~ Shrishti Sharma

The financial landscape for women in India presents unique data points that diverge from the general landscape. Financial inclusion is crucial for societal progress, so understanding the financial behavior and preferences of women becomes a priority.

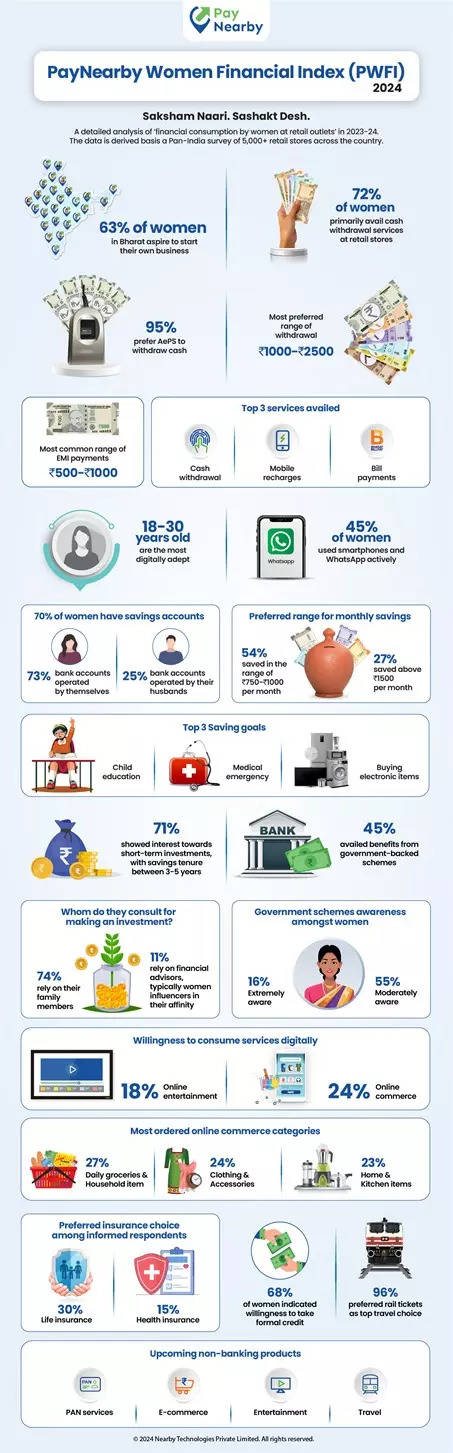

PayNearby, a Mumbai-based Fintech, released its PayNearby Women Financial Index (PWFI) report that offers a look into the financial lives of women in Bharat, bringing spotlight on their aspirations, challenges, and what is the state of financial services.

There are over 15 million MSMEs in India, as mentioned in a report released by IFC in 2022, According to the PWFI report, over 63% of women in Bharat aspire to venture into entrepreneurship. India, as a developing country, has always faced the dilemma of more people waiting to be employed than the ones generating employment. The situation seems to take a shift, with the evolved thought processes and the quench to be financially independent.

There is a prevailing preference for cash transactions among women, with 48% favoring this traditional mode. However, the rising popularity of Aadhaar-enabled Payment System (AePS) suggests a gradual shift towards digital transactions.

The PWFI report offers a comprehensive look into the savings and investment patterns of women in Bharat. From common goals such as child education and medical emergencies to preferred savings ranges and a growing interest in short-term investments, the report reflects a changing mindset among women.

Even though the government of India has been providing several schemes to benefit its citizens, for the longest time, the awareness and accessibility to such schemes has been an issue. The report brings into picture how 45% of women are availing benefits from government-backed initiatives.

Despite some progress in recent years, financial literacy remains elusive for many women, as highlighted by the findings of the PWFI. 74% of women still depend on family members when navigating investment decisions, indicating a significant gap in their independent financial knowledge. This reliance on external influences suggests that women’s financial choices may not fully reflect their own agency of thought. Although efforts have been made to bridge this gap, the complex nature of finances continues to create a barrier.