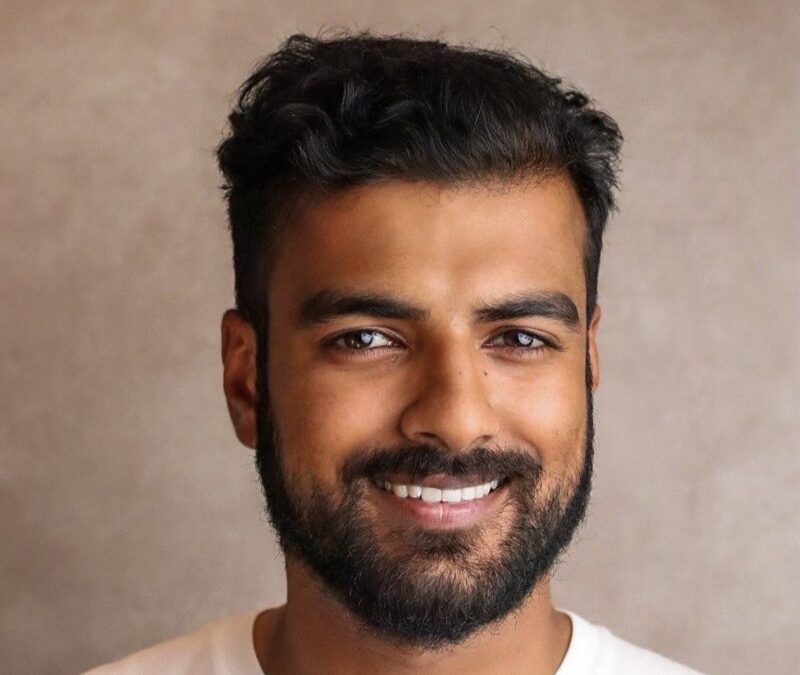

London based DKK Partners, which specialises in emerging markets (EM) and foreign exchange (FX) liquidity, has announced that the company has appointed Zain Abbas as its new Head of Product, to spearhead the development and innovation of its tailored FX services.

DKK stated that Abbas’ appointment as Head of Product will enable it to better serve emerging markets across the world, including Africa and the Middle East, and further build DKK Partners’ product function. Zain Abbas will continue DKK’s mission to support and empower organisations in frontier markets that are struggling against fragmented financial ecosystems, and which have limited access to global FX.

After years of experience in the FinTech industry at Thought Machine and IFX Payments, the new Head of Product brings decades of knowledge having led transformative projects, fostered strategic partnerships, and driven digital transformations. His expertise spans modernising banking infrastructures, developing retail banking products, and implementing virtual multicurrency IBAN wallets as well as other FX and payments solutions.

Zain Abbas, Head of Product, DKK Partners comments:

“I’m delighted to have joined DKK Partners at such a pivotal time in their growth journey. With the company making waves in the emerging markets and foreign liquidity landscape, I am looking forward to bringing my expertise and experience to help build the company and expand our product to serve emerging markets.”

Alongside his skills and qualifications, Zain Abbas is passionate about community leadership and has previously served as a Local Councillor for the Royal Borough of Kingston upon Thames, and as a secondary school mathematics teacher on the TeachFirst Leadership Development Programme.

Sheeraz Saleem, CTO of DKK Partners comments:

Sheeraz Saleem, CTO of DKK Partners comments:

“Welcome, Zain Abbas, our new Head of Product, whose FinTech expertise will ignite innovation, steering DKK Partners towards new heights of excellence.”

DKK said it has recently registered revenue growth of 226 percent over the past year amid a global expansion drive. Over the past 12 months, DKK has handled $1.3 billion worth of transactions.

DKK has ambitious expansion plans to build on last year’s growth and obtain new licenses to further boost compliance ahead of a Series B fundraising round.

About DKK Partners

Founded in 2020 by Dominic Duru and Khalid Talukder, DKK Partners is an emerging markets (EM) FX liquidity provider with revenues in excess of £100m. At DKK with our years of experience within emerging markets within foreign exchange, we develop strategies and methodologies that help corporates and institutions more effectively manage currency risk and develop sharp pricing.

As specialists in our field, we focus on three key areas: FX risk management, FX liquidity, and local collections. Our exact solutions will vary depending on your circumstances, but the quality of our approach can be seen by working with us.

What other firms call deals, we call solutions. In every situation, we work with our clients to understand their business needs and provide ideas that help power growth.