Third Point founder and chief executive Dan Loeb, in a colorful way, isn’t a believer that the current economic growth will be sustained.

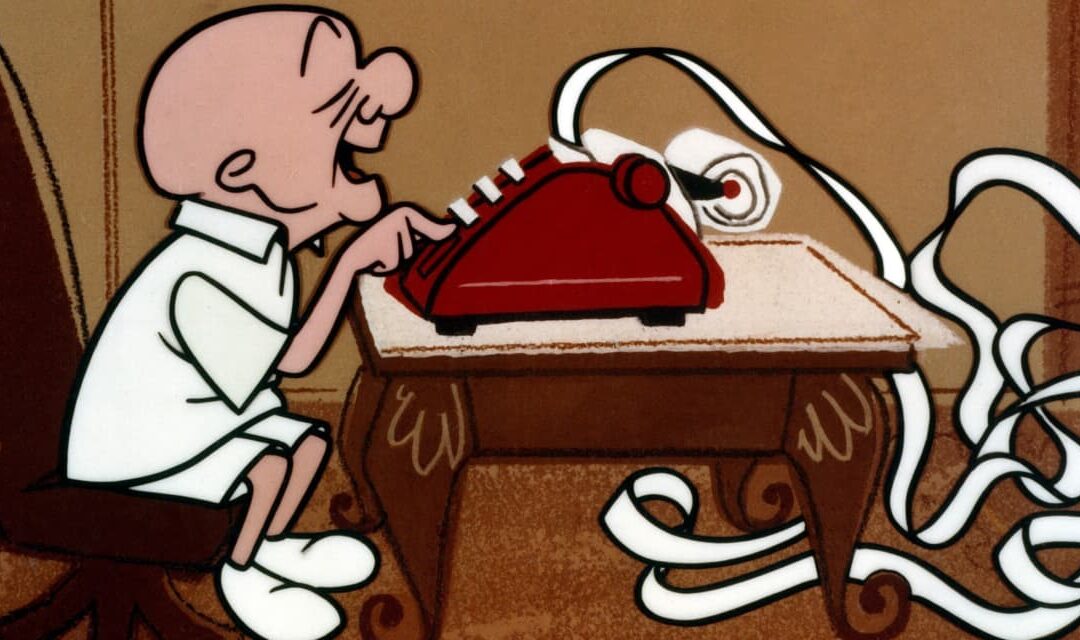

In a now-deleted message on the social media service X, Loeb quote-tweeted a New York Times opinion piece arguing Bidenomics is still working very well. The hedge-fund investor called it “MrMagooenomics,” and said celebrating conditions now is like enjoying a party before hangovers and DUIs, though he said people were at the moment having a “splendid time.”

Mr. Magoo was a bumbling cartoon character, who it should be noted often ended up in a situation no worse than before.

The U.S. unemployment rate is at a historically low 3.7% and gross domestic product grew an annualized 3.3% in the fourth quarter, though inflation remains high with year-over-year consumer price growth of 3.1% in December.

Loeb’s flagship offshore fund returned 3.4% last year, compared to the 26.3% total return for the S&P 500

SPX.

“While assets have certainly priced in some of the good macroeconomic news on inflation and rates, we still believe headline equity market multiples exaggerate the valuation most companies are trading for and continue to find high-quality companies trading at reasonable valuations,” he said in a shareholder letter earlier this month.

Third Point’s most recent 13-F does show some Magnificent Seven winners including Microsoft

MSFT,

Amazon.com

AMZN,

and Meta Platforms

META,

but notably did not include Nvidia

NVDA,

whose stock soared Thursday as it became the third-most valuable company in the S&P 500.