Summary

The employment situation report for April kicked off the second quarter with signs that the labor market is cooling. Nonfarm payrolls increased by 175K in the month, below consensus expectations for a 240K gain, while the unemployment rate rose a tenth to 3.9%. Meantime, average hourly earnings growth slowed and, at just 3.9% year-over-year, is not too far above the 3.3% average that prevailed in 2019.

Overall, today’s data point to a jobs market that is still tight, but not nearly as hot as it was a year or two ago. This should support a further slowdown in inflation as the year progresses, even if improvement proceeds only gradually. We think it is unlikely the FOMC will be ready to start cutting rates by its next meeting in June, but our base case for the first rate cut to occur at the September 18 FOMC meeting remains firmly in play based on today’s employment data.

Employment Underwhelms to Start Q2

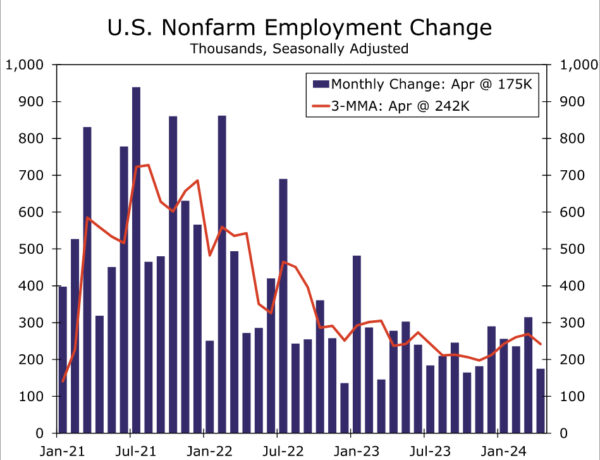

The April employment report leaves the jobs market looking a little more vulnerable to the Fed’s efforts to cool the economy down. Nonfarm payrolls registered an increase of 175K compared to a prior three-month average of 276K (now 269K incorporating revisions). The increase fell short of consensus expectations for a 240K gain in what is only the fourth time in the past two years the initial print undershot the consensus.

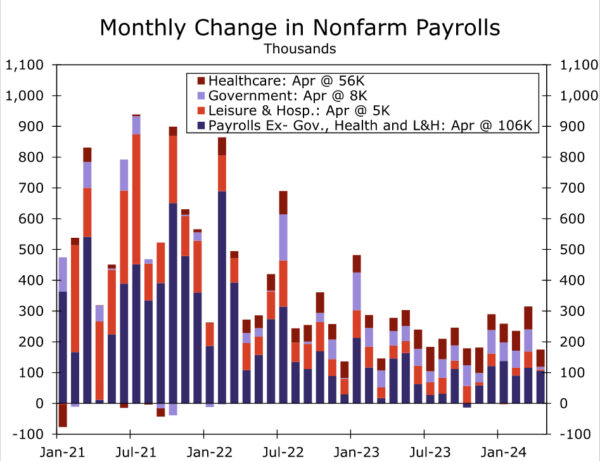

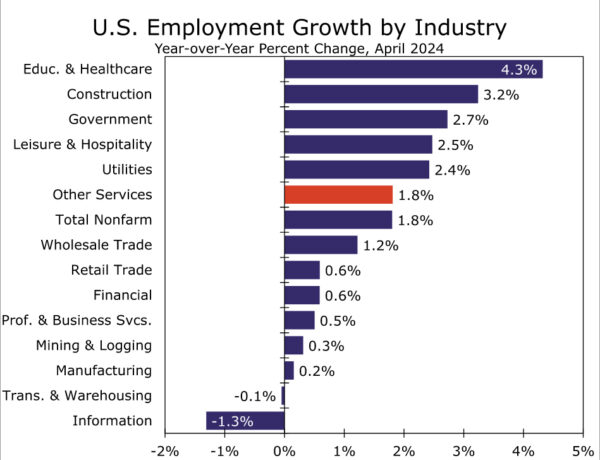

On an industry basis, job growth remained solid in healthcare & social assistance (+87K), while picking up in manufacturing (+8K). However, elsewhere the picture was underwhelming. Leisure & hospitality and construction employment slowed sharply relative to their Q1 averages, suggesting the mild winter weather and early Easter/spring breaks may have pulled some hiring forward. Government hiring also downshifted notably, up by just 8K compared to an average of 55K the prior 12 months. Higher-wage industries also struggled to add jobs, with payrolls declining in information, professional & business services and mining, flat within the utilities industry, and up only modestly in the financial industry in April.

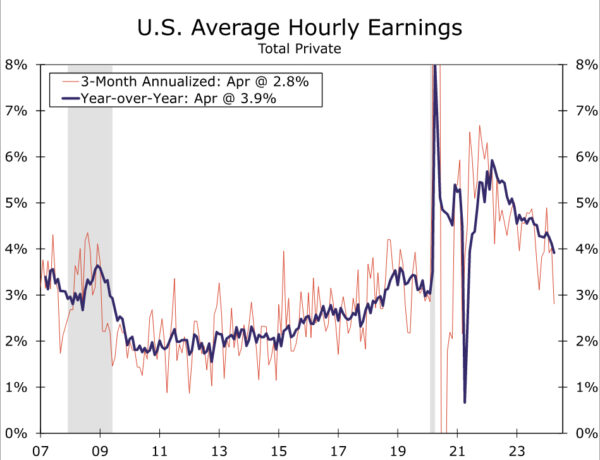

The weak outturn in payrolls for higher-paying industries as well as gradual loosening in labor market conditions weighed on average hourly earnings (AHE) growth over the month. AHE for private sector workers increased 0.2%, which was a tick less than the consensus and our own expectations. On a year-ago basis, average hourly earnings growth slowed to 3.9%, the first sub-4% print in nearly three years. While average hourly earnings are less encompassing than the employment cost index and prone to revision, the subdued gain in April suggests the labor market is still on track to bring some relief on the inflation front this year after the downward trend in both labor costs and inflation stalled in Q1. While the slower rate of nominal wage growth in April may be good news for the Fed’s inflation fight, in the near term it is likely to challenge consumer spending, particularly when coupled with the slower rate of job growth and another dip in the average workweek.

The more volatile household survey showed employment rising by just 25K in April. A 63K increase in unemployment helped push the unemployment rate up a tenth to 3.9%. Although still low, the unemployment rate is now 0.3ppt above its 2023 average of 3.6%. The labor force participation rate held steady at 62.7% amid an 87K increase in the labor force in the month.

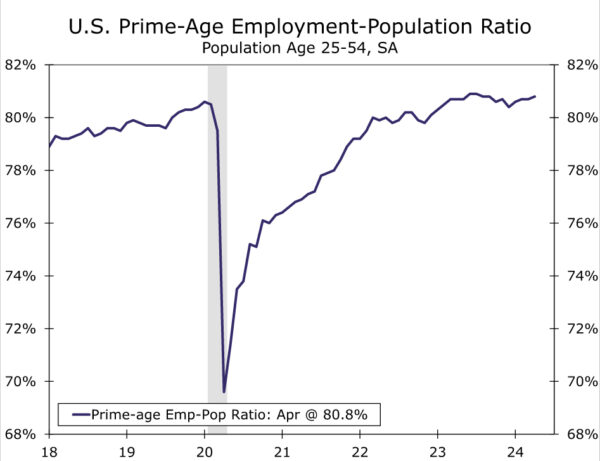

It was not all bad news in the household survey. Full-time employment rose by 949K, with a 649K decline in people working part-time for noneconomic reasons. The share of the “prime-age” population that was working in April also climbed a tick and is now just one-tenth away from reclaiming the high that was reached in the summer of 2023 (chart). Household employment growth over the past year remains significantly weaker than the payroll survey, but as we discussed at length in a recent report, we do not think the household measure is presaging an imminent collapse in payrolls.

The data for the U.S. economy were strong across-the-board in Q1, with employment and prices both accelerating through the first few months of the year. The first employment report of Q2 offers a tentative sign that the underlying trend is not quite as hot as the Q1 data suggested. Nonfarm payrolls grew in April at the slowest pace since October of last year, the unemployment rate climbed by a tenth and average hourly earnings dipped below a 4% year-ago pace for the first time since early 2021. These data points are broadly consistent with a labor market that is still tight but not nearly as hot as it was a year or two ago. This in turn should be associated with a continued slowdown in inflation as the year progresses, albeit gradually.

That said, a 175K increase in nonfarm payrolls and a 3.9% unemployment rate is hardly cause for panic. Furthermore, the FOMC will want to see if the pending inflation data also show signs of a slowdown relative to Q1. The next CPI report will be released on May 15, and the one after that will be released on June 12, coinciding with the conclusion of the next FOMC meeting. We think it is unlikely the FOMC will be ready to start cutting rates by its next meeting in June, but our base case for the first rate cut to occur at the September 18 FOMC meeting remains firmly in play based on today’s employment data. The next few months of inflation data will be critical to that forecast.