- The Fed is widely expected to maintain the Fed Funds Rate unchanged next week by both markets and analyst consensus.

- The Fed could announce upcoming tapering of the QT pace already next week, but we would not expect it to have a significant impact on financial conditions.

- With no new projections, the market will have to rely on Powell for verbal guidance on rates outlook. We believe the Fed still sees cuts in the horizon in 2024, which could mean downside risks to yields and upside risks to EUR/USD.

The recent string of upside surprises in US inflation data has put rate cut speculation on the backfoot. We expect Powell to echo most of his colleagues in saying that some cuts are still expected for 2024, but that as long as the economy shows no significant signs of cooling, there is no sense of urgency for moving quickly.

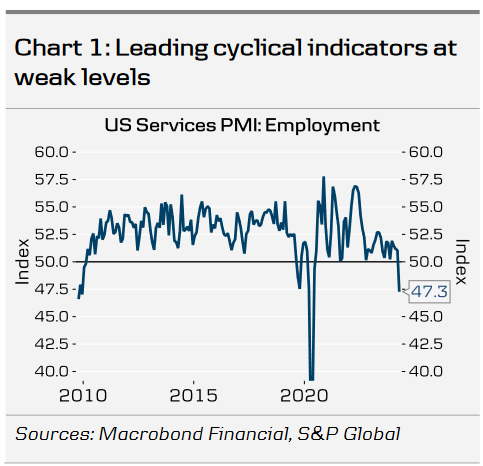

In our view, two factors suggest that the Fed is not yet ready to give up on signalling rate cuts for 2024. First, while rapid recovery in labour supply and improving productivity have given a sizable boost to the structural growth outlook, cyclical indicators still remain at subdued levels. April flash PMIs showed leading new orders components plunging across manufacturing and services. We have previously highlighted how fading support from inventory cycle is explaining the former and how early layoff indicators have flashed warning signals for the latter (see RtM USD, 16 April). Excluding the initial Covid-19 shock, services employment PMI fell to the lowest level since 2009 (Chart 1).

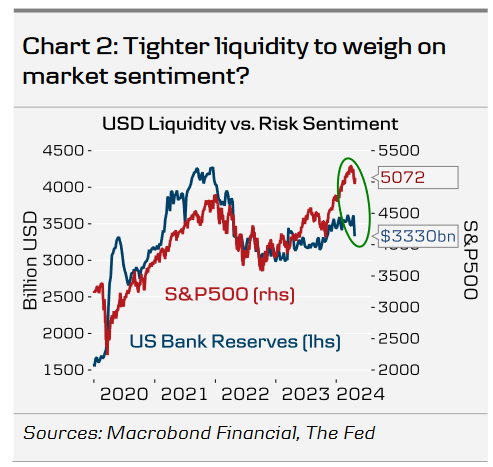

Second, after significant easing in late 2023, financial conditions have started to retighten. Bond yields have edged higher, broad USD has strengthened, commodity prices are rising and even equity markets gave up some of their gains in April. USD liquidity conditions are set to start tightening due to the Fed’s QT in early summer as the liquidity boost from ON RRP has soon been depleted, which could signal further headwinds for the sentiment (Chart 2). Tighter financial conditions are a drag on the economy, and only around a year ago, the SVB’s collapse illustrated how sudden the consequences can potentially be (markets were pricing in the Fed Funds Rate reaching as high as 5.7% just ahead of the crisis).

The Fed could also announce tapering the pace of QT already in this meeting. In our view, the Fed is not in a hurry to taper yet, but latest commentary has suggested that the participants prefer the ‘slower but longer’ approach to the QT’s endgame to avoid 2019-esque sudden tightening in liquidity conditions. We discussed the implications for liquidity and the Fed’s bond holdings in more detail in RtM USD, 23 April. In any case, the announcement should not have a significant impact on financial conditions.

All together, we see risks tilted towards slightly dovish market reaction, if the Powell maintains clear verbal guidance for rate cuts in 2024, even when emphasizing that there is no urgent need to act for the time being. Our call for rate cuts starting already in June is inarguably under pressure, but we still like our view for three cuts in total in 2024.