Pan-European market infrastructure Euronext today published its results for the fourth quarter and full year 2023.

FX trading revenue was stable at €6.7 million in the final quarter of 2023 as higher volumes were offset by FX impact. On a like-for-like basis at constant currencies, FX trading revenue was up 4.8% compared to Q4 2022.

FX trading revenues were at €25.6 million in 2023, down 10.0% compared to a record performance in 2022. This decrease reflects the lower volatility in the first three quarters of the year and negative FX impact.

On a like-for-like basis at constant currencies, FX trading revenue was down 7.8% in 2023 compared to 2022.

In Q4 2023, Euronext’s revenue and income amounted to €374.1 million, up 7.8% compared to Q4 2022, driven by record performance in fixed income trading, robust results in non-volume related businesses and the positive contribution of the Euronext Clearing European expansion at the end of November 2023.

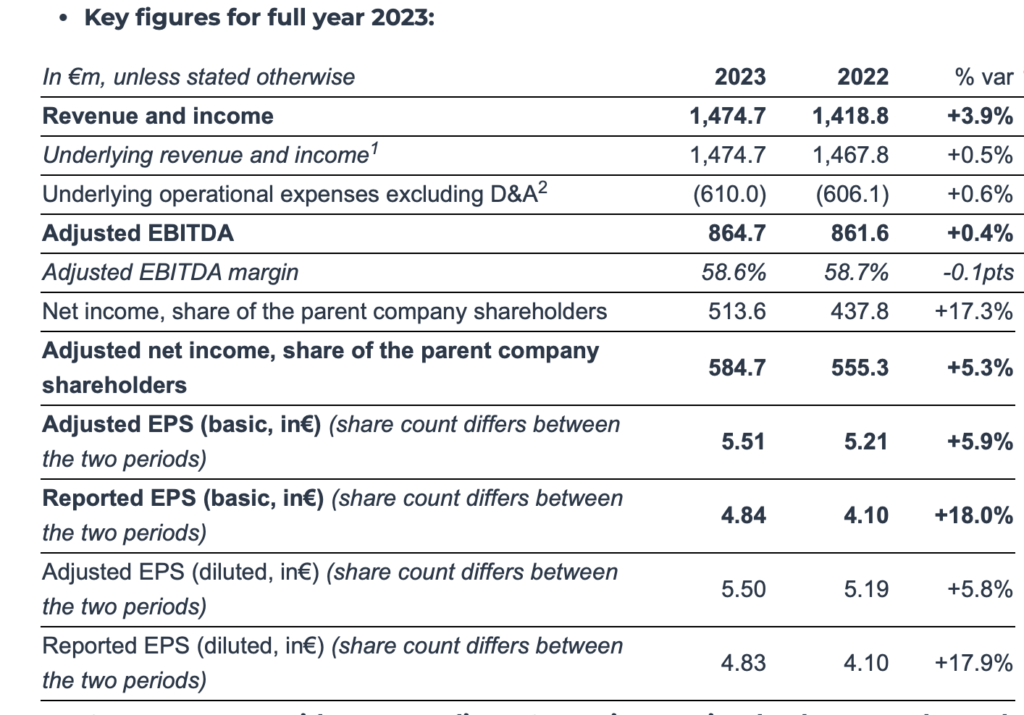

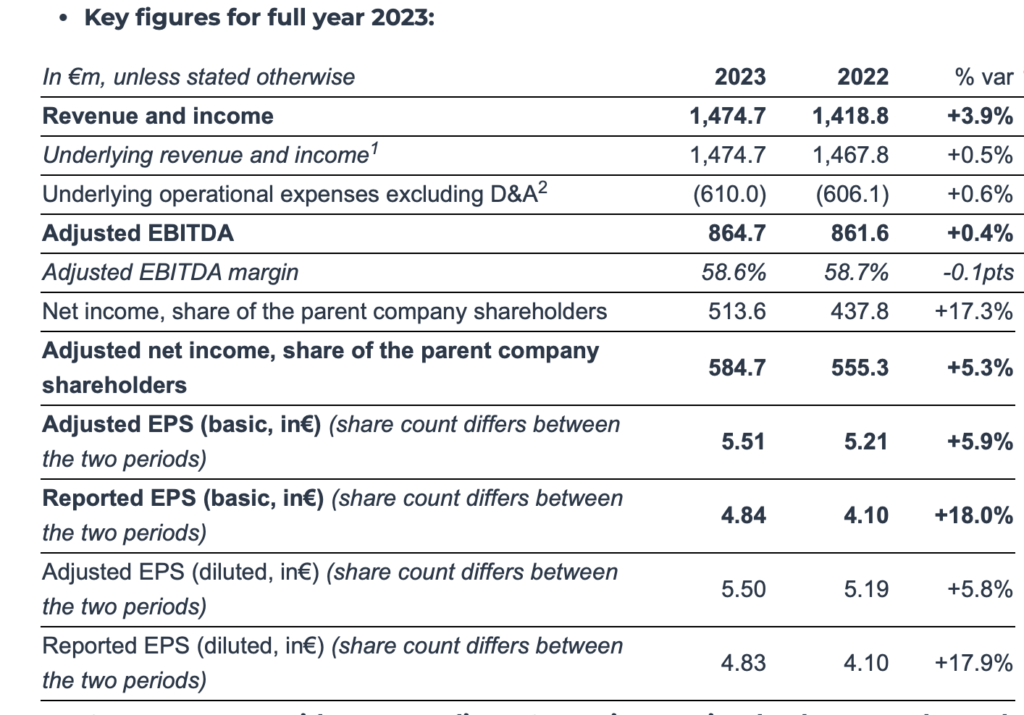

In 2023, Euronext’s underlying revenue and income was €1,474.7 million, up 0.5% compared to 2022, resulting from strong performance of non-volume related activities, offsetting the softer cash trading environment and negative impact from the NOK depreciation over the year. 2023 total revenue and income was up 3.9%, reflecting the Q3 2022 one-off loss in net treasury income related to the partial disposal of the Euronext Clearing portfolio.

On a like-for-like basis and at constant currencies, Euronext consolidated revenue and income was up 1.6% in 2023, at €1,469.7 million, compared to 2022.

A dividend of €256.8 million will be proposed to the Annual General Meeting on 15 May 2024. This represents 50% of 2023 reported net income, in line with Euronext’s dividend policy. Based on the number of outstanding shares at the end of 2023, this represents a dividend of €2.48 per share, up 11.7% compared to 2022.