Yen weakens broadly in Asian session, albeit in a subdued market environment due to Japan’s holiday. Despite this, the selloff in the Japanese currency remains relatively contained, with traders vigilant of market intervention by Japan. While 160 level against Dollar is currently considered a floor for Yen, uncertainty persists regarding Japan’s desired exchange rate, which they officially said it’s not targeted. Nevertheless, absent further actions by the authority, the range for Yen consolidation appears to be nearly established.

Elsewhere in the markets, New Zealand Dollar trails as the second weakest performer, despite an OECD report suggesting limited room for RBNZ to cut interest rates this year. Meanwhile, Swiss Franc also softens as the third weakest, retracing some of the gains triggered by last week’s Swiss CPI data.

Market focus shifts to the Australian Dollar, currently the top performer, as investors eagerly anticipate tomorrow’s RBA rate decision. Following is Canadian Dollar while Euro follows suit as the third best performer. Dollar and Sterling maintain middling posit, with the Pound awaiting BoE rate decision later in the week.

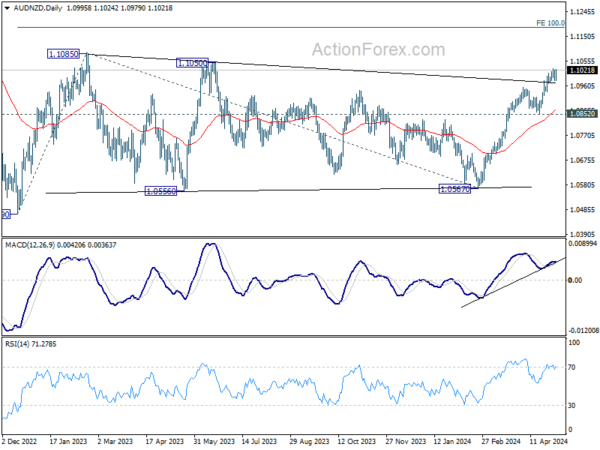

Technically, AUD/NZD is eyeing last week’s high at 1.1024 with today’s rebound. Break there will resume the rally from 1.0567 to 1.1050/1085 resistance zone. Decisive break there will resume whole medium term rise from 1.0469 to 100% projection of 1.0469 to 1.1085 from 1.0567 at 1.1183 next.

In Asia, at the time of writing, Hong Kong HSI is down -0.05%. China Shanghai SSE is up 1.05%. Singapore Strait Times is up 0.26%. Japan is on holiday.

In Asia, at the time of writing, Hong Kong HSI is down -0.05%. China Shanghai SSE is up 1.05%. Singapore Strait Times is up 0.26%. Japan is on holiday.

ECB’s Lane: Recent data improve my confidence on disinflation

ECB’s Chief Economist Philip Lane, in an interview with Spanish newspaper El Confidencial, expressed growing confidence regarding return of inflation to 2% target, thereby increasing the likelihood of an interest rate cut in June.

Lane cited recent data, and stated, “Both the April flash estimate for euro area inflation and the Q1 GDP number that came out improve my confidence that inflation should return to target in a timely manner.” Though, he emphasized the need for ongoing monitoring, acknowledging the influx of additional data between the interview date and June.

Lane downplayed the spillover effects of decisions made by Fed, stating, “The combined effects of decisions taken by the Federal Reserve would be ‘largely contained.’”

Furthermore, Lane underscored the importance of geopolitical developments, particularly in the Middle East. “We have to accept that we live in a world that is going to face a lot of geopolitical tensions over a number of years,” he said, recognizing the long-term reality of enduring geopolitical tensions.

China’s Caixin PMI services dips to 52.5, weak expectations a major hurdle

China’s Caixin PMI Services for April, while dipping slightly from 52.7 to 52.5 as expected, maintains a growth streak for the 16th consecutive month. The sector sees robust expansion in new business, marking its fastest pace in nearly a year. Business confidence also reaches its peak for the year so far. PMI Composite, which edged up from 52.7 to 52.8, reached its highest level since May 2023

“The growth in supply and demand in the manufacturing and services sectors picked up pace, with outstanding export growth,” notes Wang Zhe, Senior Economist at Caixin Insight Group. However, Wang cautions, “the pressure on the job market should not be overlooked,” with employment metrics experiencing a sharper decline compared to the previous month.

Furthermore, Wang highlights the persistent challenges in pricing dynamics, stating that “input and output prices remained relatively low, particularly due to the drag from manufacturing factory gate prices.”

Wang noted, “Weak expectations remain one of the major hurdles facing economic development, leading to increasing pressure on employment and a greater risk of deflation.”

OECD sees limited scope for RBNZ rate cut this year

OECD said the persistence of inflationary pressures within New Zealand would limiting the flexibility for monetary policy easing this year.

According to the Economic Surveys report, “Inflation is likely to be persistent,” thus constraining the scope for lowering the OCR in 2024. OECD recommends maintaining OCR at 5.5% until there is tangible evidence of inflation moderating to the middle of RBNZ’s target range.

In addition, OECD emphasizes the significance of fiscal prudence and urges the government to adopt measures aimed at gradually reducing the fiscal deficit to attain budget balance. Specifically, it advocates for the implementation of operating allowances and tax policies geared towards fiscal consolidation. OECD emphasizes, “Any tax cuts should be fully funded by offsetting revenue or expenditure measures.”

OECD projects modest economic growth for New Zealand, with expectations of a 0.8% expansion in the year through December 2024, followed by improvement to 1.9% in 2025.

RBA and BoE to hold, UK GDP and Canada employment watched

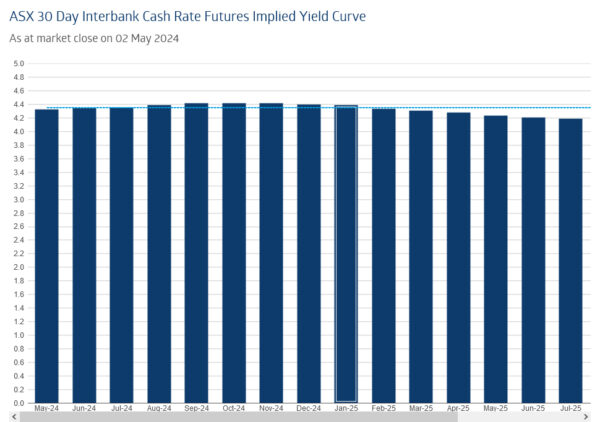

RBA’s rate decision is in the spotlight this week, and it’s widely expected to keep official cash rate at 4.35%. Australia’s “big four” banks, Commonwealth Bank of Australia, Westpac, National Australia Bank, and ANZ, all predict that the next policy move to be a rate cut in November. However, the broader market sentiment diverges significantly from this perspective. According to ASX’s RBA rate tracker, there is currently a 40% probability that RBA might increase its official cash rate by November.

Market participants will be closely examining RBA’s updated Statement on Monetary Policy and Governor Michele Bullock’s remarks during the press conference for any subtle cues that might indicate a shift towards tightening monetary policy.

In the UK, BoE is also expected to hold its ground, maintaining interest rate at 5.25%. With inflation in still a significant concern, the financial markets have tempered their expectations, now fully pricing in the first rate cut only by September. The likelihood of a subsequent rate reduction by the end of the year is currently seen as just around 50%. But these development will hinge on whether inflation would fall significantly in the months ahead, aligning with developments in Eurozone as some BoE officials anticipated.

Meanwhile, will be paying close attention to the BoE’s updated economic projections in the forthcoming Monetary Policy Report. However, significant policy revelations are not anticipated at this meeting. The voting pattern will also be observed, but it’s also unlikely to be particularly inspiring. Swati Dhingra is likely to persist as the lone advocate for a rate cut, while hawks like Jonathan Haskel and Catherine Mann are not expected to U-turn back to a hike. Other members are unlikely to vote for a change at this point. towards a more dovish stance.

Additionally, this week features other central bank activities such as BoJ’s release of its summary of opinions and ECB’s publication of its meeting accounts. However, these documents are unlikely to deliver any surprises or significant shifts in market understanding. Other crucial economic data slated for release includes the UK GDP and Canadian employment figures on Friday.

Here are some highlights for the week:

- Monday: China Caixin PMI Services; Eurozone PMI services final, Sentix investor confidence, PPI;.

- Tuesday: RBA rate decision; Swiss unemployment rate, forex currency reserves; France trade balance; UK PMI construction; Eurozone retail sales; Canada Ivey PMI.

- Wednesday: Germany industrial production; Italy retial sales.

- Thursday: Japan average cash earnings, leading indicators, BoJ summary of opinions; China trade balance; BoE rate decision; US jobless claims.

- Friday: New Zealand BNZ manufacturing; Japan household spending, current account; UK GDP, production, trade balance; Italy industrial production; ECB meeting accounts; Canada employment; US U of Michigan consumer sentiment.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 191.26; (P) 192.03; (R1) 192.72; More..

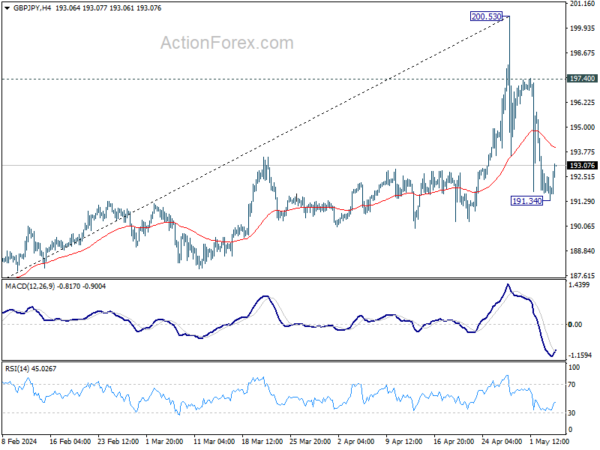

Intraday bias in GBP/JPY is turned neutral first with current recovery. On the upside, break of 55 4H EMA will bring stronger rebound back toward 197.40 resistance. On the downside, below 191.34 will resume the correction from 200.53. Sustained trading below 55 D EMA (now at 191.42) will target 61.8% retracement of 178.32 to 200.53 at 186.80.

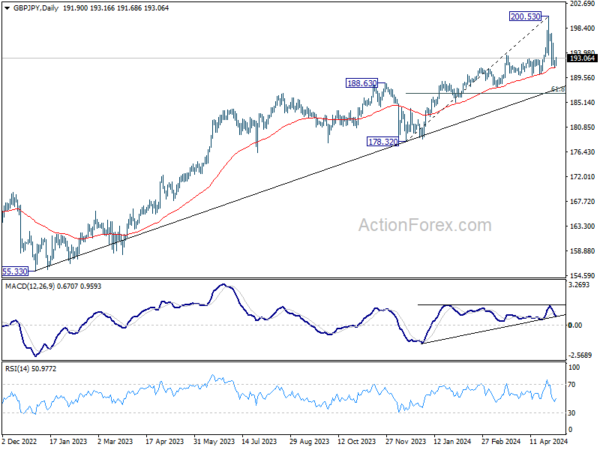

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 183.34) holds, fall from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M Apr | 0.10% | 0.10% | ||

| 01:45 | CNY | Caixin Services PMI Apr | 52.5 | 52.5 | 52.7 | |

| 07:45 | EUR | Italy Services PMI Apr | 54.7 | 54.6 | ||

| 07:50 | EUR | France Services PMI Apr | 50.5 | 50.5 | ||

| 07:55 | EUR | Germany Services PMI Apr F | 53.3 | 53.3 | ||

| 08:00 | EUR | Eurozone Services PMI Apr F | 52.9 | 52.9 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence May | -5.9 | |||

| 09:00 | EUR | Eurozone PPI M/M Mar | -0.70% | -1.00% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Mar | -8.30% |