By RoboForex Analytical Department

The USD/JPY pair is rising, reaching 148.28 on Friday. The US dollar is strengthening across the market following the release of US retail sales data.

This information is prompting market participants to reassess their expectations for the future of the US Federal Reserve’s interest rate policy. The Fed could interpret strong retail sales as a significant inflationary factor, potentially delaying the timing of any rate cut.

On Friday, Japan’s Finance Minister Shunichi Suzuki stated that the Japanese economy is no longer suffering from deflation, as there is a strong trend towards wage growth. This statement is particularly noteworthy as previous comments from officials, including the Prime Minister, suggested the country had yet to fully emerge from a deflationary state.

According to Suzuki, the government has mobilised all efforts to support this wage growth trend.

The next Bank of Japan (BoJ) meeting is scheduled for next week, and high expectations surround its outcome. The interest rate could finally move out of negative territory, currently at -0.1% annually. The BoJ remains the only major central bank that maintains negative borrowing costs.

Technical Analysis of USDJPY

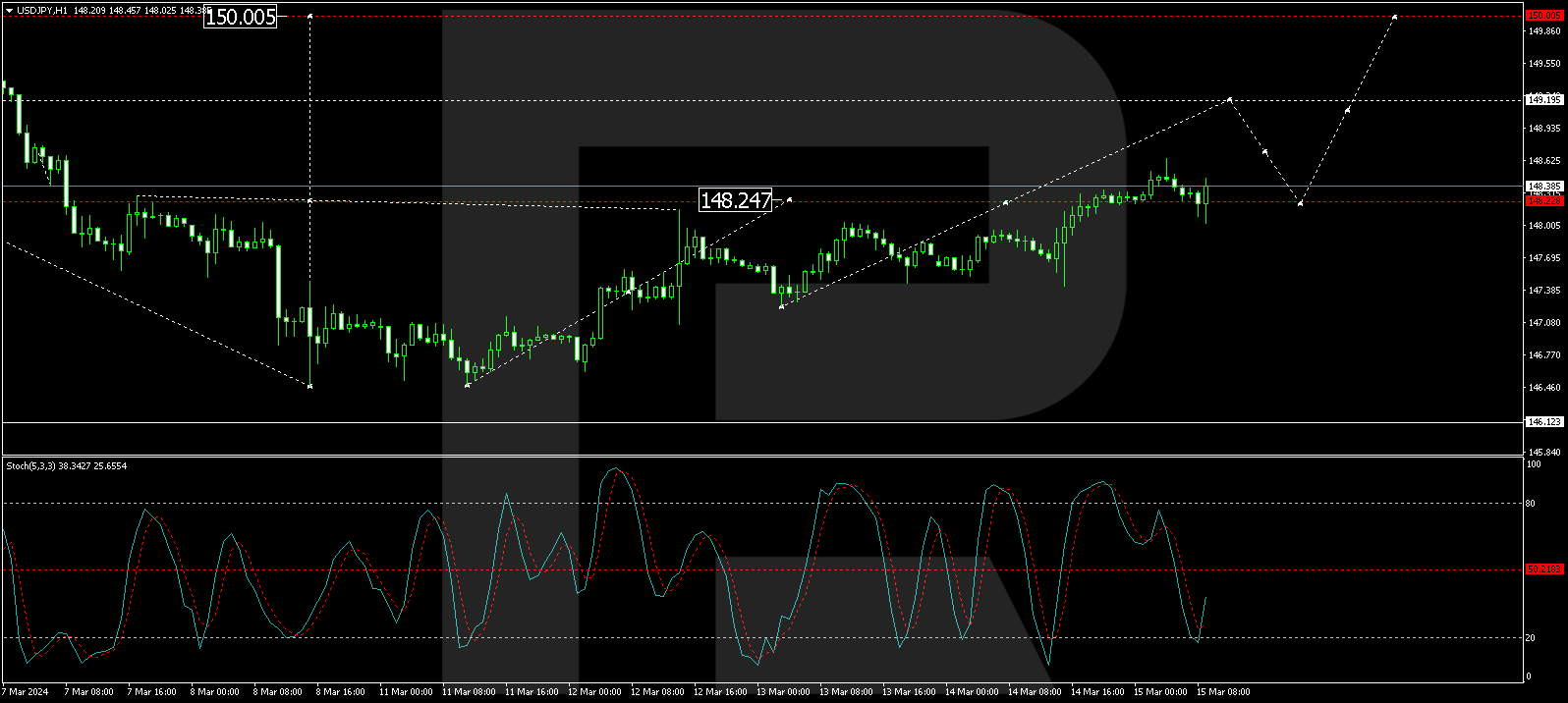

On the H4 chart, USDJPY has completed a growth wave to 148.64. Today, we consider the likelihood of forming a consolidation range below this level. Exiting upwards from this range could open the potential for a growth wave to 149.20, with the trend possibly continuing to 150.00. The MACD oscillator confirms this scenario, with its signal line breaking above zero and aiming for new highs.

On the H1 chart, USDJPY is forming a consolidation range around 148.22. We expect an upward exit from this range and the continuation of the growth wave to 149.20. Following the completion of this level, a correction back to 148.22 (testing from above) is possible. Subsequently, the growth is expected to reach the main target of the wave at 150.00. The Stochastic oscillator supports this scenario, with its signal line above the 20 mark and ready to move towards 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Yen Weakens Despite Japan’s Deflation Exit Mar 15, 2024

- Silver prices have reached a one-year high. Oil is growing amid a decline in inventories Mar 14, 2024

- Target Thursdays: USDJPY, Silver & Crude reach targets! Mar 14, 2024

- Canadian Dollar Seeks Opportunities for Growth Mar 14, 2024

- ECB intends to cut rates this spring. The US stock indices grow despite inflation growth Mar 13, 2024

- XAGUSD: Bulls down but not out Mar 13, 2024

- US Dollar Strengthens Amid Inflation Data Mar 13, 2024

- Commercial Property Prices: Why the Decline May Have Just Started Mar 12, 2024

- Natural gas prices are falling again. Chinese indices are growing amid support from the Central Bank Mar 12, 2024

- The US labor market is cooling. ECB officials talked about cutting rates in the spring Mar 11, 2024