Dollar falls broadly today and stays weak as markets enter into US session. The underlying cause of this sell-off remains somewhat ambiguous, as there were no significant economic data releases to directly attribute the currency’s selloff. The slight retreat in treasury yields, specifically the 10-year yield just gyrating between 4.35-4.40, appears insufficient to solely account for the Dollar’s dip. Additionally, market sentiment does not clearly lean towards risk-on, evidenced by European indexes trading in the red while US futures saw marginal rises. This situation raises questions about whether traders are preemptively betting on the anticipated US CPI data set for release tomorrow.

Meanwhile, tomorrow’s financial calendar is notably packed with major events that could potentially redefine market dynamics. Apart from US inflation data, RBNZ and BoC will announce rate decisions, and FOMC minutes are scheduled for release. This confluence of events suggests that the currency market is poised for significant volatility, with the prospects for a dramatic shift in positionings.

In terms of currency performance today, Dollar emerges as the biggest loser, trailed by Canadian Dollar and then Yen. On the other end of the spectrum, Kiwi stands out as the strongest, followed by Aussie and Sterling, while Euro and the Swiss Franc find themselves in middle positions.

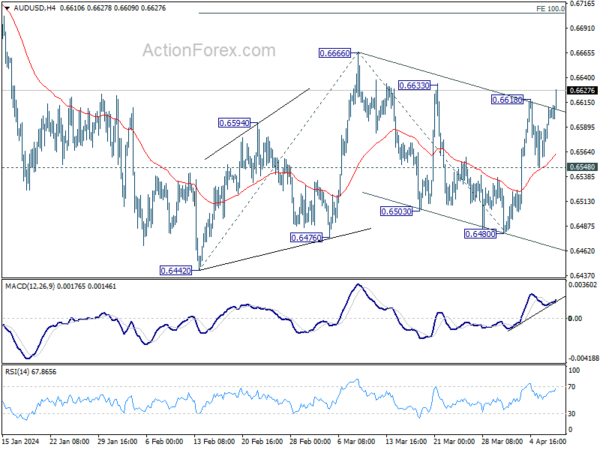

Technically, AUD/USD’s break of 0.6618 resistance indicates resumption of the rebound from 0.6480. Also, the development affirms the case that rise from 0.6480 is the third leg of the pattern from 0.6442. Further rise should be seen to 0.6666 first. Firm break there will target 100% projection of 0.6442 to 0.6666 from 0.6480 at 0.6704 next.

In Europe, at the time of writing, FTSE is up 0.20%. DAX is down -0.51%. CAC is down -0.21%. UK 10-year yield is down -0.0476 at 4.037. Germany 10-year yield is down -0.042 at 2.397. Earlier in Asia, Nikkei rose 1.08%. Hong Kong HSI rose 0.57%. China Shanghai SSE rose 0.05%. Singapore Strait Times rose 0.67%. Japan 10-year JGB yield fell -0.0070 to 0.785.

BoJ’s Ueda: Economic and price developments could trigger monetary stimulus reduction

Speaking to the parliament today, BoJ Governor Kazuo Ueda highlighted the possibility of future reduction in monetary stimulus, contingent on the alignment of economic and price conditions with current projections.

“If economic and price conditions move in line with our current projections, trend inflation will gradually accelerate. If so, we must consider reducing the degree of stimulus,” he explained.

A significant point of consideration as outlined by Governor Ueda revolves around the outcomes of annual wage negotiations and their subsequent reflection in actual data. “We’ll also check at each policy meeting whether rising wages will be reflected in services prices, he added.

NZ NZIER business confidence tumbles, high interest rates deepen pessimism

In Q1, New Zealand’s business community signaled a stark downturn in confidence, with NZIER business confidence index plunging from -9.9 to -23.7 . This dramatic drop is accompanied by reversal in firms’ trading activity expectations for the coming quarterly, from 6.6 to -11.5, as well as retrospective decline in past three months’ trading activity from 6.7 to -23.2.

NZIER attributes this downturn to the effect of heightened interest rates, which appear to be fulfilling their role in tempering demand to alleviate inflationary pressures. Moreover, the looming uncertainty surrounding the new Government’s fiscal strategies, particularly in terms of spending adjustments and cutbacks in the public sector, is exacerbating business caution.

Detailed further illuminates the current economic challenges, with a net 11% of firms having reduced their workforce in the March quarter, albeit with slightly positive hiring intentions moving forward. Investment intentions are also on the downturn, with a net 14% of businesses intending to cut back on plant and machinery investment, and a net 8% planning to curtail investment in buildings over the next year.

Australia Westpac consumer sentiment falls to 82.4, prolonged pessimism

Australia Westpac Consumer Sentiment Index marked a decrease of -2.4% mom to 82.4 in April. This downturn extends the index’s streak below the neutral threshold of 100 to nearly two years, underscoring a prolonged period of consumer pessimism.

Westpac’s analysis attributes the lack of recovery in consumer sentiment primarily to the ongoing inflationary pressures that have gripped Australia. Over the past three years, consumer prices have risen significantly, outpacing wage growth by six percentage points. This inflationary trend, coupled with the notable rise in interest rates and increased tax burdens, has significantly strained household incomes, subjecting them to prolonged financial duress.

As attention turns to RBA’s next meeting in May, Westpac anticipates no change to the official cash rate. This forecast hinges significantly on the upcoming March quarter CPI update, due on April 24, which is expected to play a crucial role in shaping the RBA’s stance.

Australia NAB business confidence rises to 1, cost pressures show slight relief

Australia NAB Business Confidence rose from 0 to 1 in March. Business Conditions fell from 10 to 9. Trading Conditions and employment conditions held steady at 15 and 6 respectively. But profitability conditions decline notably from 10 to 6.

Alan Oster, NAB’s Chief Economist, pointed out the unusual situation where business conditions have been “a little above average” and confidence “a little below average” for an extended period. This, according to Oster, reflects a cautious outlook among firms regarding the future, even as the economy shows signs of resilience.

Further details from the report indicate a softening in cost pressures. Labor cost growth decelerated to 1.6% on quarterly equivalent basis, down from 2.0%. Purchase cost growth slowed to 1.4% from 1.8%. Additionally, there was a moderation in product price growth to 0.7% from 1.2%, with retail price growth slightly reducing to 1.3% from 1.4%. Despite these easing pressures, cost concerns remain high, with retail price growth still elevated.

Oster interprets these figures as being aligned with expectations that the journey towards inflation normalization will be “gradual”. Q1 PI result later in April is expected to further reinforced this view.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2624; (P) 1.2644; (R1) 1.2675; More…

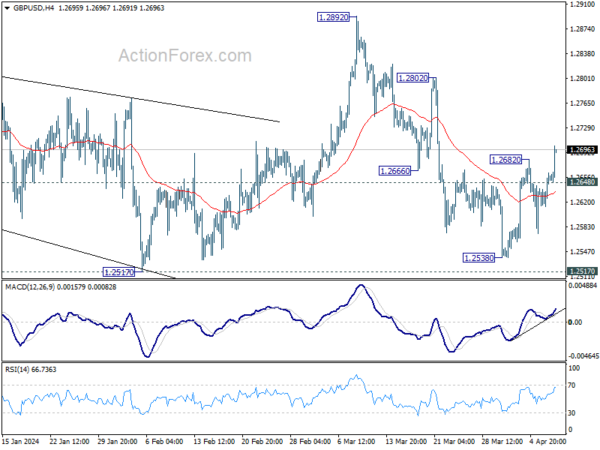

Intraday bias in GBP/USD is back on the upside with break of 1.2682. Rebound from 1.2538 would target 1.2802 resistance first. On the downside, though, below 1.2648 minor support will turn intraday bias neutral again.

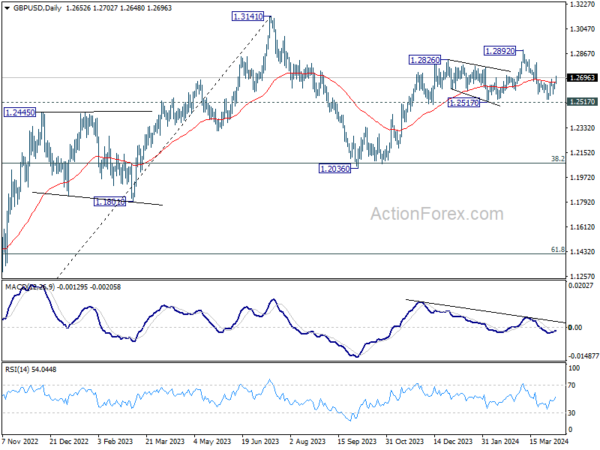

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which might still be in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q1 | -25 | -2 | ||

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Mar | 3.20% | 1.80% | 1.00% | |

| 00:30 | AUD | Westpac Consumer Confidence Apr | -2.40% | -1.80% | ||

| 01:30 | AUD | NAB Business Confidence Mar | 1 | 0 | ||

| 01:30 | AUD | NAB Business Conditions Mar | 9 | 10 | ||

| 05:00 | JPY | Consumer Confidence Mar | 39.5 | 39.7 | 39.1 | |

| 06:00 | JPY | Machine Tool Orders Y/Y Mar P | -3.80% | -8.00% | ||

| 06:45 | EUR | France Trade Balance (EUR) Feb | -5.2B | -7.0B | -7.4B | -7.2B |

| 10:00 | USD | NFIB Business Optimism Index Mar | 88.5 | 90.2 | 89.4 |