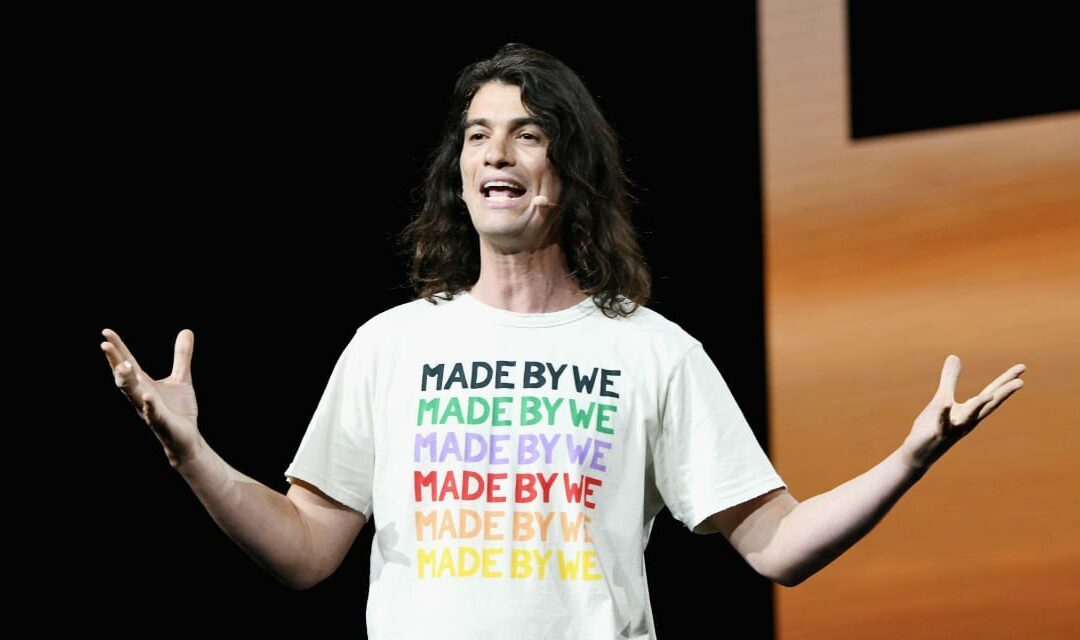

Adam Neumann is trying to buy back the company he co-founded and loaded with debt.

According to a letter obtained by Bloomberg News and the New York Times, Neumann is trying to buy WeWork out of Chapter 11 bankruptcy, with an assist from Dan Loeb’s Third Point. WeWork filed for bankruptcy protection in November.

The letter said Neumann’s Flow Global and other investors have been trying to obtain information to lodge a bid since December.

“In a hybrid work world where demand for WeWork’s product should be greater than ever, my clients believe that the synergies and management expertise offered by an acquisition by my clients could significantly exceed the value of the Debtors on a stand-alone basis. WeWork should at least educate itself about that potential and not preclude itself from maximizing value,” says the letter that the New York Times published.

In a statement, WeWork said it’s received many expressions of interest, without directly commenting on Neumann. “We receive expressions of interest from external parties on a regular basis. We and our advisors always review those approaches with a view to acting in the best interests of the company. We continue to believe that the work we are currently doing — addressing our unsustainable rent expenses and restructuring our business — will ensure WeWork is best positioned as an independent, valuable, financially strong and sustainable company long into the future.”

Neumann made at least $1 billion from WeWork, according to Wall Street Journal calculations. WeWork said an independent investigation is looking into the company’s transactions with Neumann as well as the settlement agreement when he departed. Neumann so far has declined to cooperate, WeWork said in a filing to the bankruptcy court.

Over the weekend, the company lamented that rapidly rising interest rates have led to leases and subleases at reduced rates and more flexible terms, creating significant competition for WeWork’s target customers. The post-pandemic return to the office has been slower than expected, leading to a corresponding drag on WeWork’s sales.

“Saddled with many sub-optimal leases characterized by above-market rents and fixed annual rent escalation without rent resets or lessee-friendly termination rights, WeWork’s existing business became increasingly difficult to maintain in the changing real estate market,” the company said.