Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the second quarter ended December 31, 2023 of its fiscal year 2024.

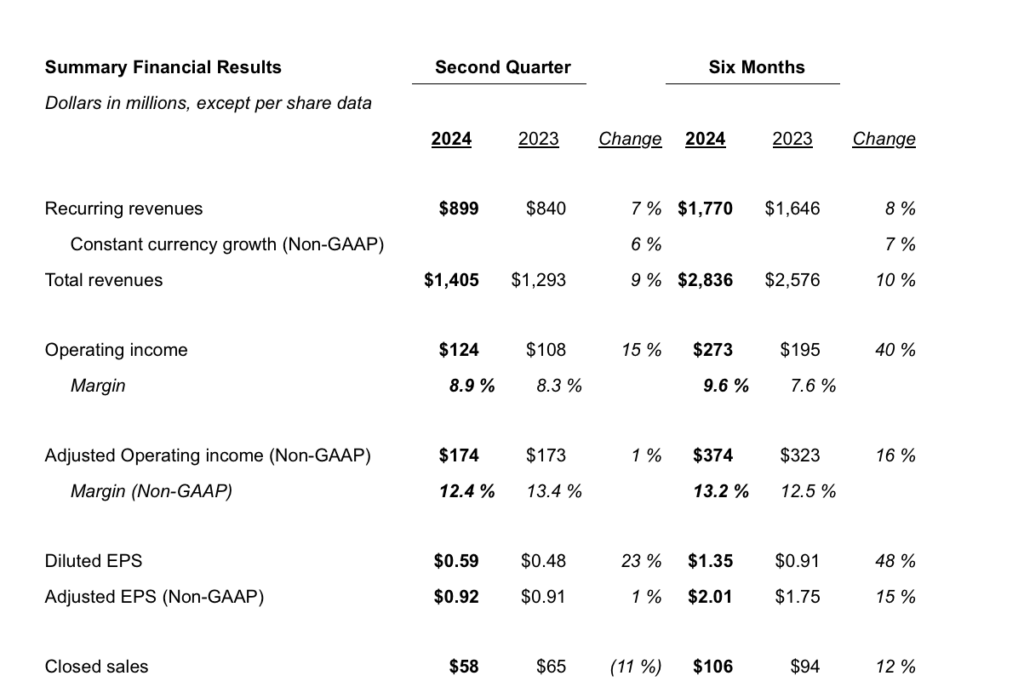

Total revenues for the second quarter of fiscal year 2024 increased 9% to $1,405 million from $1,293 million a year earlier.

Recurring revenues increased $58 million, or 7%, to $899 million. Recurring revenue growth constant currency (Non-GAAP) was 6%, all organic, driven by Net New Business and Internal Growth.

Event-driven revenues increased $18 million, or 47%, to $55 million, driven by higher mutual fund proxy activity.

Distribution revenues increased $36 million, or 9%, to $451 million, thanks to the postage rate increase of approximately $28 million and higher event-driven mailings.

Operating income was $124 million, an increase of $16 million, or 15%. Operating income margin increased to 8.9%, compared to 8.3% for the prior year period, primarily due to higher Recurring revenues and higher event-driven revenues.

Adjusted Operating income was $174 million, an increase of $1 million, or 1%. Adjusted Operating income margin was 12.4% compared to 13.4% for the prior year period. The operating leverage from higher revenues and a 40 basis point net benefit from higher float income and distribution revenue was offset by increased investment spending and higher selling, general and administrative expenses.

Net earnings increased 22% to $70 million and Adjusted Net earnings increased 1% to $110 million.

Diluted earnings per share increased 23% to $0.59, compared to $0.48 in the prior year period, and

Adjusted earnings per share increased 1% to $0.92, compared to $0.91 in the prior year period.

“Broadridge’s second quarter marks continued progress toward the growth objectives we outlined at our Investor Day in December,” said Tim Gokey, Broadridge CEO. “Our results, including 6% organic Recurring revenue growth constant currency, demonstrate continued execution on our goals to democratize and digitize governance, simplify and innovate trading in capital markets, and modernize wealth management. Our focus on driving growth and returns is translating into higher Free cash flow and positions us to return additional capital to shareholders.

“We are reaffirming our 2024 guidance including 6-9% Recurring revenue growth constant currency, 8-12% Adjusted EPS growth, and record Closed sales of $280-320 million. As a result, we are off to a strong start in delivering on our three-year growth objectives including annualized growth of 7-9% for Recurring revenues and 8-12% for Adjusted EPS,” Mr. Gokey concluded.