In today’s subdued Asian session, the currency markets saw minimal movement, with most major pairs and crosses gyrating within yesterday’s range. Japanese Yen managed to carve out modest gain, buoyed by optimistic remarks and tangible actions related to wage growth within the country. Chief Cabinet Secretary Yoshimasa Hayashi’s commentary on seeing “strong momentum” for wage increases provides a beacon of hope for substantial wage growth, particularly among small and mid-sized firms—a crucial component for a balanced economic uplift.

This sentiment is further reinforced by landmark wage agreements by stalwarts of Japan’s industrial sector, including Toyota Motor which agreed to raise workers’ wages by the largest rate in 25 years. Meanwhile, Panasonic and Nissan committed to meet union demands in full.

Despite these positive developments, BoJ’s stance on interest rate adjustments remains cautiously in the balance. Reports suggest that while a decision on hiking interest rates next week is nearing, it has not been conclusively reached.

Dollar’s performance is mixed, failing to capitalize significantly on the post-CPI rebound. While, recovery in 10-year yield provided some support, the greenback’s advances were capped by robust risk-on sentiment, evidenced by a new record close for S&P 500. The market’s expectations for a Fed rate hike in June have moderated slightly from 72% to 66%, according to Fed funds futures, yet the anticipation of such a move remains a cornerstone of current market projections.

Overall in the markets, , Sterling is currently as the week’s weakest link, with investors keenly awaiting today’s UK GDP data for directional cues. Yen and Kiwi are the next weakest. On the other hand, Dollar is the strongest followed by Swiss Franc and Canadian. Euro and Aussie are mixed in the middle. But still, it’s emphasized that all major pairs and crosses are stuck inside last week’s range, suggesting that consolidative trading is still in progress.

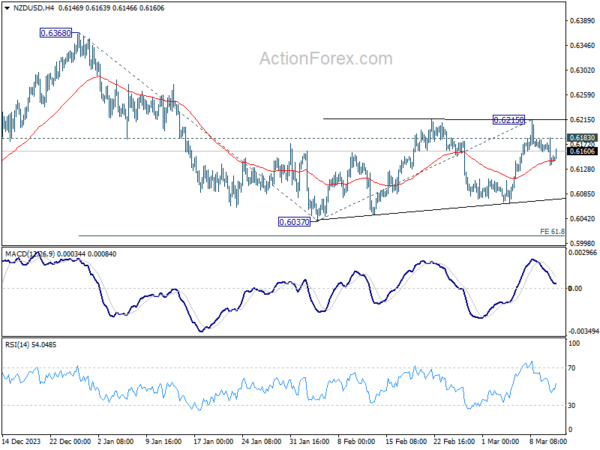

Technically, NZD/USD recovered mildly after hitting 55 4H EMA (now at 0.6143). But risk is mildly on the downside as long as 0.6183 minor resistance holds. Sustained break of the EMA will argue that corrective pattern from 0.6037 has completed with three waves to 0.6215. In this case, fall from 0.6368 would be ready to resume through 0.6037. If realized, the next down move in NZD/USD would likely be accompanied by AUD/USD’s fall towards 0.6442 support.

In Asia, at the time of writing, Nikkei is down -0.17%. Hong Kong HSI is up 0.50%. China Shanghai SSE is down -0.07%. Singapore Strait Times is up 0.54%. 10-year JGB yield is down -0.0044 at 0.764. Overnight, DOW rose 0.61%. S&P 500 rose 1.12%. NASDAQ rose 1.54%. 10-year yield rose 0.051 to 4.155.

BoE’s Bailey surge in unemployment unnecessary on tackling inflation

BoE Governor Andrew Bailey expressed a more positive stance on the UK’s inflation scenario compared to a year ago, particularly regarding the potential for “second round effects” to drive further price surges.

At a panel discussion at the Bank of Italy Symposium, he noted there is “very limited evidence so far” that an uptick in unemployment is a prerequisite for reigning in inflationary pressures.

Bailey highlighted the UK’s labor market status, pointing out that the country is near or at full employment. “It doesn’t get a lot of comment, but we have seen very limited evidence so far of an increase in unemployment as a sort of necessary condition of reducing inflation,” he added.

ECB’s Villeroy sees broad agreement for Spring rate cut

In an interview with Le Figaro, ECB Governing Council member Francois Villeroy de Galhau revealed a “very broad agreement” within the council to initiate rate cuts in spring, with lasts until end of June.

Villeroy, who also serves as Governor of Bank of France, expressed optimism that “we’re winning the battle against inflation”. The bank lowered core inflation forecast for 2024 from 2.8% to 2.4%. This revision aligns with more moderate wage increases, with average salaries expected to rise by 3.2%, down from the previously predicted 4.1%.

On the growth front, Bank of France downgraded its 2024 growth projections slightly from 0.9% to 0.8%, with expectations for an acceleration to 1.5% in 2025 and 1.7% in 2026. Villeroy confidently stated, “France will avoid recession.”

ECB’s Wunsch: We have to make a bet at some point

ECB Governing Council member Pierre Wunsch emphasized the need for proactive stance on interest rates, acting on the fact that “inflation has gone down, is moving in the right direction”.

Speaking at a news conference for the Belgian national bank’s annual report, Wunsch candidly expressed that ECB is nearing a point where it must “make a bet” on cutting interest rates.

However, he was quick to temper expectations, noting that any decision to cut rates would be made carefully, with a keen eye on the persisting challenges of “service inflation and wage developments”, which are “still running at levels that are ultimately not compatible with our objective”

Despite these concerns, Wunsch indicated that ECB would not delay rate cuts until wage growth falls to 3%.

Looking ahead

UK will release GDP, production and trade balance in European session. Eurozone will release industrial production. North America calendar is empty.

USD/JPY Daily Outlook

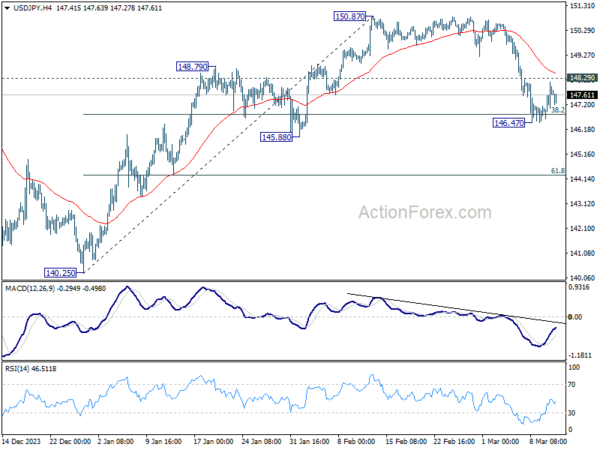

Daily Pivots: (S1) 146.85; (P) 147.44; (R1) 148.27; More…

Intraday bias in USD/JPY remains neutral for the moment, and outlook is unchanged. On the downside, sustained break of 38.2% retracement of 140.25 to 150.87 at 146.81 will argue that fall from 150.87 is reversing the whole rally from 140.25. In this case, deeper decline would be seen to 61.8% retracement at 144.30 and below. Nevertheless, strong support from 146.81, followed by break of 148.29 minor resistance resistance, will argue that fall from 150.87 is merely a correction, which has completed already. Retest of 150.87 should be seen next.

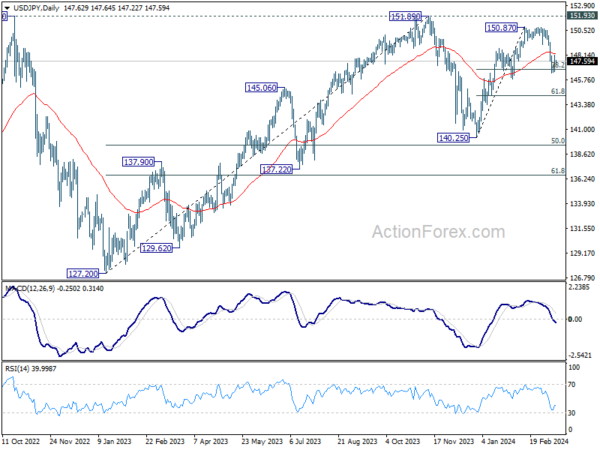

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | GDP M/M Jan | 0.20% | -0.10% | ||

| 07:00 | GBP | Manufacturing Production M/M Jan | 0.00% | 0.80% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Jan | 2.00% | 2.30% | ||

| 07:00 | GBP | Industrial Production M/M Jan | 0.00% | 0.60% | ||

| 07:00 | GBP | Industrial Production Y/Y Jan | 0.70% | 0.60% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Jan | -15.0B | -14.0B | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | -1.00% | 2.60% | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) Feb | -0.10% | |||

| 14:30 | USD | Crude Oil Inventories | 0.9M | 1.4M |