Yen weakened broadly during Asian session today, giving back some of last week’s strong gains that were reportedly driven by Japan’s market intervention. Japan’s Chief Cabinet Secretary Yoshimasa Hayashi repeated in a press conference that it is crucial for currency rates to move “stably” and reflect economic fundamentals. He reiterated the government’s commitment to taking necessary measures against speculative moves in Yen’s exchange rate.

Despite these warnings, it appears Japan might be comfortable with Yen at its current levels and is unlikely to take further action to push it higher against Dollar. If this view is correct, the range is probably set for USD/JPY to consolidate in the near term.

Meanwhile, Canadian dollar is in the spotlight today with the release of Canada’s CPI data. In May, core inflation measures unexpectedly jumped just after BoC became the first G7 central bank to cut interest rates on June 5. However, subsequent job data revealed minimal growth and a rise in unemployment rate. If today’s CPI data show that disinflation is back on track, BoC could be in a position to cut interest rates again next week.

Elsewhere, Swiss franc and Dollar are currently the strongest performers of the day, followed by Loonie. Yen is the weakest, followed by Kiwi and Aussie, both of which are weighed down by disappointing GDP data from China this week. Euro and Sterling are positioned in the middle.

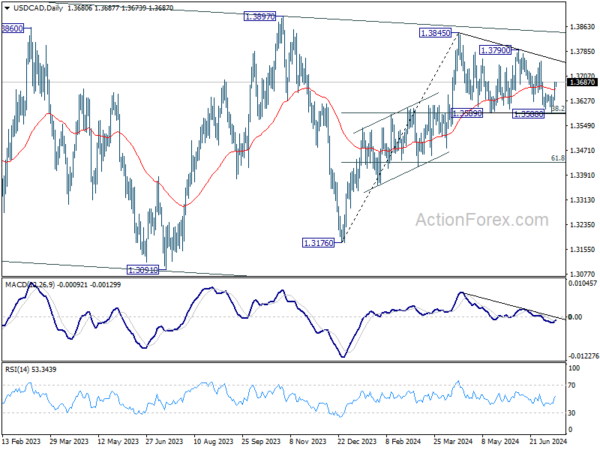

Technically, USD/CAD’s strong rebound this week and break of 55 D EMA raises the chance that corrective pattern from 1.3845 has completed with three waves to 1.3588. That came after hitting 38.2% retracement of 1.3716 to 1.3845 at 1.3589 twice. Near term focus is back on 1.3790 resistance. Decisive break there will argue that rise from 1.3716 is ready to resume through 1.3845.

In Asia, at the time of writing, Nikkei is up 0.28%. Hong Kong HSI is down -1.35%. China Shanghai SSE is down -0.31%. Singapore Strait Times is down -0.43%. Japan 10-year JGB yield is down -0.0204 at 1.030. Overnight, DOW rose 0.53%. S&P 500 rose 0.28%. NASDAQ rose 0.40%. 10-year yield rose 0.040 to 4.229.

Fed’s Powell: Q2 inflation data do add somewhat to confidence

Fed Chair Jerome Powell, speaking at an event overnight, highlighted that in Q2, the economy made “some more progress” on taming inflation. He noted that there have been “three better readings” on inflation, averaging them places Fed in a “pretty good place.”

Powell reiterated that it wouldn’t be appropriate to start loosening policy until there is greater confidence that inflation is sustainably returning to 2% target. However, he also acknowledged that Q2’s data “do add somewhat to confidence”.

Fed’s Daly sees growing confidence in inflation control

San Francisco Fed President Mary Daly, speaking at a conference overnight, expressed optimism about the Fed’s progress in controlling inflation. “Confidence is growing that we are getting nearer a sustainable pace of getting inflation back down to 2%,” Daly noted.

However, she refrained from providing specific timelines or numbers for potential rate cuts. “I’m not going to give time-based guidance. I’m not going to tell you when the rate cut is, how many rate cuts might come,” Daly stated.

“Over time, as inflation comes down and the labor market slows, we have to make sure that we’re holding rates high enough that we don’t lose that inflation fight, but not hold them too long and risk worsening the labor market to a point where it’s challenging for people to get jobs,” Daly added.

Looking ahead

Eurozone will release trade balance while Germany will publish ZEW economic sentiment in European session. Later in the day, Canada CPI will take center stage. US retail sales, import prices, business inventories and NAHB housing index will also be featured.

USD/JPY Daily Outlook

Daily Pivots: (S1) 157.32; (P) 157.88; (R1) 158.57; More…

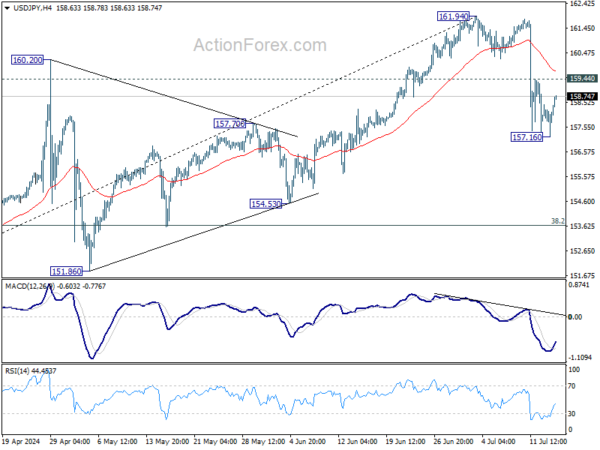

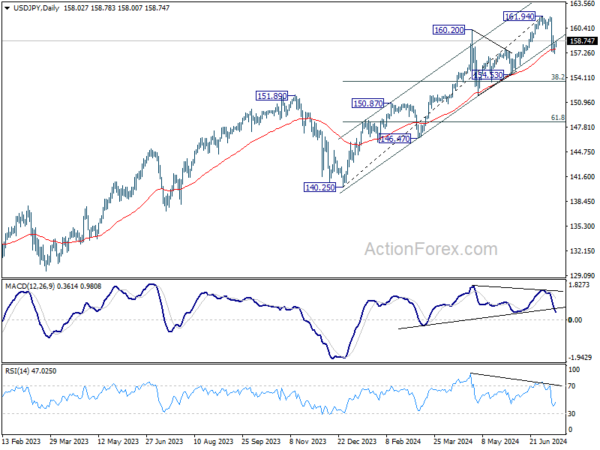

USD/JPY quickly recovered after dipping to 157.16. With 4H MACD crossed above signal line, intraday bias is turned neutral first. On the downside, break of 157.16 and sustained trading below 55 D EMA (now at 157.72) will bring deeper correction to 38.2% retracement of 140.25 to 161.94 at 163.65. But strong support should be seen there to bring rebound. Meanwhile, break of 159.44 minor resistance will turn bias back to the upside for stronger rebound towards 161.94 high.

In the bigger picture, as long as 151.89 resistance turned support holds, long term up trend could still continue through 161.94 at a later stage. Next target will depend on the depth of the current correction from 161.94. However, sustained break of 151.89 will argue that larger scale correction or trend reversal is underway.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M May | -0.4% | 0.20% | 1.90% | 2.20% |

| 09:00 | EUR | Eurozone Trade Balance (EUR) May | 20.3B | 19.4B | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Jul | 44.3 | 47.5 | ||

| 09:00 | EUR | Germany ZEW Current Situation Jul | -73 | -73.8 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jul | 50.2 | 51.3 | ||

| 12:15 | CAD | Housing Starts Y/Y Jun | 259K | 265K | ||

| 12:30 | CAD | CPI M/M Jun | 0.10% | 0.60% | ||

| 12:30 | CAD | CPI Y/Y Jun | 2.90% | |||

| 12:30 | CAD | CPI Median Y/Y Jun | 2.70% | 2.80% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Jun | 2.80% | 2.90% | ||

| 12:30 | CAD | CPI Common Y/Y Jun | 2.40% | 2.40% | ||

| 12:30 | USD | Retail Sales M/M Jun | -0.20% | 0.10% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 0.10% | -0.10% | ||

| 12:30 | USD | Import Price Index M/M Jun | 0.20% | -0.40% | ||

| 14:00 | USD | Business Inventories May | 0.30% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 44 | 43 |