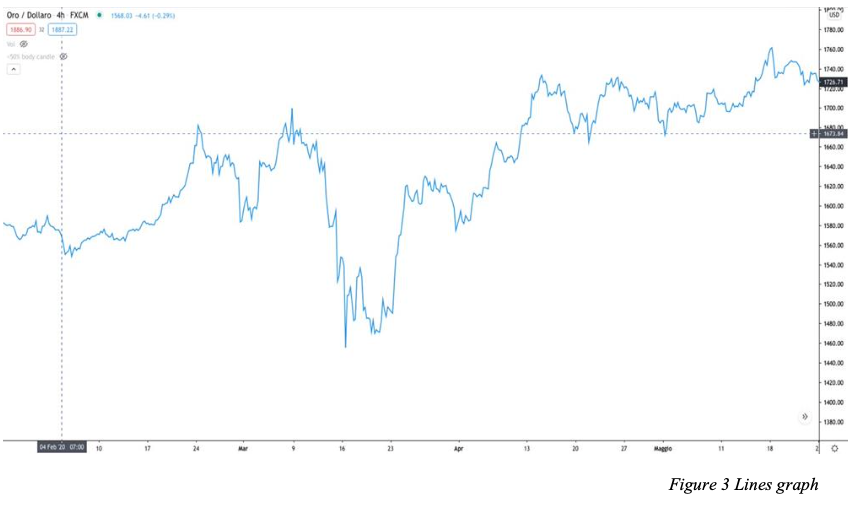

Lesson 5: Type of Graphs

Every day, we see stock market charts on the TV news. They are often “line” charts, but there are many other ways to read them. The most used are “lines”, “candles”, and “bars” charts. Let’s find them out!

Guess what? The graph with which the market is analyzed is not the usual line chart they show us daily, but rather the candlestick one. It looks as complicated as a graph, but it’s not!

THE CANDLE GRAPH: As the name implies, the chart comprises many candles next to each other. Each candle indicates a respective time frame; if you set your chart at 1h, each candle will represent 1h of the day. If we set the chart at 4h, each candle will indicate 4h of the day.

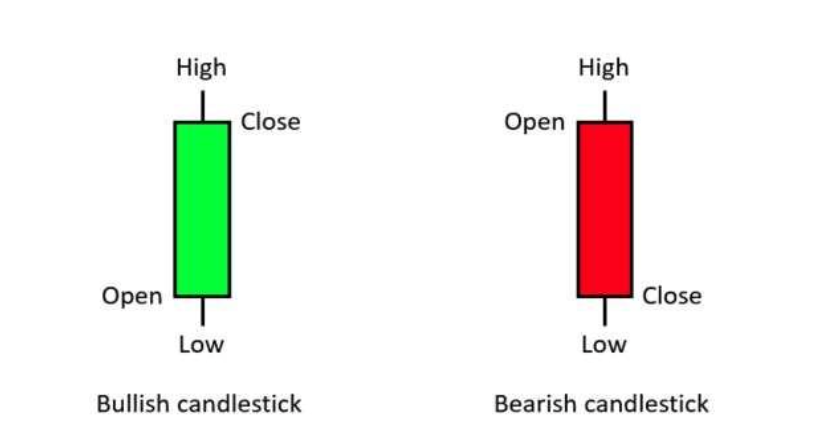

Important! The candles have 2 different colours respectively: green indicates a rise, red indicates a drop.

As you can see, each candle comprises a body and two shadows, the upper and the lower. If the market is uptrend (Bull Market), we will find many more green candles than red ones. Each green candle is formed by an opening level, which refers to the level at which the old candle closed and the beginning of the new one; the lower shadow indicates the lowest point where the price has arrived, and the upper shadow indicates the maximum price reached.

The body’s closing is the price achieved at the end of the minute. Remember that each candle indicates a specific period of time; therefore, the minimum and maximum points of a candle are referred to the time you set. In the event of a bearish trend (Bear Market), we will find many more red candles than green ones. The way of looking at them is the same, only the perspective changes. The closing point of the green candle will be the opening point of the red candle, while the opening point of the candle following our red candle indicates where our candle closed. The trend changes and, therefore, also the way of observing each candle.

Congratulations, now you know how to read candles, but unfortunately, this is only the beginning!

Trading Lessons:

Lesson 1: Quick Introduction

Lesson 1: Introduction "The secret to being successful from a trading perspective is to have an indefinite and tireless thirst for information and knowledge." Paul Tudor Jones Forex trading, the abbreviation for "Foreign Exchange Market", occurs when one...

Lesson 2: Trading Timetable

Lesson 2: Trading Timetable The Forex market is open 5 days a week 24 hours a day, but it is divided into 4 different sessions: • Sydney • Tokyo • London • New York Each session has a different opening and closing time. Attention: In summer and winter the...

Lesson 3: How to Invest in Trading

Lesson 3: How to Invest in Trading 85% of traders lose their money. How is it possible? There is nothing more important than investing in yourself. To become a professional trader, you must face many needs and fears. A winning strategy is necessary, notions of...

Lesson 4: Fundamental Notions

Lesson 4: Fundamental Notions The market can make three movements: Bull Market: if the trend rises, the currency gains value. Bear Market: if the trend falls, the currency loses value. Horizontal Trend (Kangaroo Market): the price moves continuously,...

Lesson 6: Type of Candles

Lesson 6: Type of Candles Each candle has its own story and, of course, its meaning. Recognizing the type of candle is very important as it indicates the intentions of the market. It does not matter to know the names of each type, but it is good to understand...

Lesson 7: Support and Resistance

Lesson 7: Support and Resistance Supports and resistances are levels where the price has a great chance to bounce. We will notice how the price will bounce several times on the same level before continuing its rise or fall. Supports: Levels at which the price is...

Lesson 8: TrendIines and Patterns

Lesson 8: Trendlines and Patterns In trading, there are not only supports and resistances, but other patterns must be considered very important. Price often forms channels in which the trend bounces. You must recognize them to be prepared to enter the market....

Lesson 9: Market Movement

Trading Course Introduction The market goes through three different moments, which is good to know. In both bearish and bullish momentum, the market will go through 3 various movements:• Distribution• Re-Distribution• Accumulation•...

Lesson 10: Types of Trend

Lesson 10: Types of Trend Let’s start with the definition of “Momentum”. Momentum refers to the general trend of the graph. As we have already studied, the market can be in a Bearish, Bullish or Kangaroo phase. Now, we need to look at how the trend moves in...

Lesson 11: Supply and Demand

Lesson 11: Supply and Demand As I mentioned at the beginning, I am a Scalper, and consequently, I am satisfied with a small slice of the trend, from 10 to 20 PIPS. Don't think that with 20 Pips, you can earn less than with 100; trading is based on percentages....

Lesson 12: Fibonacci Retracement

Trading Course Introduction Many of you may have heard about Fibonacci Retracement but don't know how to use it. Let's start with a basic definition: Fibonacci Retracement is a key technical analysis tool that uses percentages and horizontal lines drawn on price...

Lesson 13: Indicators

Lesson 13: Indicators Forget the indicators; most are useless, and they only dirty the graph. Remember that we work with clean charts; we follow the trend. Many Forex Gurus will advise you to use indicators on indicators, but in these chapters, you will find...

Lesson 14: Market Manipulation

Lesson 14 Market Manipulation Many of you have already heard of the Fake Out; the Fake Out can be considered a market manipulation that serves to deceive traders. It happens after a long series of ascending or descending markets; the price breaks the support or...

Lesson 15: Plan and Risk Management

Lesson 15: Plan and Risk Management Many people approach the world of trading fascinated by simple money, but trading is a whole other world; as you can already understand, it is 90% patience and 10% the correct analysis. Anyone who believes in easy money will...

Lesson 16: Simple Trading Strategy

Lesson 16: Simple Trading Strategy I begin by saying that this strategy worked for me initially, and it’s not sure it will work for all of you. Each one will improve over time, and you will understand the best strategy suitable for yourself.As you can see, we...

Lesson 17: Psychology

Lesson 17: Psychology I’m the greatest. I said that even before I knew that I was -Muhammad Ali Reread this chapter whenever you fail and think you can't do it. I'm sorry to tell you that you will keep losing and burning accounts without the proper psychology,...

Lesson 18: Suggestions

Lesson 18: Suggestions Brokers: ICMARKETS: It is by far the best. Remember to open an ECN / RAW account if you are a Scalper. This will have a commission instead of the spread. As a scalper, I am also happy with 7 Pips. Certainly, I don't want to earn to give...