While the Reserve Bank of India maintaining status quo and rate in February policy disappointed the market, analysts see a potential shift in the RBI’s stance to “neutral” in the April policy, possibly marking the first step towards easing. Speculation centres around a 50 basis points (bps) rate cut by the RBI, anticipated to commence in June. The optimism stems from the expected decline in headline Consumer Price Index (CPI) inflation to the 4 percent level in Q2 FY25.

The benign nature of core inflation, dipping below the 4 percent mark in December, provides a potential comfort factor for the RBI. The market has already adjusted, with the 10-year Government Securities (G-sec) yield softening to 7.07 percent from 7.35 percent in Feb ’23, indicating an anticipation of a 25 bps rate cut.

Factors likely to prompt a rate cut include lower budgeted gross borrowing figures and passive inflows due to India’s inclusion in global bond indices. The RBI’s inflation projection for FY24 stands at 5.4 percent, with an average headline inflation expected to soften in FY25 to 4.5 percent, despite potential risks from below-normal monsoon and volatile food prices.

However, the RBI’s decision is anticipated to hinge on global cues, particularly from the Federal Reserve. A severe growth slowdown in the US, leading to an increase in the quantity of dollars globally, could influence the RBI to consider more than a 50 bps cut to ease liquidity conditions. The impact of this decision is already visible, with bank and financial services stocks experiencing a downturn after an initial positive start.

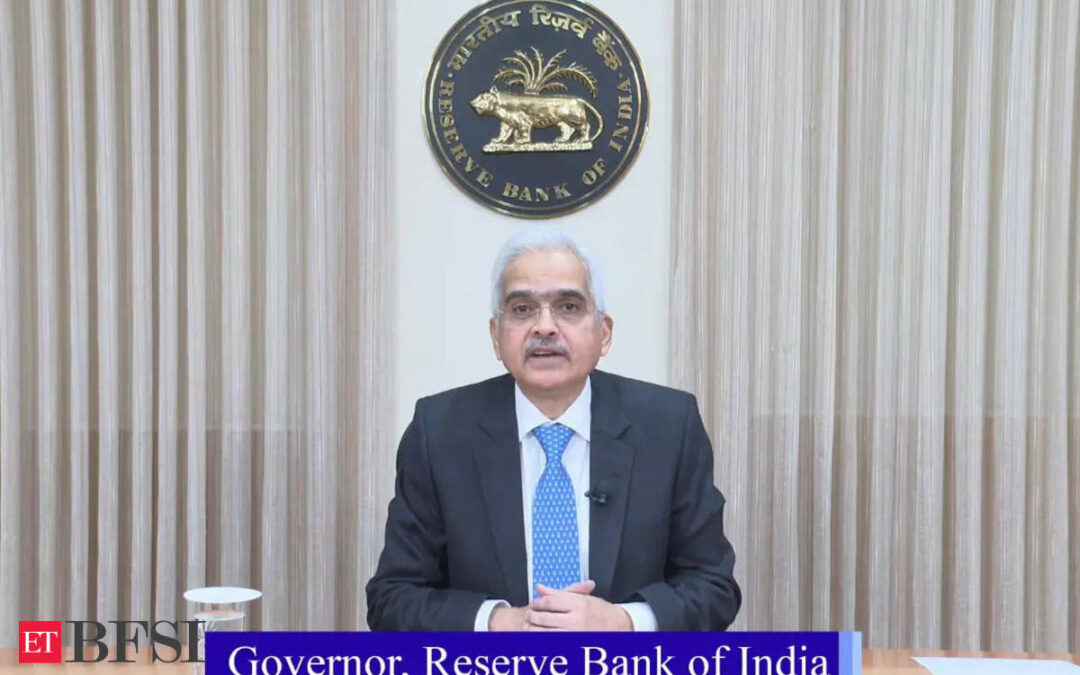

The February policy

In the bi-monthly Monetary Policy Committee (MPC) meeting held from February 6-8, 2024, the RBI opted to maintain the policy repo rate at 6.5 percent, signalling a cautious approach amidst economic uncertainties. Contrary to expectations of a shift to a “neutral” stance, the central bank continues with its current policy of “withdrawal of accommodation.”

The RBI’s decision seems anchored in a strategy of fiscal prudence and lower government borrowing, as outlined in the interim budget for 2024. While the positive growth outlook could pave the way for monetary easing, the central bank appears hesitant, preferring to wait for inflation to firmly stabilise around the 4 percent target before decisively altering its stance. The RBI’s approach echoes the sentiment that “Being right too early is being wrong.”

Despite persistent liquidity deficits in the banking system since September ’23, the RBI’s focus on durable liquidity, adjusted for the government’s cash balance, remains positive. This nuanced approach, contrary to market expectations, has led to disappointment among fixed-income market participants.

Market reactions were notable, with initial optimism in bank and financial services stocks giving way to a downward trend after the RBI’s decision. Nifty Bank witnessed a 0.9 percent decline, and Nifty Financial Services fell over 1 percent. Analysts attribute this to the RBI’s commitment to curbing inflation, keeping liquidity tight.