The Bank of England sent its clearest signal yet that it was closing in on interest-rate cuts, with Governor Andrew Bailey indicating markets were underpricing the pace of easing in the months ahead.

The BOE governor made his comments after the UK central bank voted 7-2 to keep the base interest rate at 5.25%, a decision announced Thursday in London. He said recent inflation data have been “encouraging.”

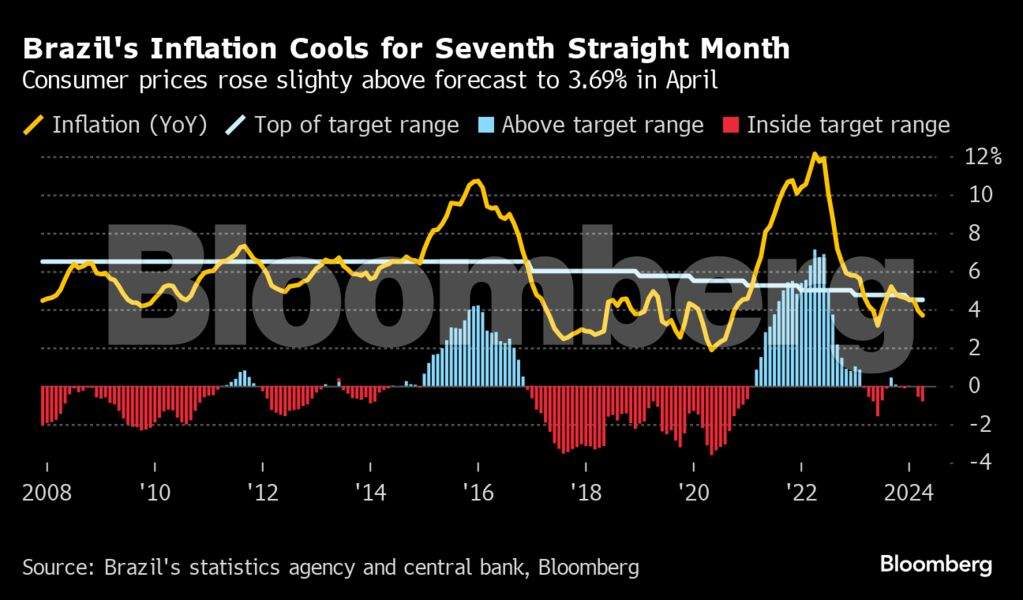

Meanwhile, price pressures in Brazil continued to ease, prompting the central bank to cut interest rates but at a slower pace.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, geopolitics and markets:

World

Thirteen economies across the developed world were in per-capita recessions at the end of last year, according to exclusive analysis by Bloomberg Economics. While there are other factors — such as the shift to less-productive service jobs and the fact that immigrants typically earn less — housing shortages and associated cost-of-living strains are a common thread.

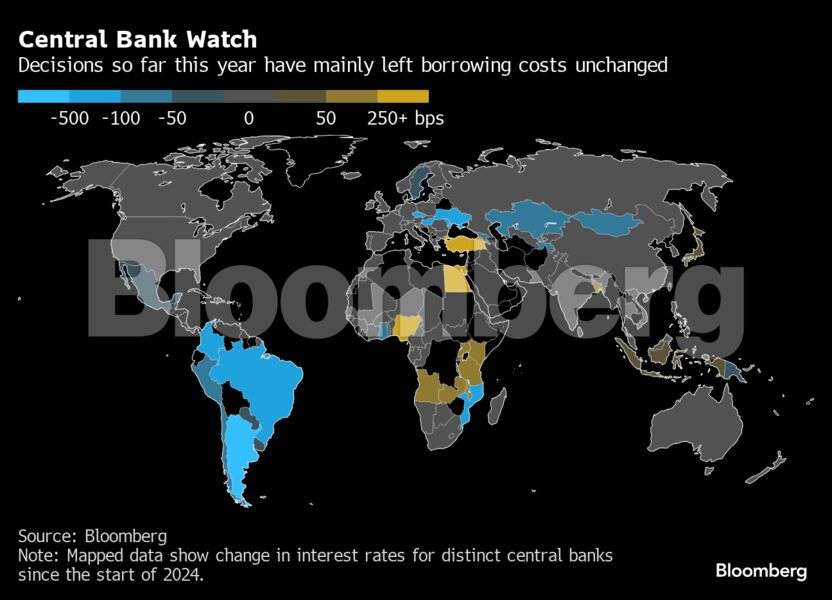

Outside of the BOE, Australia, Malaysia, Mexico, Poland and Serbia also held rates steady. Sweden cut its rate for the first time in eight years, while Brazil and Peru also lowered borrowing costs.

Europe

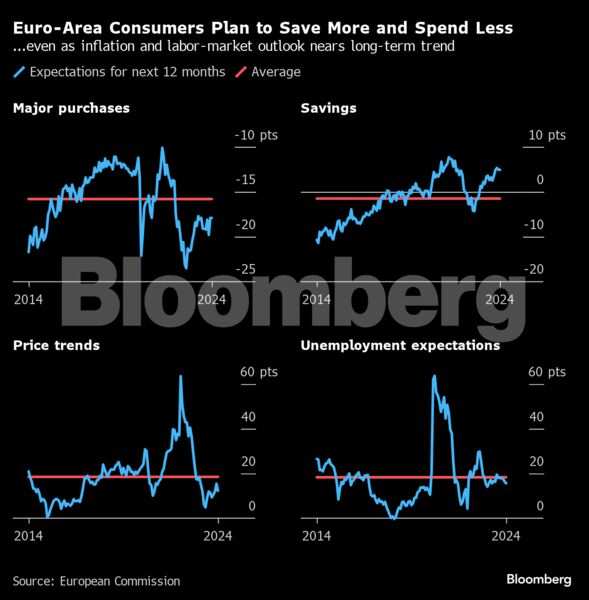

The euro zone’s economy is waiting for a resounding vote of confidence from its own consumers for its long-awaited rebound to finally take shape. The evidence so far suggests that didn’t really happen during the first quarter, but there are some recent hints that the consumer-driven rebound could be materialising.

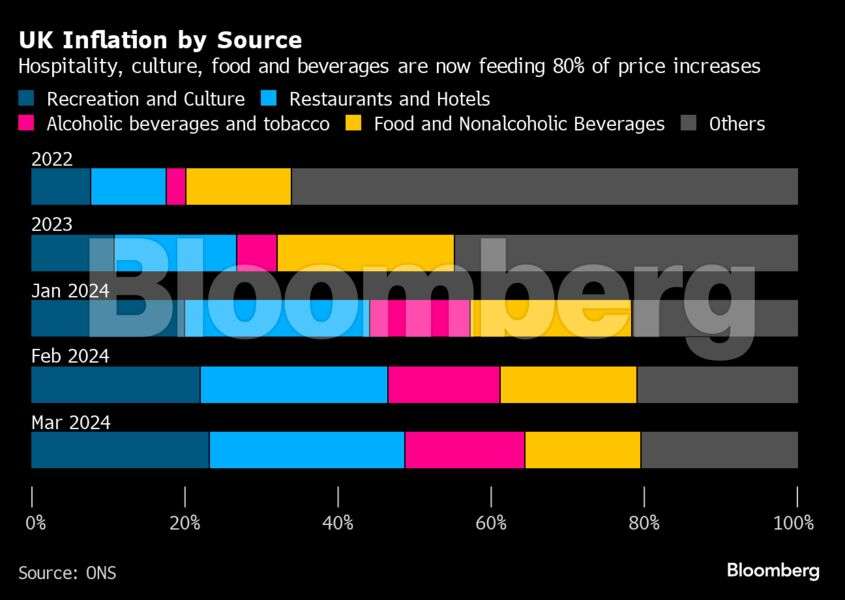

The hospitality sector — pubs, restaurants, hotels and theaters, together with food and beverages — now accounts for about 2.5 percentage points, or about 80%, of the UK’s annual rate of inflation, according to data from the Office for National Statistics. Those also are the sectors that have been hit hardest by a suite of government policies, including minimum wage increases, higher alcohol taxes and a 50% increase on the pay required for employees who receive work visas.

Asia

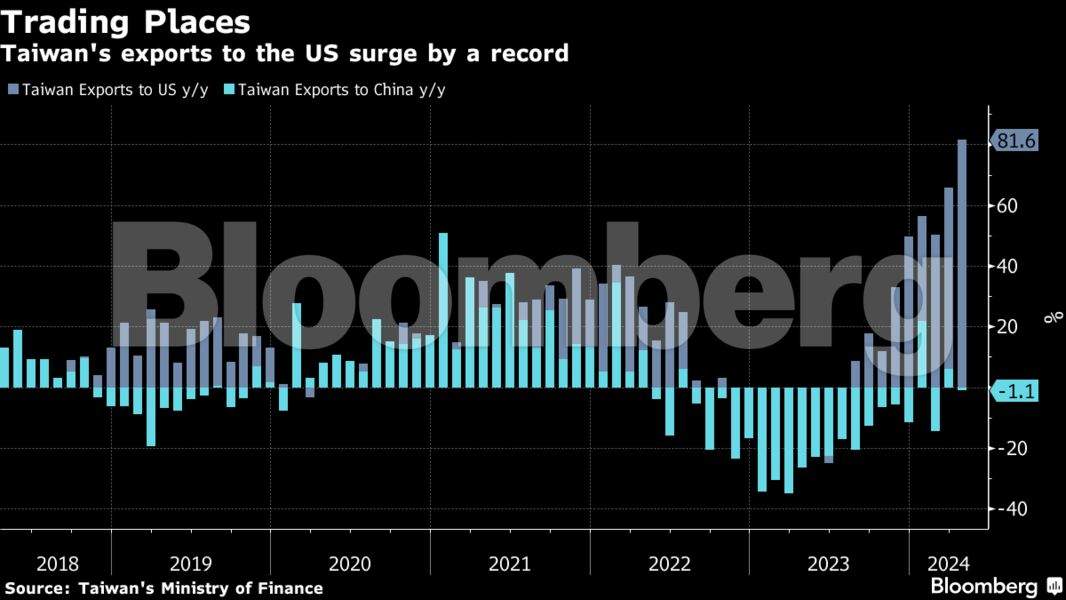

Taiwan’s exports to the US surged by a record last month while shipments to China fell, underscoring the accelerating decoupling of technology supply chains between the world’s two largest economies.

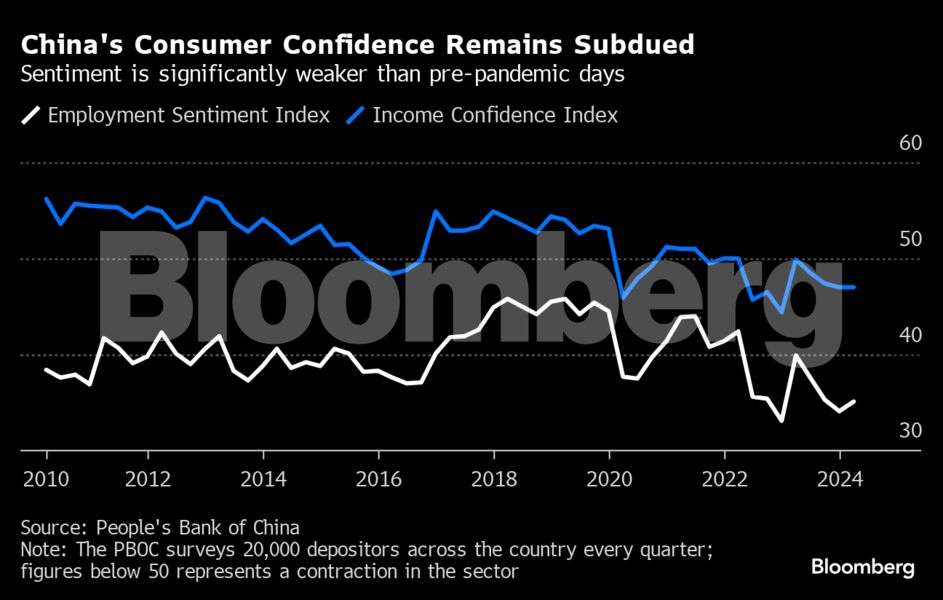

Chinese tourists hit the road in greater numbers during a recent five-day Labor Day holiday but kept a tight grip on their wallets, reflecting still-weak sentiment in the world’s second-largest economy.

US

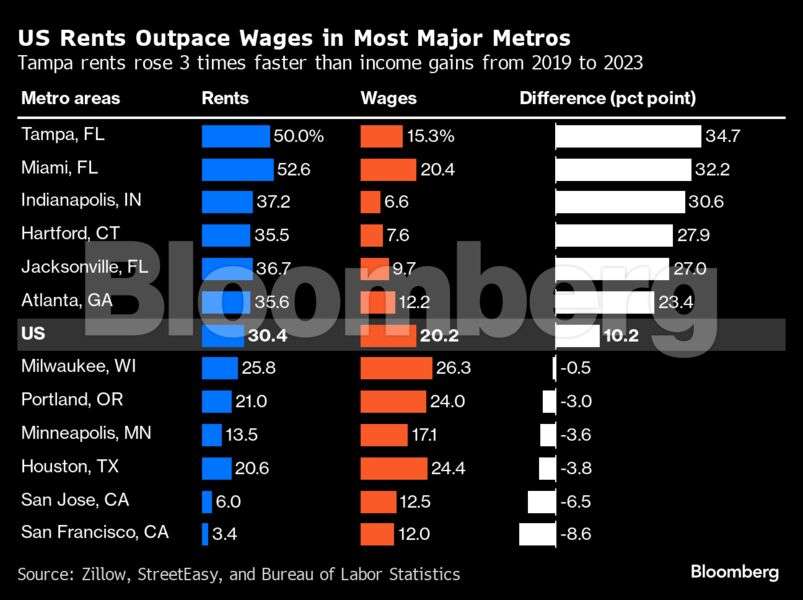

Rents in most major US metropolitan areas have risen some 1.5 times faster than wages in the last four years, according to an analysis by Zillow Group Inc. Florida, a migration hot spot, had some of the most dramatic differences — Tampa and Jacksonville have seen rents surge more than three times quicker than wages.

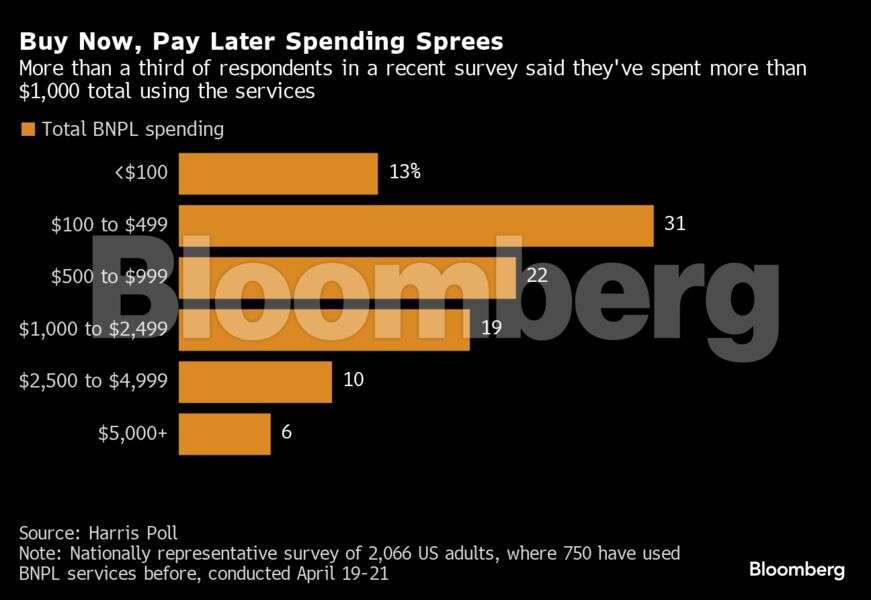

Time and again, “Buy Now, Pay Later” platforms have resisted calls for greater disclosure, even as the market has grown each year since at least 2020 and is projected to reach almost $700 billion globally by 2028. That’s masking a complete picture of the financial health of American households, which is crucial for everyone from global central banks to US regional lenders and multinational businesses.

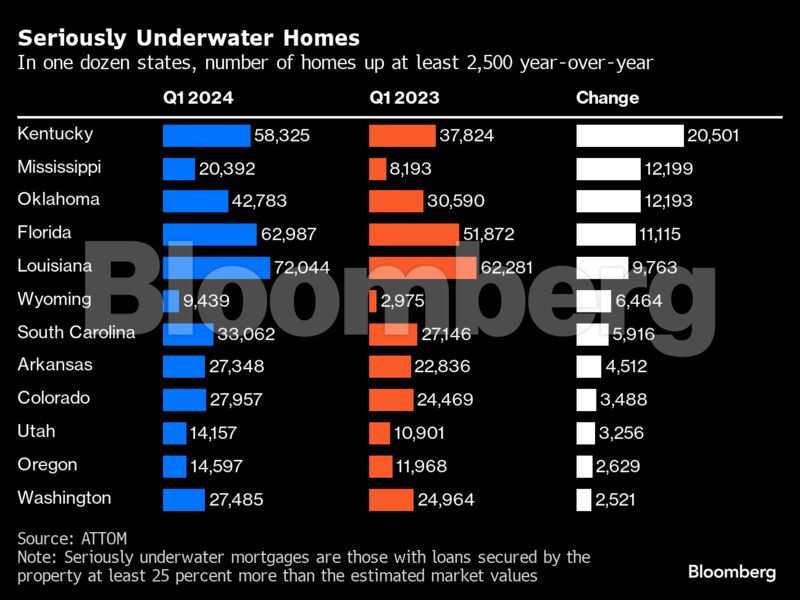

Roughly one in 37 homes are now considered seriously underwater in the US and that share is much higher across a swath of southern states, according to data out Thursday. Nationally, 2.7% of homes carried loan balances at least 25% more than their market value in the first few months of the year. That’s up from 2.6% in the previous quarter.

Emerging Markets

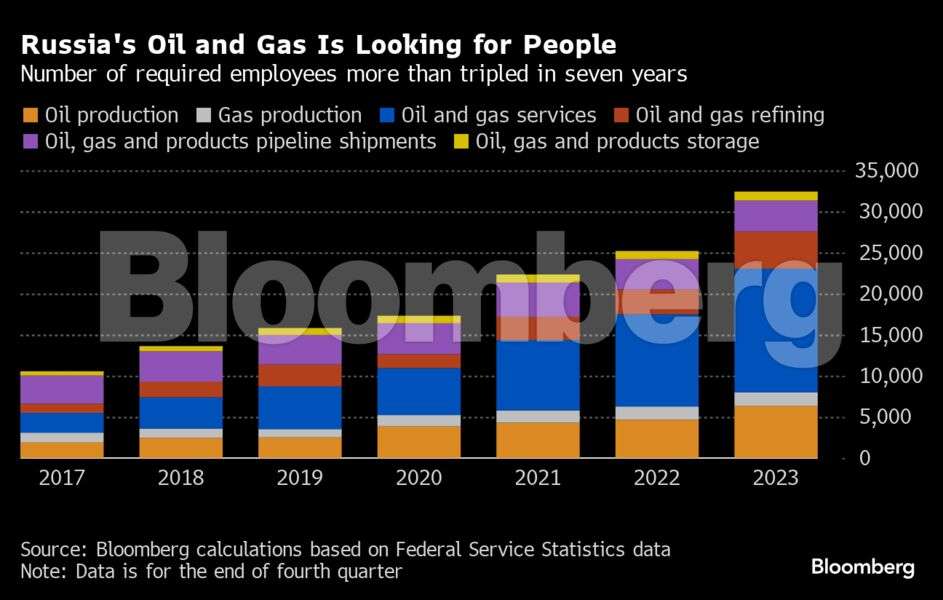

Russia’s oil and gas industry has been crucial for bankrolling the invasion of Ukraine, giving the Kremlin the funds to keep fighting even as the conflict drags on through its third year. But the industry is facing a shortage of manpower as the full mobilisation of Russia’s economy for war exacerbates a longstanding demographic crunch.

Brazil’s annual inflation cooled slightly less than expected as investors deliberate the central bank’s next move after policymakers slowed the pace of interest-rate cuts on price pressure concerns. Some economists interpreted a slowdown in measures of underlying inflation, which exclude volatile items like fuel and food, as sign that the central bank would continue at its current pace.