Canadian Dollar’s rally gathers additional momentum during early US session, buoyed by data that depicted faster re-acceleration in Canadian inflation than anticipated. It is noteworthy that the surge in headline inflation figure was chiefly influenced by escalating gasoline prices, yet inflation excluding gasoline did not decelerate as BoC would love to see. This scenario is poised to raise eyebrows at BoC, prompting concerns over whether current interest rates are restrictive enough to pull inflation back to target. This data also escalates the importance of BoC’s summary of deliberations slated for release tomorrow.

Beyond Loonie, Australian and New Zealand Dollars follow suit as the day’s strong performers. In contrast, Yen lags, primarily due to an increasing yield gap with other major economies. Dollar and Euro are similarly struggling, only slightly outperforming Yen, while Sterling and Swiss Franc find themselves sandwiched in between. However, this dynamic could undergo a radical transformation, with pivotal releases such as FOMC decision and UK CPI data set to unravel tomorrow, coupled with featured policy announcement from BoE, SNB, and BoJ later this week.

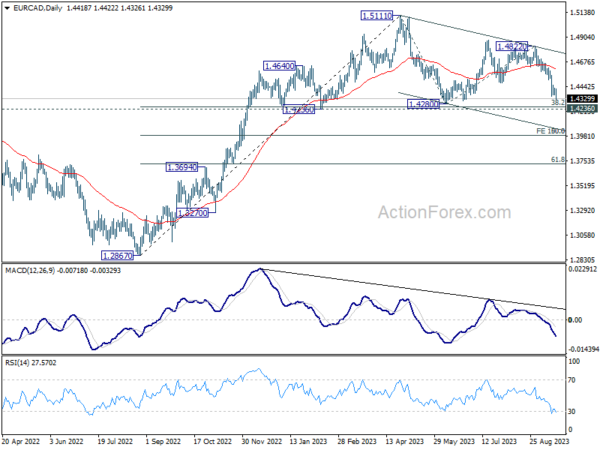

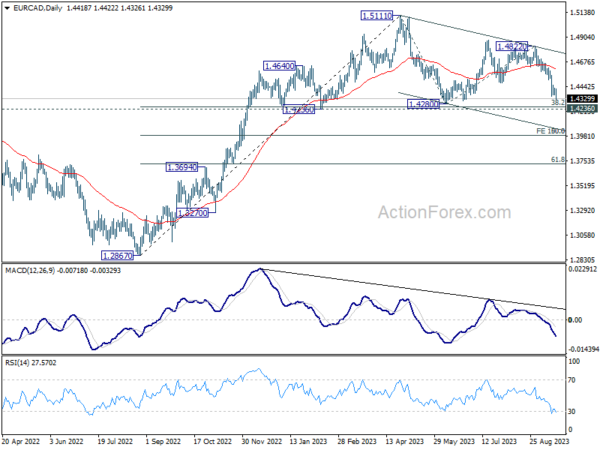

On the technical front, the longevity of Canadian Dollar’s rally is in the spotlight. Can this surge push EUR/CAD beyond 1.4236 cluster support level? Given that ECB has already signaled an extended pause in its tightening cycle, any hawkish tones from BoC officials in the coming days could further depress the cross. Should the 1.4236 support be taken out decisively, it opens the doors to further decline to the next cluster level at 1.4, aligned closely with 50% retracement of 1.2867 to 1.5111 at 1.3989, and 100% projection of 1.5111 to 1.4280 from 1.4822 at 1.3991.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is down -0.37%. CAC is down -0.02%. Germany 10-year yield is up 0.0395 at 2.751. Earlier in Asian, Nikkei dropped -0.87%. Hong Kong HSI rose 0.37%. China Shanghai SSE dropped -0.03%. Singapore Strait Times dropped -0.69%. Japan 10-year JGB yield rose 0.0086 to 0.719.

Canada CPI jumps to 4% yoy on gasoline, above expectation of 3.8% yoy

Canada CPI accelerated to 4.0% yoy in August, up from July’s 3.3% yoy, above expectation of 3.8% yoy. The in CPI was largely the result of higher year-over-year prices for gasoline in August (+0.8%) compared with July (-12.9%). Excluding gasoline, CPI was unchanged at 4.1% yoy.

CPI median rose from 3.7% yoy to 4.1% yoy, above expectation of 3.7% yoy. CPI trimmed rose from 3.6% yoy to 3.9% yoy, above expectation of 3.5% yoy. CPI common was unchanged at 4.8% yoy, matched expectations.

On a monthly basis, CPI rose 0.4% mom in August, double expectation of 0.2% mom.

Eurozone CPI finalized at 5.2% in Aug, core CPI at 5.3%

Eurozone CPI was finalized at 5.2% yoy in August, down from 5.3% yoy in July. CPI core (all-items ex-energy, food, alcohol & tobacco) was finalized at 5.3% yoy, down from 5.5% yoy in July. Services prices slowed from 5.6% yoy to 5.5% yoy. Energy prices rose from -6.1% yoy to -3.3% yoy.

EU CPI was finalized at 5.9% yoy, down from 6.1% yoy in July. The lowest annual rates were registered in Denmark (2.3%), Spain and Belgium (both 2.4%). The highest annual rates were recorded in Hungary (14.2%), Czechia (10.1%) and Slovakia (9.6%). Compared with July, annual inflation fell in fifteen Member States, remained stable in one and rose in eleven.

ECB’s Villeroy advocates for sustained 4% deposit rate to counter inflation

In an interview with BFM television, ECB Governing Council member Francois Villeroy de Galhau emphasized the pivotal role of interest rates in curbing inflation, which he starkly referred to as a “disease.” Drawing a clear line of action against inflationary pressures, he advocated for maintaining a firm grip on the existing measures.

Villeroy underscored the effectiveness of the current strategy by stating, “Inflation is a disease and rates are the medicine. The medicine is starting to work.” T

Diving into specifics, he highlighted the appropriateness of the 4% deposit rate level, voicing his opinion that this rate should be upheld for a “sufficiently long time” to ensure that it effectively counters inflationary trends.

Looking to the future, Villeroy elucidated that once the inflation rate cools down to hover around 2% target, it would then be feasible to consider a reduction in ECB rate.

RBA minutes flag risks on growth, consumption and China

RBA’s meeting held on September 5, the minutes revealed that officials weighed two courses for monetary policy: increasing cash rate target by 25 bps or standing pat.

After a thorough consideration of the prevailing economic circumstances, members resolved that maintaining the current cash rate was the more compelling choice, highlighting the necessity to allot more time to gauge the comprehensive impacts of monetary policy tightening enacted since May 2022. This consensus is grounded in an understanding of the substantial delays that characterize transmission of policy repercussions through the economy.

Amid these considerations, members also highlighted potential risks. Specifically, there were concerns regarding the possibility that “the economy could slow more sharply than forecast.” Factors like potentially weaker consumption and mounting downside risks to the Chinese economy were flagged.

However, the minutes reflected a cautiously optimistic tone, with members deducing that “recent developments had not materially altered the outlook.” The general consensus remained that the economy still seems to be on a balanced path where inflation is poised to return to the target range, and employment growth is anticipated to sustain its momentum.

OECD downgrades 2024 global growth, interest rate close to current levels into 2024

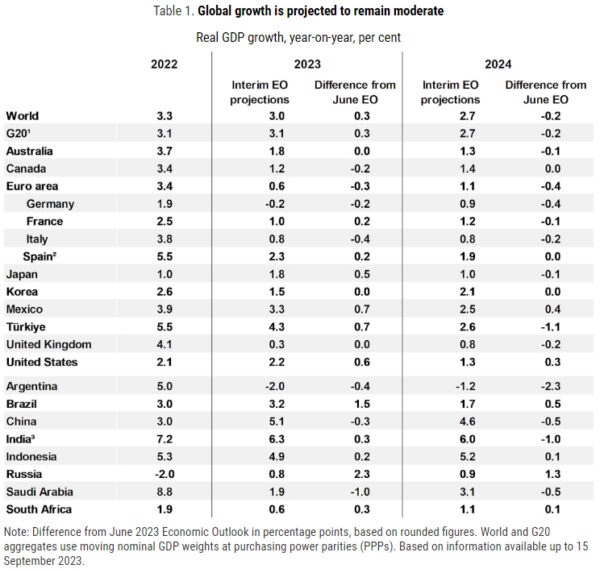

The latest OECD Interim Economic Outlook has revealed revised global growth forecasts, with an incremental uptick for 2023 followed by a slight dip in 2024. The updated predictions reflect a blend of uplifted expectations for some economies and dampened hopes for others, amidst a backdrop of inflation concerns and the repercussions of a more sluggish recovery in China.

For 2023, the global economic growth forecast now stands at 3.0%, marking a 0.3% increase from previous predictions. Conversely, projections for 2024 have seen a decrease of -0.2%, bringing the anticipated growth down to 2.7%.

Dissecting the outlook on a regional basis unveils a mixed bag of prospects:

- US: A positive revision with growth estimates standing at 2.2% for 2023, up by 0.6%, and a 1.3% prediction for 2024, reflecting a 0.3% increase.

- Eurozone: Here the expectations have been trimmed down with 2023 forecasts reduced by -0.3% to a mere 0.5%, and a 2024 estimate of 1.1%, down by -0.4%.

- Japan: The outlook for 2023 appears brighter with a 0.5% increase to 1.8%, although the 2024 forecast has been slightly reduced by -0.1%, standing at 1.0%.

- China: Forecasts have been negatively revised to 4.1% in 2023, a drop of -0.3%, and 4.6% in 2024, reflecting a decrease of -0.5%.

The OECD outlook points out considerable downside risks, emphasizing potential persistency in inflation accompanied by potential disruptions in the food and energy markets. Slowdown in China’s economy stands as a prominent concern, with ripple effects expected to diminish growth in global trading partners and possibly undercut business confidence universally.

Projections for headline inflation in G20 nations indicate a gradual decrease through 2023, moving from 7.8% in 2022 to 6.0% in 2023, and further dwindling to 4.8% in 2024. However, core inflation, primarily fueled by the services sector and relatively taut labour markets, is predicted to linger, necessitating a sustained restrictive posture in monetary policy across several countries.

As economies globally grapple with these changing dynamics, the emphasis remains on steering a cautious course, with a keen eye on inflation patterns as a decisive factor in shaping future policy directions. The evolving economic narrative dictates a necessity for many countries to maintain interest rates close to their present markers, extending well into 2024.

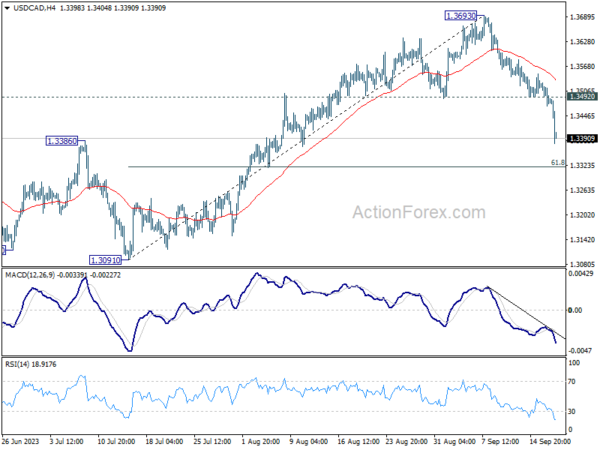

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3462; (P) 1.3496; (R1) 1.3519; More….

Intraday bias in USD/CAD stays on the downside at this point. Current fall from 1.3693 is seen as another falling leg in the corrective pattern from 1.3976. Deeper decline would be seen to 61.8% retracement of 1.3091 to 1.3693 at 1.3321. Sustained break there will target 1.3091 support next. On the upside, above 1.3492 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, price actions from 1.3976 are viewed as a corrective pattern to the up trend from 1.2005 (2021 low). Deeper decline could be seen as the pattern is now extending. But downside should be contained by 50% retracement of 1.2005 to 1.3796 at 1.2991. Rise from 1.2005 is still expected to resume after the correction completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Aug | 4.05B | 4.23B | 3.13B | |

| 08:00 | EUR | Current Account (EUR) Jul | 20.9B | 30.2B | 35.8B | |

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 5.20% | 5.30% | 5.30% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 5.30% | 5.30% | 5.30% | |

| 12:30 | USD | Building Permits Aug | 1.54M | 1.45M | 1.44M | |

| 12:30 | USD | Housing Starts Aug | 1.28M | 1.44M | 1.45M | |

| 12:30 | CAD | CPI M/M Aug | 0.40% | 0.20% | 0.60% | |

| 12:30 | CAD | CPI Y/Y Aug | 4.00% | 3.80% | 3.30% | |

| 12:30 | CAD | CPI Median Y/Y Aug | 4.10% | 3.70% | 3.70% | |

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 3.90% | 3.50% | 3.60% | |

| 12:30 | CAD | CPI Common Y/Y Aug | 4.80% | 4.80% | 4.80% |