Dollar stands firm as the day’s strongest currency, with the financial markets on edge for the Fed’s impending announcement. While interest rate is widely anticipated to hold steady at 5.25-5.50%, the spotlight is on the potential adjustments to Fed’s dot plot. December’s projections hinted at three rate cuts for the year, yet the consensus was narrowly divided—11 members forecasting three or more cuts, against 8 envisaging two or fewer. A pivotal shift of just two dots could recalibrate expectations to merely two rate cuts, a scenario that could bolster Dollar, at least in the short term.

In the broader market context, Australian and Canadian Dollars trail behind Dollar by some distance. Yen languishes as the day’s weakest currency, followed closely by Kiwi. European majors, with Euro slightly ahead, occupy the middle ground, even as ECB President Christine Lagarde reaffirms conditional guidance towards a June rate cut. Swiss Franc faces downward pressure, partly due to risks of a dovish surprise SNB tomorrow. Sterling’s progress is tempered by CPI figure that fell short of expectations and the looming BoE decision, also due tomorrow.

Technically, stock markets’ reactions to FOMC are also important to monitor. Bearish divergence condition in D MACD in S&P 500 is a factor that could cap its rally at 138.2% projection of 3808.86 to 4607.07 from 4103.78 at 5206.91. Break of 5056.82 support will confirm short term topping and bring deeper correction to 55 D EMA (now at 4968.40). Nevertheless, decisive break of 5206.91 would pave the way to 161.8% projection at 5395.28 before topping.

In Europe, at the time of writing, FTSE is down -0.18%. DAX is up 0.20%. CAC is down -0.64%. UK 10-year yield is down -0.0320 at 4.133. Germany 10-year yield is down -0.0228 at 2.433. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.08%. China Shanghai SSE rose 0.55%. Singapore Strait Times rose 0.12%.

ECB’s Lagarde sets conditions for June rate cut

ECB President Christine Lagarde provided clarity in a speech on the conditions that would lead to a rate cut in June, highlighting reliance on “two important pieces of evidence” as pivotal to the central bank’s confidence on dialing back monetary restrictions. .

Firstly, ECB anticipates receiving data on negotiated wage growth for Q1 by the end of May. Secondly, by June, ECB will have access to a new set of economic projections, enabling it to verify the validity of the inflation path forecasted in its March projection.

After the first move, Lagarde emphasized to “confirm on an ongoing basis” that incoming data aligns with its inflation outlook. This approach underscores a commitment to data-driven policy decisions, maintaining a “meeting-by-meeting” stance that eschews any pre-commitment to a fixed rate path.

Furthermore, Lagarde noted the enduring significance of ECB’s policy framework in processing incoming data and determining the appropriate policy stance. However, she also mentioned that the relative importance of the three criteria guiding these decisions would require regular reassessment.

UK CPI slows to 3.4% in Feb, core down to 4.5%

UK CPI slowed from 4.0% yoy to 3.4% yoy in February, below expectation of 3.5% yoy. CPI core (excluding energy, food, alcohol and tobacco) slowed from 5.1% yoy to 4.5% yoy, below expectation of 4.6% yoy.

CPI goods annual rate slowed from 1.8% yoy to 1.1% yoy, while CPI services annual rate eased from 6.5% yoy to 6.1% yoy.

On a monthly basis, CPI rose 0.6% mom, below expectation of 0.7% mom.

New Zealand Westpac consumer confidence rises to 93.2 in Q1, yet pessimism lingers

New Zealand Westpac Consumer Confidence rose from 88.9 to 93.2 in Q1, marking its highest level in over two years. Despite this rise, the index continues to hover below the pivotal 100 mark, indicating prevailing sense of pessimism among New Zealanders regarding economic conditions. Present Conditions Index saw significant uplift from 77.1 to 85.1, while Expected Conditions Index advanced modestly from 96.7 to 98.6.

Westpac’s analysis highlights that households are gradually feeling more optimistic about their financial situations, which has subsequently spurred an increase in “spending appetites”. This positive shift in consumer sentiment is observed across all income brackets, with “middle-income households exhibiting” the most marked improvement.

USD/CHF Mid-Day Outlook

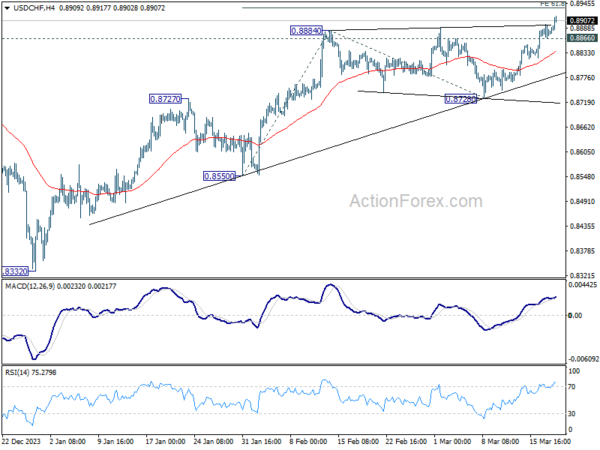

Daily Pivots: (S1) 0.8866; (P) 0.8882; (R1) 0.8898; More….

USD/CHF’s rally from 0.8332 is still in progress and intraday bias stays on the upside for 61.8% projection of 0.8550 to 0.8884 from 0.8728 at 0.8934. Firm break there will target 100% projection at 0.9062 next. On the downside, break of 0.8866 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

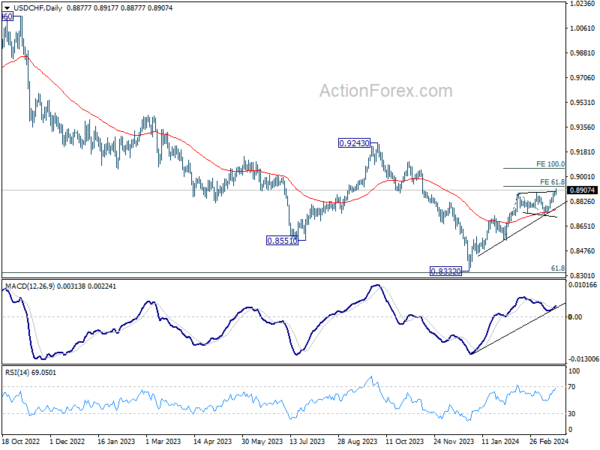

In the bigger picture, price actions from 0.8332 medium term bottom as seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8555 support holds. But upside should be limited by 0.9243 resistance, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q1 | 93.2 | 88.9 | ||

| 21:45 | NZD | Current Account (NZD) Q4 | -7.84B | -7.80B | -11.47B | -10.97B |

| 07:00 | EUR | Germany PPI M/M Feb | -0.40% | -0.20% | 0.20% | |

| 07:00 | EUR | Germany PPI Y/Y Feb | -4.10% | -3.80% | -4.40% | |

| 07:00 | GBP | CPI M/M Feb | 0.60% | 0.70% | -0.60% | |

| 07:00 | GBP | CPI Y/Y Feb | 3.40% | 3.50% | 4.00% | |

| 07:00 | GBP | Core CPI Y/Y Feb | 4.50% | 4.60% | 5.10% | |

| 07:00 | GBP | RPI M/M Feb | 0.80% | 0.80% | -0.30% | |

| 07:00 | GBP | RPI Y/Y Feb | 4.50% | 4.50% | 4.90% | |

| 07:00 | GBP | PPI Input M/M Feb | -0.40% | 0.20% | -0.80% | -0.10% |

| 07:00 | GBP | PPI Input Y/Y Feb | -2.70% | -2.70% | -3.30% | -2.80% |

| 07:00 | GBP | PPI Output M/M Feb | 0.30% | 0.10% | -0.20% | 0.00% |

| 07:00 | GBP | PPI Output Y/Y Feb | 0.40% | -0.10% | -0.60% | -0.30% |

| 07:00 | GBP | PPI Core Output M/M Feb | 0.20% | 0.20% | 0.30% | |

| 07:00 | GBP | PPI Core Output Y/Y Feb | 0.30% | -0.40% | -0.30% | |

| 09:00 | EUR | Italy Industrial Output M/M Jan | -1.20% | 0.10% | 1.10% | |

| 14:30 | USD | Crude Oil Inventories | -0.9M | -1.5M | ||

| 15:00 | EUR | Eurozone Consumer Confidence Mar P | -15 | -16 | ||

| 17:30 | CAD | BoC Summary of Deliberations | ||||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |