By RoboForex Analytical Department

The USD/JPY pair soared to 160.34 on Thursday, reaching levels not seen since 1986, as market participants increasingly anticipate potential interventions from Japanese authorities. Despite repeated verbal assurances, the Japanese government has not taken concrete financial measures, leaving the yen vulnerable.

Finance Minister Shunichi Suzuki reiterated that the government stands ready to counteract sudden and undesirable fluctuations in the yen’s value, highlighting its preparedness to engage in market operations if necessary. However, when and how these interventions might occur remains uncertain, adding to the yen’s woes.

A significant factor in the yen’s ongoing decline is the stark contrast in interest rates between the Bank of Japan, which maintains a rate close to zero, and the Federal Reserve. This disparity has been a primary driver of the yen’s weakness, with the currency losing approximately 2% against the dollar in June alone, culminating in a 14% decline over the year.

USD/JPY technical analysis

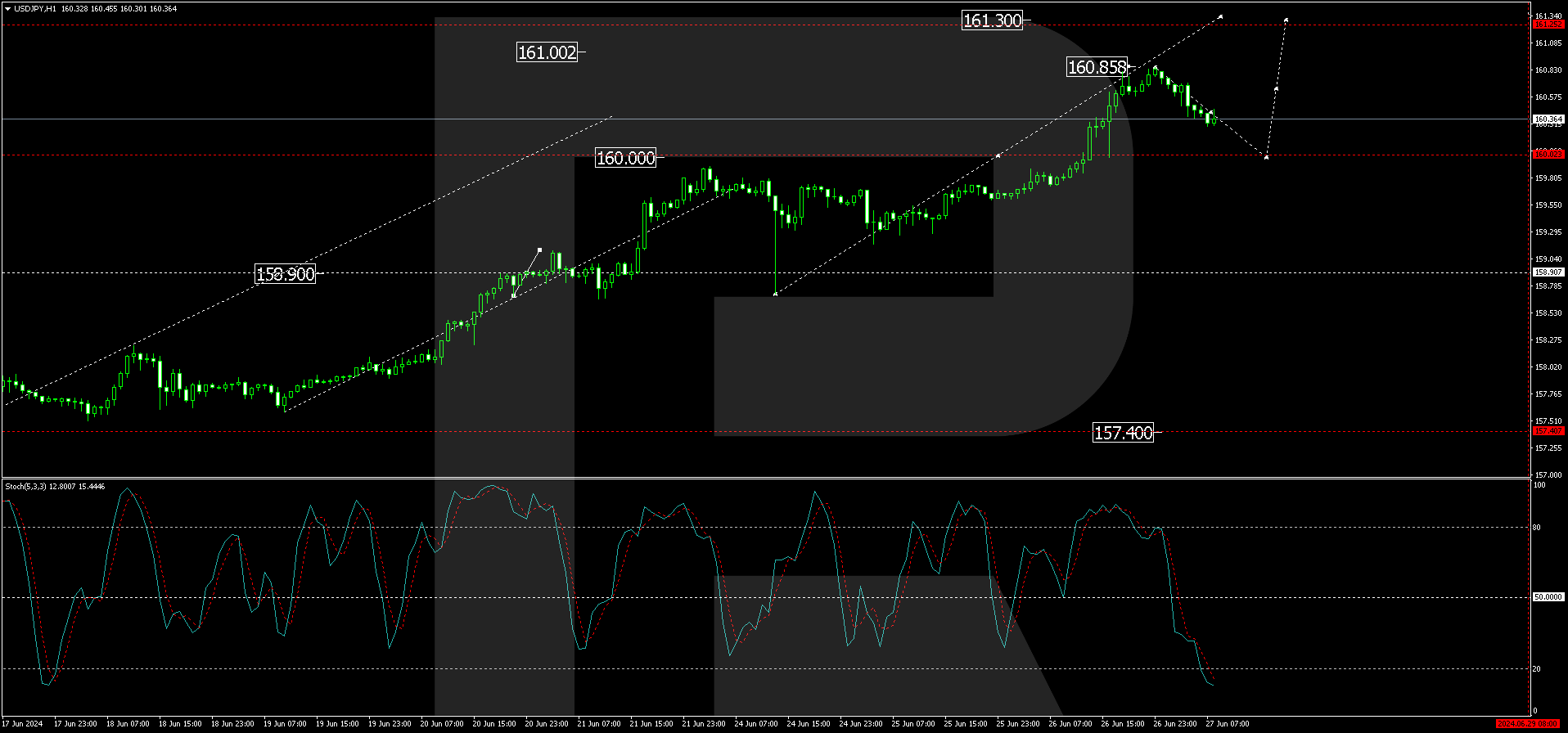

The USD/JPY has broken through the critical 160.00 level, reaching up to 160.85. The market is currently retracing to test the 160.00 level from above. Should this level hold, we anticipate further growth towards 161.30, potentially extending the bullish trend to 163.30. This bullish scenario is supported by the MACD indicator, which shows the signal line well above zero, indicating strong upward momentum.

On the H1 chart, after reaching 160.85, the pair is undergoing a correction towards 160.00. Completion of this correction could pave the way for another ascent to 161.30. This view is technically reinforced by the Stochastic oscillator, which is currently below 20 and poised for a rebound towards 80, suggesting a potential resurgence in buying pressure.

Market outlook

As the discrepancy between US and Japanese monetary policies continues to influence the USD/JPY, traders should remain alert to any signs of actual intervention by Japanese authorities. Such intervention could significantly impact market dynamics, potentially stalling or reversing the yen’s current depreciation trend.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Yen under pressure as USD/JPY hits new highs since 1986 Jun 27, 2024

- Bitcoin: Waits on key risk event Jun 26, 2024

- AUD/USD surged, buoyed by RBA confidence and inflation growth Jun 26, 2024

- RBA may raise rates amid price hikes. BoC is likely to postpone rate cuts amid inflationary pressures Jun 26, 2024

- Brent crude oil hits two-month high amid geopolitical tensions Jun 25, 2024

- RBA and RBNZ have no plans to cut rates this year. Oil is trading at a 2-month high Jun 25, 2024

- FXTM’s Corn: Lingers near 3-month low Jun 25, 2024

- Commodity markets are under pressure from the US dollar growth. New geopolitical risks in the Middle East are on the agenda Jun 24, 2024

- DELL and NVDA are jointly building an artificial intelligence factory. SNB cuts rate for the second time in a row Jun 21, 2024

- The yen is falling again: the devaluation scenario remains the main one Jun 21, 2024