Dollar rebounded broadly overnight and stayed generally firm in Asian session. Stock investors were apparently adopting a cautious stance and lightening up positions ahead of Fed’s rate decision and subsequent press conference today. With recent data pointing to persistent inflationary pressures, expectations are mounting that Fed would adopt a more hawkish tone. It’s a minimum that Fed will indicate that rate cuts would only be considered once inflation consistently moves towards the target. The central question now is the extent of this hawkish shift.

For now, the selloff in the currency markets seemed to be concentrated most in Swiss Franc primarily due to diverging monetary path with other major central banks. While SNB has already begun policy easing, other central banks, including even ECB, may not ease as aggressively as previously anticipated. This disparity in central bank policies is contributing to Franc’s weakness.

Elsewhere, New Zealand Dollar softened slightly following significantly weaker than expected employment data. Although this did not trigger extended selling, Kiwi remains one of the week’s weaker performers, only outdone by Australian Dollar and followed closely by Canadian Dollar. Conversely, Yen stands out as the strongest performer, with Dollar and Sterling also showing resilience. Euro and Swiss Franc are positioned in the middle of the pack, with the Franc appearing particularly vulnerable.

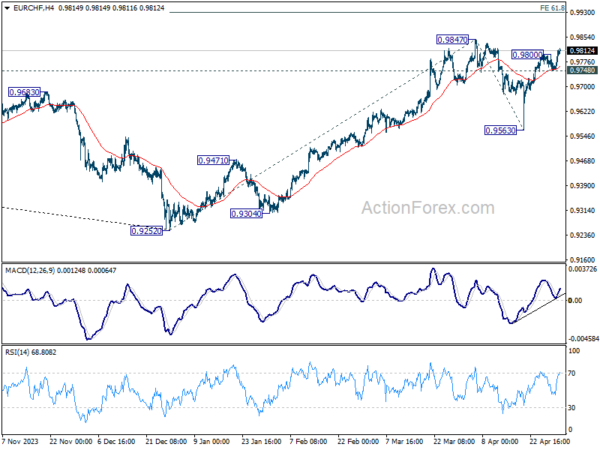

Technically, EUR/CHF’s rebound from 0.9563 resumed by breaking through 0.9800. Retest of 0.9847 should be seen next. Firm break there will resume whole rally from 0.9252 and target 61.8% projection of 0.9252 to 0.9847 from 0.9563 at 0.9931 next.

In Asia, at the time of writing, Nikkei is down -0.14%. Japan 10-year JGB yield is up 0.0195 at 0.893. Hong Kong, China, and Singapore are on holiday. Overnight, DOW fell -1.49%. S&P 500 fell -1.57%. NASDAQ fell -2.04%. 10-year yield rose 0.072 to 4.686.

US stocks plunge as market braces for hawkish Fed pivot

US stocks tumbled sharply overnight, concluding a turbulent April as traders anticipated a hawkish pivot from Fed Chair Jerome Powell in his upcoming post-FOMC meeting press conference today. DOW recorded -5% loss for the month, marking its worst monthly performance since September 2022. Similarly, S&P 500 and NASDAQ fell by -4.2% and -4.4%, respectively, ending their five-month streaks of gains.

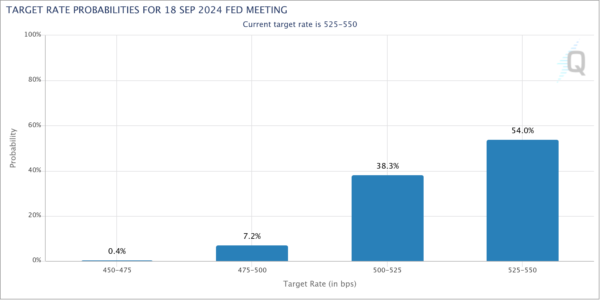

Amidst this backdrop, Fed is widely expected to maintain federal funds rate at its current level of 5.25-5.50%. With no new economic projections or dot plot updates, all eyes are on Powell’s statement and subsequent press conference. Market speculation suggests Powell might confirm that a rate cut in June is unlikely and could adjust expectations to reflect fewer than three rate cuts for the year.

Powell’s comments will be crucial for investors, as any indication towards maintaining higher rates for longer, or even hinting at the possibility of a rate hike, could signal a more aggressive stance than previously anticipated. Currently, Fed fund futures reflect a 54% probability that rates will remain at the current level after the September meeting.

Technically, near term bias in DOW is kept on the downside after be rejected by 55 D EMA twice. Further decline is in favor through 37611.56 support. Nevertheless, fall from 39899.05 is currently seen as developing into a corrective pattern to rise from 32327.20 only. Hence, strong support would be seen from 38.2% retracement of 32327.20 to 39899.05 at 37000.42 to bring rebound. However, sustained break of 37000.42 will argue that larger scale correction could be underway.

Japan’s PMI manufacturing finalized at 49.6, moving towards stabilization

Japan’s PMI Manufacturing was finalized at 49.6 in April, marking an increase from March’s 48.2 and reaching its highest level in eight months. While the index remains below the pivotal 50.0 mark, which distinguishes expansion from contraction, the latest data suggests that the sector is moving towards stabilization in the near term.

Paul Smith from S&P Global Market Intelligence noted that the April PMI “continued to paint a fairly subdued picture of the Japanese manufacturing sector,” but also pointed out that “another rise in the headline PMI points to a sector heading towards at least stabilization in the near-term.”

The report also highlighted concerns about inflation, with a broad-based increase in input prices contributing to heightened cost pressures for manufacturers. Notably, the strength of market demand is allowing firms to pass these increased costs onto consumers, with the extent of charge hikes reaching the steepest level in nearly a year.

New Zealand employment falls -0.2% qoq in Q1, unemployment rate jumps to 4.3%

New Zealand employment fell -0.2% qoq in Q1, much worse than expectation of 0.3% qoq growth. Unemployment rate rose from 4.0% to 4.3%, above expectation of 4.0%. Underutilization rate rose 0.5% to 11.2%. Employment rate fell -0.6% to 68.4%. Labor force participation rate fell -0.3% to 71.5%.

For wages, average ordinary time hourly earnings growth slowed from 6.9% yoy to 5.2% yoy. All sector unadjusted labor cost index slowed slightly from 4.3% yoy to 4.1% yoy.

“Although wage cost inflation eased and average hourly earnings growth started to slow this quarter, annual growth remained high for the two surveys,” business employment insights manager Sue Chapman said.

RBNZ cautions on persistent inflation risks and financial market volatility

RBNZ the decline in global inflation from previously elevated levels. At the same time, financial markets are currently anticipating lower policy rates over the next year.

However, “there remains a risk that new or persistent inflation pressures could mean global interest rates remain restrictive for longer, placing continued pressure on households, businesses and the financial system,” RBNZ warned in its semi-annual Financial Stability Report.

The report also observed that expectations for monetary policy easing have spurred rallies in equity markets across major economies. Yet, RBNZ cautioned that these gains could be vulnerable to a swift reversal.

“An abrupt reversal in sentiment arising from weaker-than-expected earnings or inflation remaining elevated could drag stock prices down, which would generate economic and financial risks from a market-driven tightening in financial conditions,” it warned.

Looking ahead

UK PMI manufacturing final is the only feature in European session. Later in the day, Canada PMI manufacturing and US ISM manufacturing will be released. But main focus is on Fed rate decision and post-meeting press conference.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9128; (P) 0.9162; (R1) 0.9231; More….

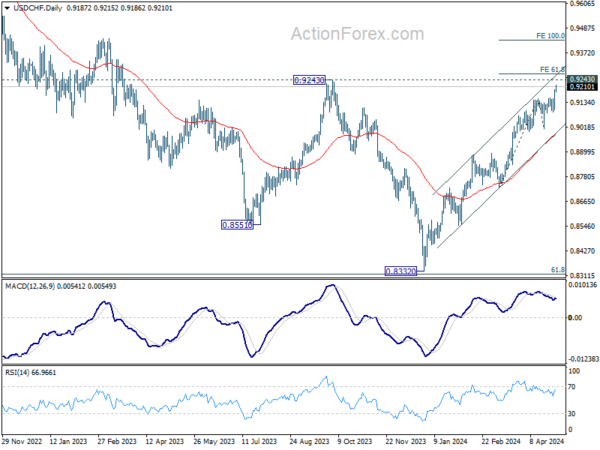

USD/CHF’s rally from 0.8332 resumed and hit as high as 0.9215 so far. Intraday bias is back on the upside for 0.9243 resistance next. Decisive break there will carry larger bullish implications. Next target will be 61.8% projection of 0.8728 to 0.9151 from 0.9009 at 0.9270. For now, near term outlook will stay bullish as long as 0.9087 support holds, in case of retreat.

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8884 resistance turned support holds. But upside should be limited by 0.9243 resistance, at least on first attempt. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q1 | -0.20% | 0.30% | 0.40% | |

| 22:45 | NZD | Unemployment Rate Q1 | 4.30% | 4.30% | 4.00% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.80% | 0.80% | 1.00% | |

| 00:30 | JPY | Manufacturing PMI Apr F | 49.6 | 49.9 | 49.9 | |

| 08:30 | GBP | Manufacturing PMI Apr F | 48.7 | 48.7 | ||

| 12:15 | USD | ADP Employment Change Apr | 180K | 184K | ||

| 13:30 | CAD | Manufacturing PMI Apr | 50.2 | 49.8 | ||

| 13:45 | USD | Manufacturing PMI Apr F | 49.9 | 49.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 50.1 | 50.3 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 55.6 | 55.8 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 47.4 | |||

| 14:00 | USD | Construction Spending M/M Mar | 0.30% | -0.30% | ||

| 14:30 | USD | Crude Oil Inventories | -2.3M | -6.4M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |