By RoboForex Analytical Department

Brent crude oil continues its rally, reaching peak values since early November 2023, with prices around USD 87.00 per barrel. Investor concerns over commodity supply, particularly due to tensions in several oil-producing countries, significantly influence quotes by incorporating potential supply disruptions.

Iraq has announced a reduction in crude oil exports to 3.300 million barrels per day soon to compensate for OPEC+ quota implementations. This reduction marks the second consecutive month of export decreases, including in Saudi Arabia, where exports dropped to 6.297 million barrels per day from the previous 6.308 million.

Despite these cuts, global demand for energy remains high. Recent statistics from China have shown a confident retail sales and industrial production sector and a stable outlook for oil demand this year.

It is important to note that a five-session rally of the US dollar could act as a headwind for the oil market. The American currency is at a two-week high against its major counterparts, making commodity purchases more expensive for investors holding other currencies.

Market projections concerning demand for aviation fuel during the summer season are not very confident at this time. There is a risk this could affect the global upward trend in oil. Due to increased summer travel activity, world prices for aviation fuel in Q3 2024 are expected to be 5-6% higher than previous forecasts, reaching around USD 111.00 per barrel. However, the number of flights remains low due to the global economic situation, which could pressure the market and the cost of aviation fuel.

Brent Technical Analysis

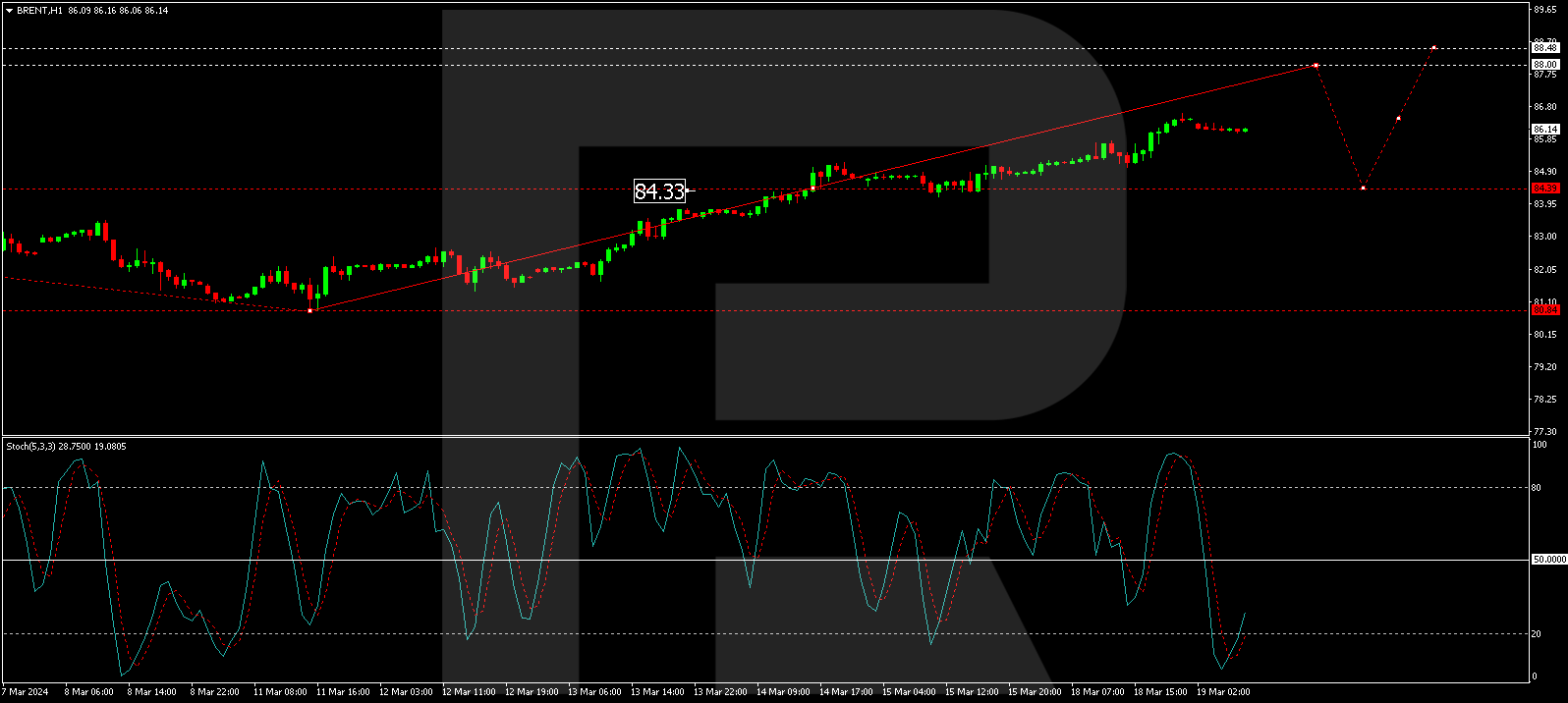

The H4 Brent chart has formed a consolidation range around 84.33, with the market breaking upward to 86.60. A decrease to 85.70 could occur today, followed by a new growth structure towards 87.87, a local target. A correction back to 84.33 might follow, then an increase to 88.48 as the first target. The MACD indicator supports this scenario, with its signal line above zero and poised to reach new highs.

On the H1 Brent chart, a growth wave structure towards 88.00 is forming. This is a local target, following which a correction to 84.40 (testing from above) is considered, with expectations for the continuation of the growth wave to 88.50. This scenario is technically supported by the Stochastic oscillator, whose signal line is below 20, indicating the start of a rise towards 50 with the potential to continue to 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Brent Oil Prices Continue to Surge, Reaching New Peaks Mar 19, 2024

- Trade Of The Week: EURCHF to challenge major resistance? Mar 18, 2024

- US stock indices are under quarterly expiration pressure. The focus of attention this week is on central bank meetings Mar 18, 2024

- AUD/USD Stabilizes Amid Chinese Economic Data and US Inflation Concerns Mar 18, 2024

- COT Metals Charts: Speculator Bets led by Silver & Platinum Mar 16, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Mar 16, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybeans Mar 16, 2024

- COT Stock Market Charts: Speculator Bets led by Russell & Nikkei 225 Mar 16, 2024

- This Copper Co. May Be a Perfect Proxy for 2024 Metals Advances, Expert Says Mar 15, 2024

- Rising US producer inflation may reduce the number of scheduled Fed rate cuts Mar 15, 2024