Dollar strengthens broadly in Asian session today, extending last week’s late rebound. This uptick comes in the wake of Fed Chair Jerome Powell’s interview on 60 Minutes, where he reiterated the premature nature of interest rate cuts in March. He also highlighted the underlying economic resilience that affords Fed the luxury of patience. Powell’s stance has been interpreted as a positive signal for dollar, while reinforcing investor confidence towards US markets. However, the durability of this optimism remains contingent on the forthcoming ISM Services data, which is keenly anticipated.

The situation in Asia, particularly in China, presents a contrasting picture. The continuing decline in Chinese stock markets underscores investor wariness, despite the Securities Regulatory Commission’s recent assurances to stabilize market fluctuations. Announced measures include directing more medium- and long-term funds into the market and a stringent crackdown on illegal trading practices, such as malicious short selling and insider trading. However, these promises have yet to fully assuage trader concerns, reflecting a persistent skepticism towards the government’s staggered approach to economic stimulus and market regulation.

Back to the currency markets, European majors, at the time of analysis, are showing clear underperformance, particularly the British Pound, which is leading the downturn among its peers. On the other hand, commodity-linked currencies are maintaining some stability, albeit on the brink of volatility driven by critical economic events on the horizon, including RBA’s rate decision and employment data from New Zealand and Canada.

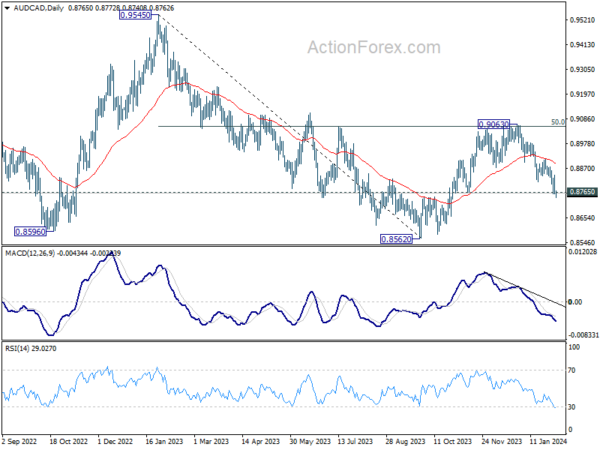

Technically, AUD/CAD is trying get rid of 0.8765 structural support today, but lacks clear follow through momentum yet. But in any case, outlook will stay bearish as long as 55 D EMA (now at 0.8890) holds. Corrective rebound from 0.8562 should have completed at 0.9063 already. Sustained trading below 0.8765 will pave the way to retest 0.8562 low.

In Asia, at the time of writing, Nikkei is up 0.64%. Hong Kong HSI is up 0.82%. China Shanghai SSE is down -0.74%. Singapore Strait Times is down -1.54%. Japan 10-year JGB yield is up 0.0599 at 0.721.

Fed Powell repeats March too soon for interest rate cut

In an interview on CBS’s 60 Minutes, Fed Chair Jerome Powell emphasized the importance of ensuring inflation is convincingly on a downward trajectory toward 2% target before the central bank cut interest rates. He candidly stated, “it’s not likely that this committee will reach that level of confidence in time for the March meeting,” echoing the comments he made last week at the post-FOMC press conference.

Highlighting the collective outlook of FOMC, Powell shared that the majority of its 19 participants anticipate a scenario where cutting federal funds rate would be appropriate within the year. However, he stressed that any such decision would “depend on the evolution of the economy.”

Powell also underscored a forward-looking perspective, stating, “we wouldn’t wait to get to 2% to cut rates,” and acknowledging that rate cuts are “actively being considered” despite current inflation rates hovering between 2-

Expectations for inflation’s trajectory were also addressed, with Powell predicting a decrease in the 12-month inflation figures throughout the year. He attributed this anticipated decline to the “unwinding” of “pandemic-related distortions” and the consequential impact of the Fed’s “tightening of policy.”

Japan’s PMI services finalized at 53.1, fueling overall economic growth

Japan’s PMI Services was finalized at 53.1 in January, marking a continuous expansion for the 17th month and an improvement from December’s 51.5. PMI Composite was finalized at 51.5, up from prior month’s 50.0, indicating a modest uptick in overall private sector activity for the first time since October.

According to Usamah Bhatti, Economist at S&P Global Market Intelligence, key observations include accelerated growth in business activity, new orders, and the first rise in exports in five months.

Capacity pressures intensified, with the strongest backlog increase since last June and a sharper job creation rate. Business confidence for the year ahead hit an eight-month high, reflecting robust optimism.

China’s PMI services dips slightly to 52.7, significant challenges remain

In January, China’s Caixin PMI Services slightly decreased to 52.7 from 52.9, aligning with expectations. PMI Composite also and a minor reduction to 52.5 from 52.6.

Wang Zhe, Senior Economist at Caixin Insight Group, pointed out that the economy faces “significant challenges” including tepid demand, increased employment pressures, and subdued market expectations, indicating that “This status quo has yet to experience a fundamental reversal.”

Starting with US ISM services, followed by RBA and employment data from New Zealand and Canada

US ISM Services Index is poised to kick off the week with significant impact. The prevailing market sentiment is marked by robust confidence in the US economy’s resilience, which seems to overshadow concerns about Fed’s potential delay in commencing interest rate reductions. The forthcoming ISM services data, encompassing key details such as pricing, new orders, and employment, will be a crucial test to this narrative.

RBA’s rate decision also occupies a central position in economic discussions. It is widely anticipated that the central bank will maintain cash rate unchanged at 4.35%. More critically, given the satisfactory progress in disinflation observed in Q4 CPI, tightening bias could be dropped, with indication that further further rate hikes in the current cycle are becoming increasingly unlikely.

Opinions on the timing of RBA’s interest rate cuts are divided. Westpac and Commonwealth Bank project the initial reduction to occur in September, while NAB anticipates it in December. The debate also encompasses the magnitude and pace of subsequent policy easing, with projections ranging significantly—from Commonwealth Bank’s prediction of a decrease to 2.85% by June 2025 to the more conservative estimates by Westpac and NAB of a reduction to 3.10% by September and December 2025, respectively.

In line with new operational changes, RBA will issue the Statement on Monetary Policy alongside the rate decision. This will be followed by a press conference an hour later, providing Governor Michele Bullock with an excellent opportunity to synchronize market expectations with her narratives and the latest economic projections.

BoC Summary of Deliberations and employment data from Canada are also expected to draw significant interest. With BoC maintaining its concern over persistent inflationary pressures, especially in housing costs, policy easing appears to be off the table for now. The forthcoming minutes are anticipated to reveal the extent of the bank’s concerns about the persistence of underlying inflation. Meanwhile, signs of ongoing tightness in the job market and strong wage growth could delay BoC’s first rate cut to the latter half of the year, contrary to market expectations of a second-quarter adjustment.

Employment data from New Zealand are awaited with considerable interest as well. Paul Conway, RBNZ’s Chief Economist, has recently underscored the central bank’s increased focus on non-tradable inflation, which remains high at 5.9%, and the slow pace of its reduction. Without marked increase in unemployment and corresponding decrease in wages growth, there is little room for RBNZ to maneuver in terms of reducing interest rates within the year.

Additional data points of interest include Eurozone Sentix Investor Confidence, wage growth in Japan, and China’s Caixin PMI services and CPI.

Here are some highlights for the week:

- Monday: Australia goods trade balance; China Caixin PMI services; Germany trade balance; Eurozone PMI services final, Sentix investor confidence, PPI; UK PMI services; US ISM services.

- Tuesday: Japan average cash earnings, household spending; RBA rate decision; Germany factory orders;l UK construction PMI; Eurozone retail sales; Canada Ivey PMI.

- Wednesday; New Zealand employment, labor cost index; Swiss unemployment rate, foreign currency reserves; Germany industrial production; France trade balance; Canada trade balance, BoC summary of deliberations; US trade balance.

- Thursday: Japan bank lending, current account; China CPI, PPI; ECB monthly bulletin; US jobless claims.

- Friday: Germany CPI final; Canada employment.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0747; (P) 1.0822; (R1) 1.0864; More…

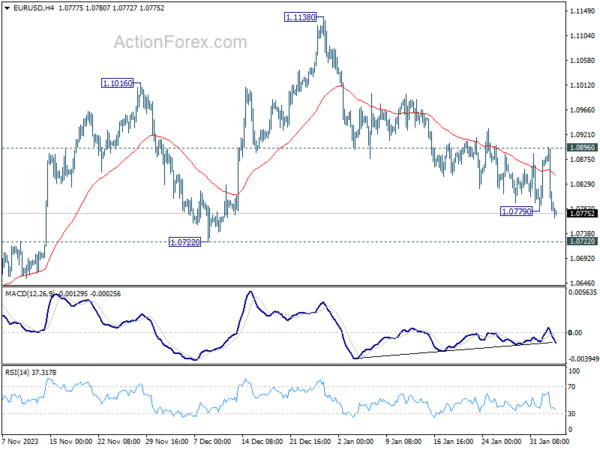

EUR/USD’s break of 1.0779 support suggests that fall from 1.1138 is resuming. Intraday bias is back on the downside for 1.0722 support. considering bullish convergence condition in 4H MACD, strong support could be seen there to bring rebound. But break of 1.0896 resistance is needed to signal short term bottoming first. Meanwhile, decisive break of 1.0722 will argue that whole rise from 1.0447 has completed, and target this low.

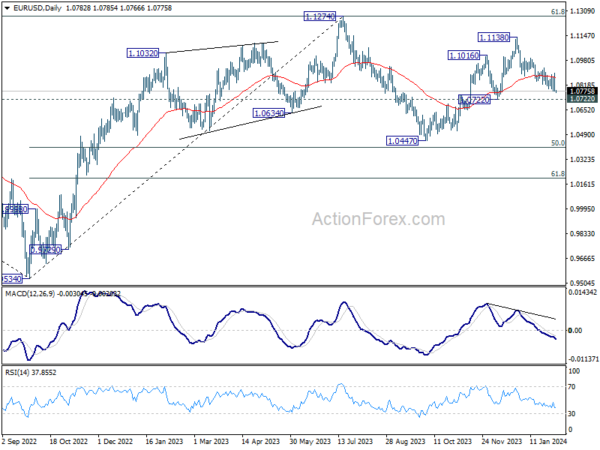

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | TD Securities Inflation M/M Jan | 0.30% | 1.00% | ||

| 00:30 | AUD | Goods Trade Balance (AUD) Jan | 10.96B | 10.50B | 11.44B | |

| 01:45 | CNY | Caixin Services PMI Jan | 52.7 | 52.7 | 52.9 | |

| 07:00 | EUR | Germany Trade Balance (EUR) Dec | 22.3B | 20.4B | ||

| 08:45 | EUR | Italy Services PMI Jan | 50.8 | 49.8 | ||

| 08:50 | EUR | France Services PMI Jan F | 45 | 45 | ||

| 08:55 | EUR | Germany Services PMI Jan F | 47.6 | 47.6 | ||

| 09:00 | EUR | Eurozone Services PMI Jan F | 48.4 | 48.4 | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Feb | -15 | -15.8 | ||

| 09:30 | GBP | Services PMI JanF | 53.8 | 53.8 | ||

| 10:00 | EUR | Eurozone PPI M/M Dec | -0.20% | -0.30% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Dec | -8.80% | |||

| 14:45 | USD | Services PMI Jan F | 52.9 | 52.9 | ||

| 15:00 | USD | ISM Services PMI Jan | 52.1 | 50.6 |