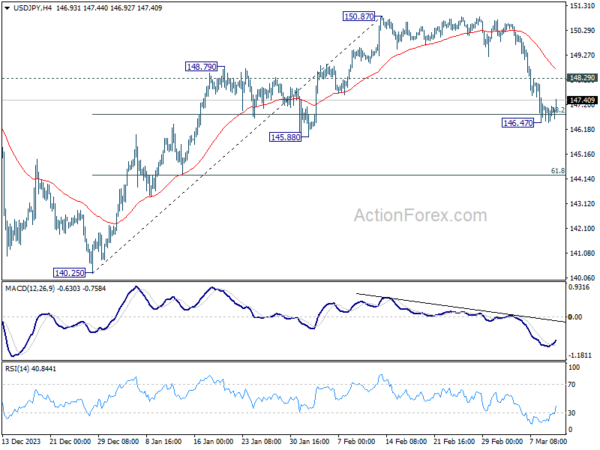

Daily Pivots: (S1) 146.57; (P) 146.87; (R1) 147.25; More…

A temporary low is formed at 146.47 with today’s recovery and intraday bias in USD/JPY is turned neutral first. On the downside, sustained break of 38.2% retracement of 140.25 to 150.87 at 146.81 will argue that fall from 150.87 is reversing the whole rally from 140.25. In this case, deeper decline would be seen to 61.8% retracement at 144.30 and below. Nevertheless, strong support from 146.81, followed by break of 148.29 minor resistance resistance, will argue that fall from 150.87 is merely a correction, which has completed already. Retest of 150.87 should be seen next.

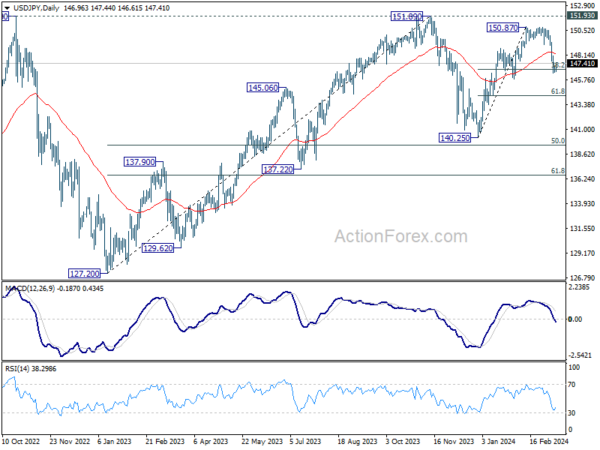

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | 0.60% | 0.50% | 0.20% | |

| 23:50 | JPY | BSI Large Manufacturing Index Q1 | -6.7 | 6.2 | 5.7 | |

| 00:30 | AUD | NAB Business Confidence Feb | 0 | 1 | ||

| 00:30 | AUD | NAB Business Conditions Feb | 10 | 6 | ||

| 07:00 | EUR | Germany CPI M/M Feb F | 0.40% | 0.40% | ||

| 07:00 | EUR | Germany CPI Y/Y Feb F | 2.50% | 2.50% | ||

| 07:00 | GBP | Claimant Count Change Feb | 20.3K | 14.1K | ||

| 07:00 | GBP | ILO Unemployment Rate (3M) Jan | 3.80% | 3.80% | ||

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Jan | 5.70% | 5.80% | ||

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jan | 6.20% | 6.20% | ||

| 10:00 | USD | NFIB Business Optimism Index Feb | 90.7 | 89.9 | ||

| 12:30 | USD | CPI M/M Feb | 0.40% | 0.30% | ||

| 12:30 | USD | CPI Y/Y Feb | 3.10% | 3.10% | ||

| 12:30 | USD | CPI Core M/M Feb | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Feb | 3.70% | 3.90% |