Risk sentiment took a sharp downturn following the release of US Q1 GDP data, which revealed weaker-than-expected economic growth alongside an acceleration in both headline and core PCE price indexes. This combination suggests that the US economy may be caught in a challenging cycle where high interest rates are dampening economic activity without effectively curbing inflationary pressures. In response, DOW futures plummeted by over -300 pts at the time of writing, signaling a steep market open, while 10-year Treasury yield is making moves to break 4.7% mark.

In the currency markets, Dollar is attempting a rebound driven by the shift in risk sentiment, though it remains uncertain whether it can fully offset this week’s losses. Currently, Japanese Yen remains the weakest performer for the week, followed by Swiss Franc. Australian Dollar continues to hold the lead as the strongest, with British Pound and New Zealand Dollar also showing resilience. Euro and Canadian Dollar are positioned in the middle. But these standings could shift dramatically if the risk-off mood intensifies throughout the remainder of the week.

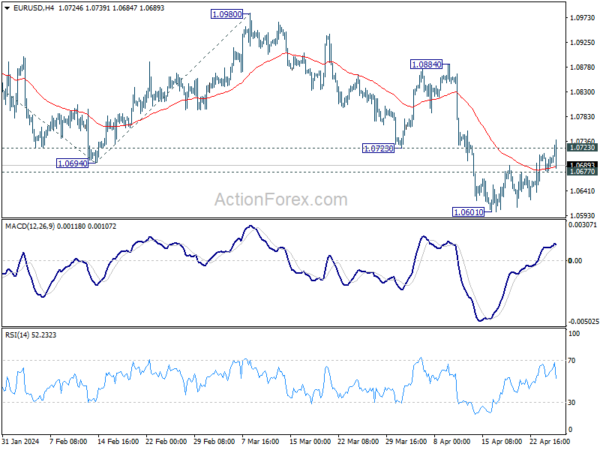

From a technical perspective, EUR/USD has struggled to maintain its position above the 1.0723 level, which acted as support turned resistance. The pair briefly breached this threshold but failed to sustain momentum. The immediate focus is now shifting to the 1.0677 minor support. A decisive break below this level could suggest that the recent recovery from 1.0601 was merely a corrective phase, and the near-term outlook could turn bearish. Should this support give way, EUR/USD may resume its downward trajectory from the 1.0980 high, potentially revisiting lows around 1.0601.

Technically, EUR/USD failed to sustain above 1.0723 support turned resistance despite breaching it briefly. Immediate focus is now on 1.0677 minor support. Firm break there will argue that recovery from 1.0601 has completed as a correction, and retain near term bearish next. EUR/USD might then be resume to resume the fall from 1.0980 through 1.0601.

In Europe, at the time of writing, FTSE is up 0.41%. DAX is down -0.93%. CAC is down -1.24%. UK 10-year yield is up 0.0399 at 4.374. Germany 10-year yield is up 0.0236 at 2.616. Earlier in Asia, Nikkei fell -2.16%. Hong Kong HSI rose 0.48%. China Shanghai SSE rose 0.27%. Singapore Strait Times fell -0.16%. Japan 10-year JGB yield rose 0.0070 to 0.898.

US GDP expands 1.6% annualized in Q1, below expectations

US real GDP grew at an annualized rate of 1.6% in Q1, missing expectation of 2.1%, sharply lower than Q4’s 3.4%.

Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending. These movements were partly offset by an acceleration in residential fixed investment. Imports accelerated.

Price index for gross domestic purchases increased 3.1% in Q1, compared with an increase of 1.9% in the Q4. Personal consumption expenditures (PCE) price index increased 3.4%, compared with an increase of 1.8%. Excluding food and energy prices, PCE price index increased 3.7%, compared with an increase of 2.0%.

ECB’s Schnabel identifies services inflation as primary concern

ECB Executive Board Member Isabel Schnabel acknowledged that the consensus that the path to disinflation is proving to be “quite bumpy,” especially as the process is in its “last mile”. The “biggest concern” is the persistent inflation within the services sector, which remains stubbornly high.

Schnabel emphasized the importance of closely monitoring unit labor costs. She noted at a conference today, “One aspect that we are looking at very vigilantly is the development of unit labor cost.”

“Wage growth remains relatively strong but it seems to be gradually easing in line with what we have in our projections,” she added.

However, Schnabel expressed particular concern over another crucial economic indicator: “The more concerning part is productivity growth,” she remarked, as Eurozone has been experiencing negative productivity growth for several quarters.

Germany’s Gfk consumer sentiment rises to -24.2, an extremely low two-year high

German Gfk Consumer Sentiment for May rose from -27.3 to -24.2, above expectation of -25.5. This marks the highest level in two years, although it remains significantly low by historical standards.

In April, economic expectations rose from -3.1 to 0.7. Income expectations rose from -1.5 to 10.7. Willingness to buy rose from -15.3 to -12.6. Willingness to save rose from 12.4 to 14.9.

Rolf Bürkl, consumer expert at NIM, attributed the stronger uplift in consumer sentiment mainly to the “noticeable increase in income expectations.” He elaborated that these expectations are closely tied to actual developments in real income, buoyed by rising wages and salaries alongside recent dip in inflation rates. This combination has laid a solid foundation for increasing purchasing power among households.

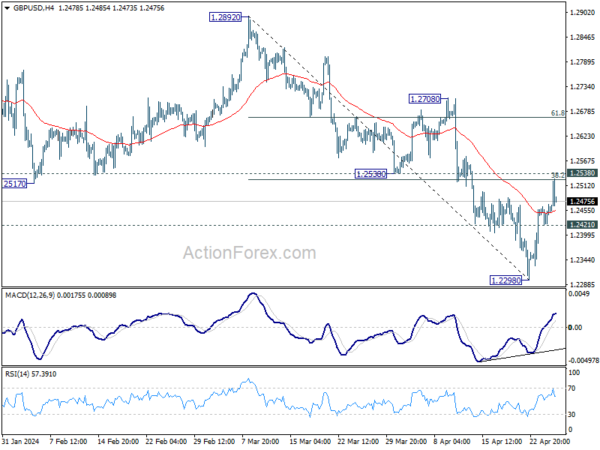

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2368; (P) 1.2414; (R1) 1.2495; More…

Intraday bias in GBP/USD remains neutral for the moment. Near term outlook stays bearish as long as 1.2538 support turned resistance holds. Break of 1.2421 minor support will argue that rebound from 1.2298 has completed and bring retest of this low. However, decisive break of 1.2538 will bring stronger rally to 55 D EMA (now at 1.2585) instead.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany GfK Consumer Confidence May | -24.2 | -25.5 | -27.4 | -27.3 |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | USD | Initial Jobless Claims (Apr 19) | 207K | 210K | 212K | |

| 12:30 | USD | GDP Annualized Q1 P | 1.60% | 2.10% | 3.40% | |

| 12:30 | USD | GDP Price Index Q1 P | 3.10% | 3.00% | 1.60% | |

| 12:30 | USD | Goods Trade Balance (USD) Mar P | -91.8B | -91.2B | -90.3B | -90.3B |

| 12:30 | USD | Wholesale Inventories Mar P | -0.40% | 0.20% | 0.50% | 0.40% |

| 14:00 | USD | Pending Home Sales M/M Mar | 0.90% | 1.60% | ||

| 14:30 | USD | Natural Gas Storage | 87B | 50B |