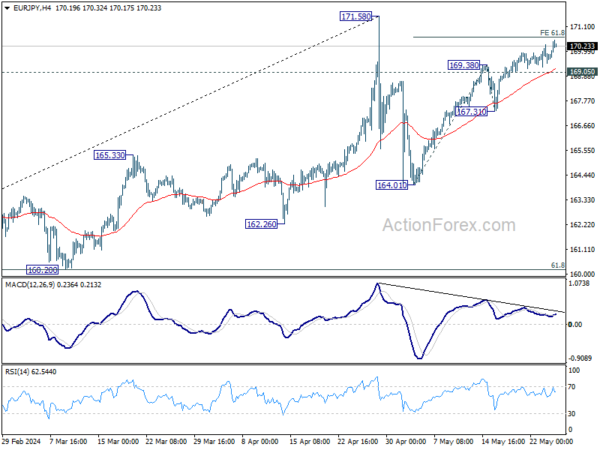

EUR/JPY’s rise from 164.01 extended by breaking through 169.38 resistance last week. This rally is seen as the second leg of the corrective pattern from 171.58. Initial bias remains on the upside for 61.8% projection of 164.01 to 169.38 from 167.31 at 170.62, and then 171.58 high. On the downside, break of 169.05 minor support will intraday bias neutral first. Further break of 167.31 should turn bias back to the downside to start the third leg towards 164.01.

In the bigger picture, a medium top could be formed at 171.58 after brief breach of 169.96 (2008 high). As long as 55 W EMA (now at 158.72) holds, price actions from there is seen as correcting the rise from 153.15 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 153.15 support.

In the long term picture, rise from 114.42 (2020 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). 100% projection of 94.11 to 149.76 from 114.42 at 170.07 was already met but there is no signal of reversal yet. Firm break of 170.07 will target 138.2% projection at 191.32. This will remain the favored case as long as 153.15 support holds.