Futures suggest Wall Street’s new week will get off to a cautious start, albeit with major stock barometers holding at record highs.

Over just the last three months the Nasdaq Composite

COMP

has climbed 13.8% and the S&P 500

SPX

has gained 11.8%. Worrywarts are seeking synonyms for bubble.

But a team at Bank of America, led by Savita Subramanian, equity and quant strategist, remains bullish, increasing their end of year S&P 500 target from 5,000 to 5,400.

To be clear, Subramanian says a market pullback is likely, noting that on average since 1929, 5% pullbacks have occurred three times per year and 10% corrections once per year.

“We are due after four months with no meaningful drop, and our Chief US Technician sees bearish divergences,” she writes in a note dated Sunday. It’s also the case that the CBOE VIX

VIX,

the volatility measure known as Wall Street’s fear gauge, tends to rise 25% from the second quarter to November of previous election years, a sign that uncertainty is building. But after the vote, the removal of uncertainty makes a year-end rally more likely.

So, that caveat out of the way, how does Subramanian reach her conclusion of a further 5% or so upside for the S&P 500 this year?

The BofA team come to their S&P 500 target by considering five different methods of forecasting market levels. They then subscribe weights to each of these factors, which can fluctuate given market circumstances and investors’ predilection at the time. These are shown in the table below.

Source: Bank of America

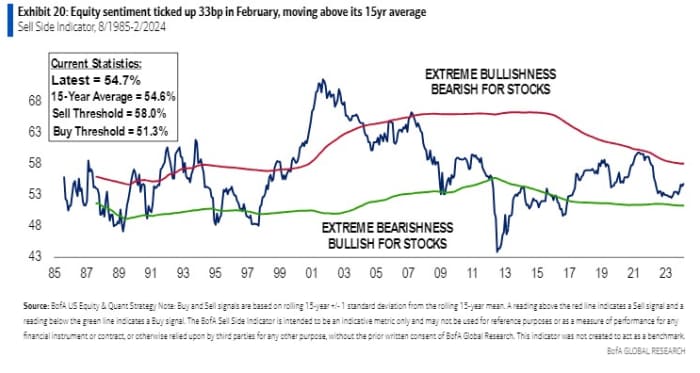

At the moment the most optimistic of the five, and with an equal top weighting of 30%, is the sell side indicator which produces a 2024 S&P 500 target of 5,706. However, the weighting has come down from 40% because the SSI shows analysts are perhaps already a bit too optimistic.

Source: Bank of America

A purely technical factor is 12-month price momentum, and this suggests a level of 5,543, though given how much momentum is a tad stretched the weighting has dropped from 15% to 10%.

The earnings surprise index produces a target of 5,523 and its weighting has been raised from 10% to 15%. “Guidance is weak (likely due to early year conservatism), but BofA analysts are positive on earnings vs. consensus,” says Subramanian.

The long term valuation factor predicts a level of 5,247 and its weighting has dropped from 15% to 10%. “Valuation may not be a catalyst, but has had strong predictive power over long-term returns,” says Subramanian. “Today’s multiple of 25x normalized earnings implies +2.6%/yr annualized returns over the next decade based on the historical relationship,” she adds.

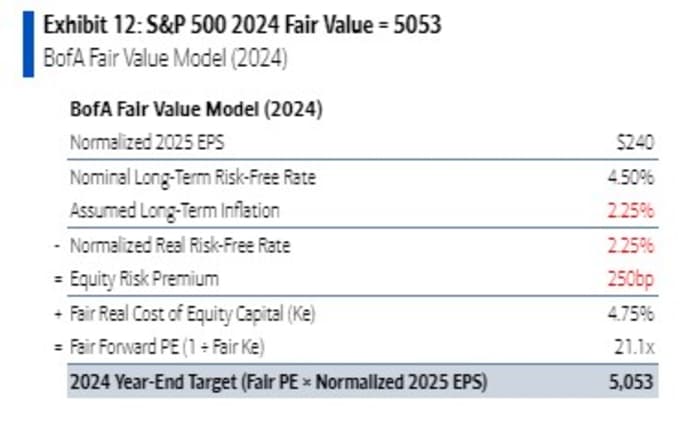

The biggest contributor to the overall S&P 500 target is an increase in the fair value model from 4,400 to 5,050, with a weighting doubling from 15% to 30%. This reflects a shift in the mix of the S&P 500 to higher margin, lower earnings risk industries, as shown by by continued margin stability despite a surge in the volatility of interest rates and inflation, according to the BofA team.

Source: Bank of America

“We see potential for improved margin stability from here as companies shift from global cost arbitrage and free capital-driven growth to efficiency/productivity,” they say.

Addressing accusations that the market is experiencing dangerous euphoria, Subramanian and team say this sentiment is “thematic and secular” concerning mainly AI and weight-loss drugs, and that they expect the market to broaden beyond those themes.

“The sell side has grown more bullish on equities…but pension fund allocations to public equity are still at 20yr lows, and positioning in up-market themes like high beta stocks and cyclical sectors is at bearish extremes”.

Markets

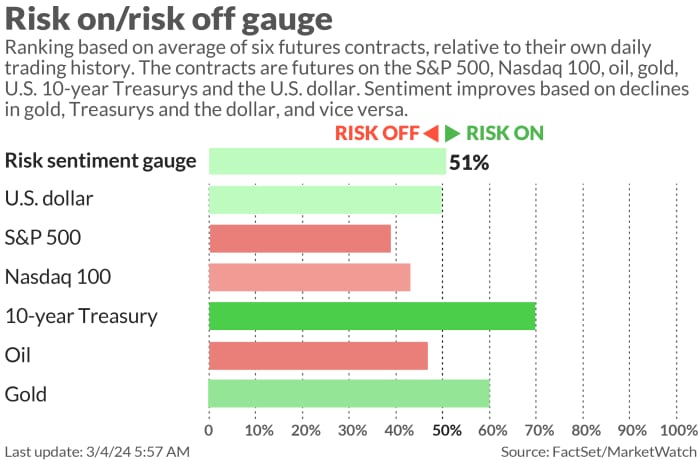

U.S. stock-index futures

ES00,

YM00,

NQ00,

are mixed as benchmark Treasury yields

NQ00,

move higher. The dollar

DXY

is a fraction lower, while oil prices

CL.1,

steady near $80 a barrel and gold

GC00,

is trading around $2,080 an ounce.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,137.08 | 0.95% | 3.60% | 7.70% | 26.98% |

| Nasdaq Composite | 16,274.94 | 1.74% | 4.13% | 8.42% | 39.23% |

| 10 year Treasury | 4.212 | -7.05 | 5.03 | 33.11 | 24.74 |

| Gold | 2,092.90 | 2.54% | 2.52% | 1.02% | 12.98% |

| Oil | 79.94 | 3.02% | 9.81% | 12.07% | -0.68% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Apple stock AAPL is off 1.5% after the European Union fined the U.S. tech giant nearly $2 billion for breaking the bloc’s competition laws by unfairly favoring its own music streaming service over rivals.

The fourth quarter of 2023 U.S. company earnings season is mostly complete, though there are a few stragglers. GitLab

GTLB,

Stitch Fix

SFIX,

and Science Applications International

SAIC,

are among those releasing results after Monday’s closing bell.

There are no big pieces of U.S. economic data due on Monday. Philadelphia Fed President Tom Harker is due to make comments at noon Eastern.

The really important Fedspeak of the week is likely to come from Chair Jay Powell, when he gives testimony to Congress on Wednesday and Thursday. The nonfarm payrolls report for February will be published on Friday.

Japan’s Nikkei 225 index

JP:NIK

rose above 40,000 for the first time as the global tech rally rumbled on.

The Chinese government said it is eliminating an annual news conference by the premier that was one of the only times a top Chinese leader took questions from the news media.

U.S. crude futures

CL.1,

are trading near $80 a barrel, with the market absorbing news that OPEC + will extend voluntary production cuts into the second quarter.

Shares of Super Micro Computer

SMCI,

are up nearly 12% following news late Friday it would join the S&P 500.

Bitcoin

BTCUSD,

rose above $65,000, helping lift shares of Coinbase Global

COIN,

the crypto trading site, up 6.5%.

The Bank for International Settlements says that option-selling ETFs are helping suppress the VIX.

Best of the web

The worst possible way to be rejected for a job.

U.S. political ‘chaos’ shuts Pentagon contractors out of military stocks boom.

U.S. defeat in Micron trade-secrets case reveals struggle countering Beijing.

The chart

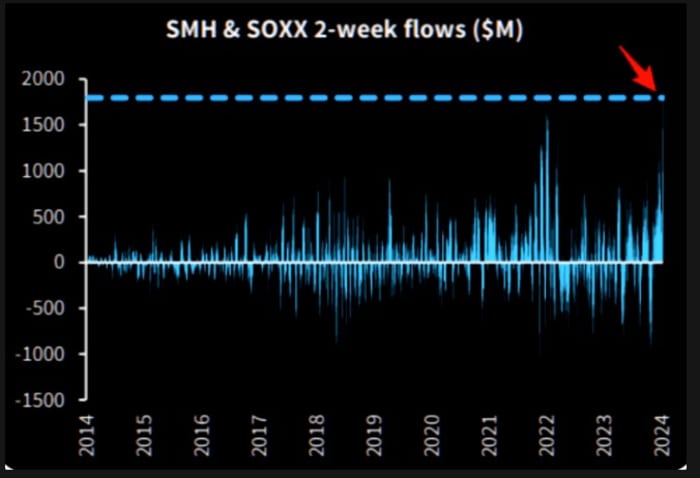

The last two weeks of fund flows into the VanEck Semiconductor ETF

SMH

and the iShares Semiconductor ETF

SOXX

are the highest on record, according to The Market Ear, and show just how much investors like chips. As TME says: “The last time we saw a surge like this was in late 2021, just before there was weakness.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

SMCI, |

Super Micro Computer |

|

TSM, |

Taiwan Semiconductor Manufacturing ADR |

|

AMD, |

Advanced Micro Devices |

|

MARA, |

Marathon Digital |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

PLTR, |

Palantir Technologies |

|

NIO, |

NIO |

Random reads

The origins of a disgusting ritual that Kylie Minoque partaked in.

This is your captain speaking: push!

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.