- Gold’s uptrend hits a snag; 2024 characterized by consolidation phase

- But ingredients for a rally are still there

- Geopolitical risks and Fed rate cuts hold key to rekindling the bulls

Scaling new heights as world goes from crisis to crisis

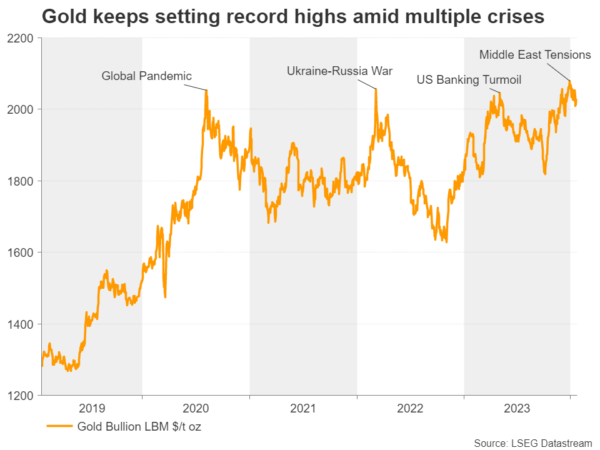

Since 2020, the world has been stumbling from one crisis onto another, creating the perfect ground for a massive rally in gold prices. From the Covid pandemic in 2020, to the Russia-Ukraine war in 2022, to the mini-banking crisis in the US in 2023, there’s been no shortage of turmoil over the past few years to boost demand for the world’s traditional safe haven.

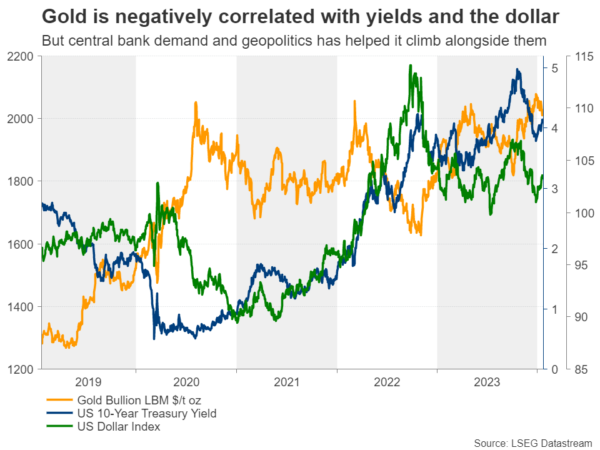

Gold is the world’s oldest store of value as well as one of the safest assets to own, which is why investors rush to gold whenever financial markets are overrun by uncertainty. However, aside from geopolitical events and panic in financial markets, gold also has a long-established relationship with government bonds and the US dollar. Both are also considered to be safe havens so are in direct competition with gold.

Are gold and yields still inversely related?

When bond yields rise, this makes investing in government bonds more attractive, and thus, negatively impacting the price of gold. But rising yields, specifically US Treasury yields, can be a double whammy for the precious metal because not only does gold lose out due to its a non-yielding attribute, but higher bond yields also increase the attractiveness of the US dollar.

As gold is priced in US dollars, it becomes more expensive for non-US investors whenever the greenback appreciates, which is why gold has such a strong negative correlation with the currency.

Whilst these relationships have always been the primary drivers for gold, they’ve become more prominent than ever now that geopolitical risks and interest rate speculation are both so elevated. After all, it is not often that gold climbs to record highs at the same time as US yields are rallying to multi-year peaks.

The geopolitical risk premium

When gold first soared above $2,000/oz in the aftermath of the pandemic in 2020, interest rates and yields were at rock bottom as central banks around the world were engaged in money printing. In the last rally when bullion hit a new all-time high of $2,135.40, borrowing costs had surged by around 500 basis points during this period, completely disobeying the negative correlation rule between the two.

This goes to show the scale at which the geopolitical risk premium has risen amid multiple hotspots around the world that could erupt at any moment. However, there is an additional element that’s also been lifting gold prices lately.

Soaring demand by central banks

Central banks have been purchasing gold in record amounts over the last few years – a trend that’s been primarily driven by China and is motivated by the desire to reduce reliance on the US dollar.

Both geopolitics and the ‘de-dollarization’ trend are expected to remain major contributors of demand in 2024, supporting the bulls’ side of the story. But the bears may not be so fortunate this year as central banks like the Fed are highly anticipated to embark on a rate-cutting cycle within the next few months, potentially leading to a substantial pullback in yields and a weaker dollar.

How risky is the inflation bet?

So does this mean that it is only a win-win scenario for gold? Not necessarily. Although there can be no disputing that the bullish case for the yellow metal is quite strong at the moment, there are risks attached to the dovish outlook for the Fed.

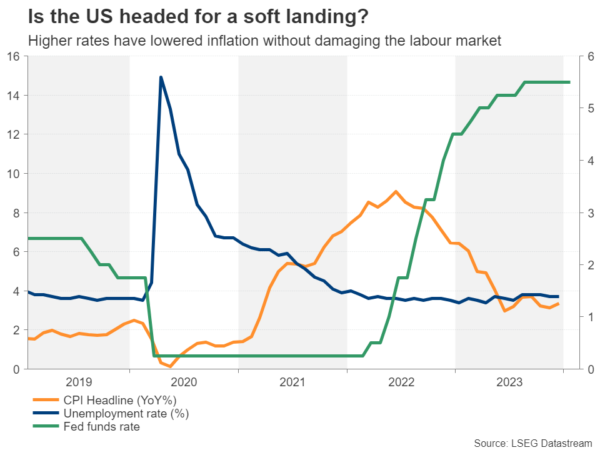

Neither the rhetoric from Fed officials nor the economic data support the argument for hefty rate cuts in 2024. Whilst a recession cannot be totally ruled out, all the evidence indicates a soft landing for the US economy, diminishing the need for a large reduction in borrowing costs. Those pointing to the drop in inflation as the main reason why the Fed will slash rates are right, but only to an extent.

Fed vs the markets

As long as growth stays positive and the labour market remains tight, the Fed will have limited scope to cut rates as looser policy under such conditions can easily overstimulate the economy. Markets have already scaled back some of their dovish bets for the Fed but still anticipate at least five 25-bps rate cuts versus the three projected by FOMC members. Subsequently, Treasury yields have reversed some of their decline, with the halt in the slide of oil prices underpinning the rebound.

With central bank easing fully priced in and the possibility of more dialling back of expectations, the prospect of gold receiving a further boost from lower yields and a weaker dollar doesn’t look particularly great as things stand now. What could change this picture, however, is a deterioration in the labour market.

Is the US outlook too rosy?

So far, despite the surge in layoffs in 2023, there’s been no notable jump in unemployment. But there is a danger that businesses will step up layoffs this year to safeguard their profit margins in a low growth environment. Senior Fed policymakers have already signalled that with inflation falling, the focus in 2024 will likely shift to the central bank’s employment mandate.

But there’s the possibility that inflation even surprises to the upside, especially following the latest developments in the Middle East. The threat of a major flare-up has risen following the attacks on Red Sea shipping by Houthi rebels in Yemen as well as the recent cross-border missile strikes by both Israel and Iran.

No let-up in geopolitical frictions

An escalation would not only push up energy prices, but additionally create a permanent pause in Red Sea journeys, sparking a broader supply chain shock for the global economy. This would have a two-way effect on gold prices as higher inflation would boost interest rates, while heightened tensions would increase safe-haven demand for gold.

Another positive risk for gold is the dollar side of the equation acting independently of bond yields. This could occur in a scenario where the outlook for the major economies improves, bolstering currencies like the euro and yen, lessening the appeal for the greenback.

In a nutshell, there seem to be an equal number of factors that can go right as well as wrong for gold in 2024, with a Fed repricing being the biggest downside risk and a new geopolitical crisis being the largest upside risk. The thing to note here is that investors are probably less prepared for the former than the latter, but nevertheless, there has been some caution brewing in the market lately.

Gold appears to be in wait-and-see mode

Gold prices have been consolidating after spiking to a record high in December. There seems to be ample support around the 50-day moving average (MA) for the time being but should this support weaken and the focus shifts to the $2,000 mark, it will then be up to the 200-day MA to defend gold’s bullish structure.

If the bulls successfully hold onto to the 50-day MA, a revisit of the all-time peak of $2,135.40 could be on the cards, although there may be a battle between the late December high of $2,088.29 and the $2,100 level to get there.

Either way, a fresh attempt into uncharted territory is probably sometime away as investors will want to tread carefully until the Fed has laid out a clearer path for interest rates, something that is unlikely to happen before the spring.