FNG Exclusive… FNG has learned that Japanese stock exchange operator Japan Exchange Group has decided on delisting the shares of INV Inc (TYO:7338) from the Tokyo Stock Exchange. The delisting became effective as of April 25, 2024.

INV Inc operates Australia based, ASIC-licensed prime services company 26 Degrees Global Markets, which accounts for about half of its overall income. 26 Degrees rebranded from Invast Global last year. The company also operates Japan based businesses that include online brokerage Invast Securities at website invast.jp, and a Japanese asset management arm, Invast Capital Management Co.

At the time of its delisting, INV Inc had a market cap of JPY 7.03B, or USD $46 million.

Japan Exchange Group reported that INV Inc’s delisting is due to falling under a case where the company implements a reverse stock split with a split ratio at which the number of all the shares owned by shareholders other than a specified party will be less than one share.

At the general shareholders meeting of INV Inc held in late March, the agenda item regarding a reverse stock split with a split ratio at which each of the shares held by shareholders other than specified entities will be less than one share was approved.

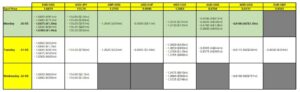

For the nine months ended December 31, 2023 (the company has a March 31 fiscal year-end), INV Inc reported Revenues of JPY 4.976B (USD $32 million), up 11% from 2022, and Net Income of JPY 190M ($1 million). In FY2023 INV Inc reported annual Revenues of JPY 6.005B (USD $39 million), and Net Profit of JPY 199M ($1 million). INV Inc is run by President & CEO Takeshi Kawaji (who is also a Director at 26 Degrees), while 26 Degrees is headed by CEO Gavin White, who also served as a Director of INV Inc until 2023.