Deutsche Börse has published a set of strong financial metrics for 2023.

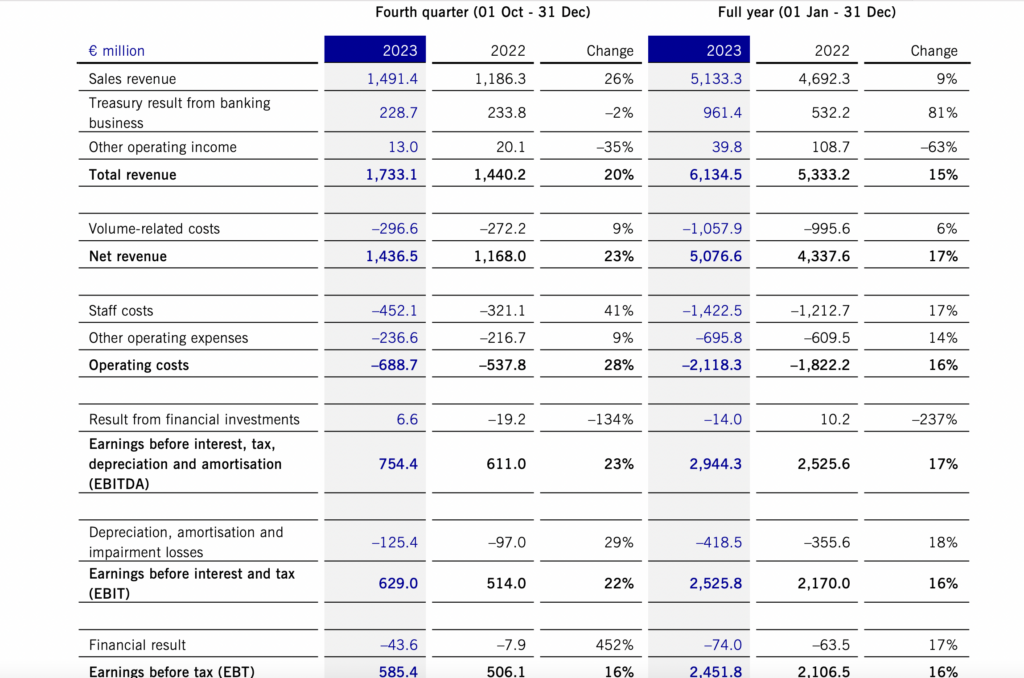

Net revenue increased to €5,076.6 million in financial year 2023 (2022: €4,337.6 million). The net revenue increase of 17 per cent consisted partly of around 5 per cent secular growth, which came largely from new customer wins and gains in market share, the expansion of customer relationships and product innovations. Cyclical growth effects accounted for around 7 per cent.

The global increase in interest rates deserves particular mention.

Another 5 per cent stemmed from M&A growth in connection with the acquisition of SimCorp.

Operating costs rose by 16 per cent to €2,118.3 million in financial year 2023 (2022:€1,822.2 million). Some 5 per cent resulted from organic cost growth, which also includes an increase in the headcount compared with the previous year, inflation effects and investments in secular growth measures. The remaining increase is due to the SimCorp consolidation, related transaction costs of €22 million and the costs of realising potential synergies in the new Investment Management Solutions segment of around €56 million.

This boosted earnings before interest, tax, depreciation and amortisation (EBITDA) by 17 per cent to €2,944.3 million (2022: €2,525.6 million). The result from financial investments, which is included in EBITDA, came to €–14.0 million (2022: €10.2 million). In the course of the purchase of minority interests in ISS and the planned bundling of expertise in the Data & Analytics segment, one-off adjustments to the valuation of a contingent purchase price component resulted in losses of €9 million in the second quarter of 2023. The decline was also due to valuation effects from minority interests.

Net profit for financial year 2023 attributable to Deutsche Börse Group shareholders was €1,724.0 million (2022: €1,494.4 million), which represents a year-on-year increase of 15 per cent.

Undiluted earnings per share were €9.35 (2022: €8.14) for an average of 185.1 million shares. Earnings per share before purchase price allocations (cash EPS) stood at €9.98 (2022: €8.61).

The Executive Board of Deutsche Börse AG is proposing a dividend of €3.80 for the 2023 financial year (2022: €3.60). This corresponds to a dividend increase of 6 per cent and a payout ratio of 40 per cent. The dividend is still subject to the formal approval of the Supervisory Board of Deutsche Börse AG and the shareholders of Deutsche Börse AG at the Annual General Meeting on 14 May 2024; the Supervisory Board has already expressed its support for the proposal.

For financial year 2024, Deutsche Börse expects the Group’s net revenue to grow to more than €5.6 billion and EBITDA to increase to more than €3.2 billion. In addition to organic growth based on our secular growth opportunities, the consolidation of SimCorp will make a significant contribution. The Group is also currently expecting a slight cyclical headwind due to a possible US key interest rates cut. If market volatility increases or key interest rates remain at current levels, this would have a positive impact on Group’s expectations.

Commenting on the results, Theodor Weimer, Chief Executive Officer of Deutsche Börse AG, said:

“2023 was an extremely successful year for us for several reasons. We were able to increase our record net revenue and earnings of the previous year further strongly, supported by the strong cyclical tailwind of high interest rates. In addition, the strategically important acquisition of SimCorp is a milestone in the expansion of our business.”