Ford Motor Co.’s stock rose 3% Wednesday after an upbeat earnings report that also spurred buying of its outstanding bonds and helped spreads tighten over U.S. Treasurys.

The car company’s

F,

fourth-quarter revenue topped consensus estimates, it announced a next-generation, smaller EV to rival Tesla Inc.’s

TSLA,

upcoming “Model 2,’ and it unveiled a special dividend along with plans for $2 billion in cost cuts this year.

The year 2023 was “solid,” but Ford is nowhere near done, Chief Executive Jim Farley said in a call after the results. “We are really positioned well for growth and for profitability, for revenues, as well.”

For analyst comments: Ford has a ‘Ferrari’? An unsung part of the business gets its due

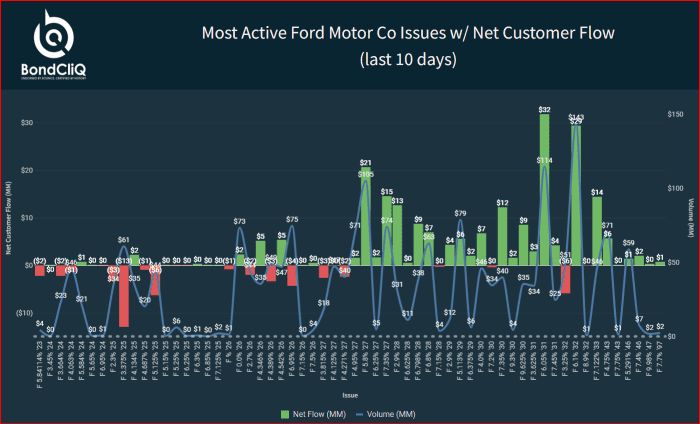

The company’s most active bonds saw net buying early Wednesday, as the following chart from data-solutions provider BondCliQ Media Services shows.

Ford Motor Co. bonds — Net customer flow (Intraday).

BondCliQ Media Services

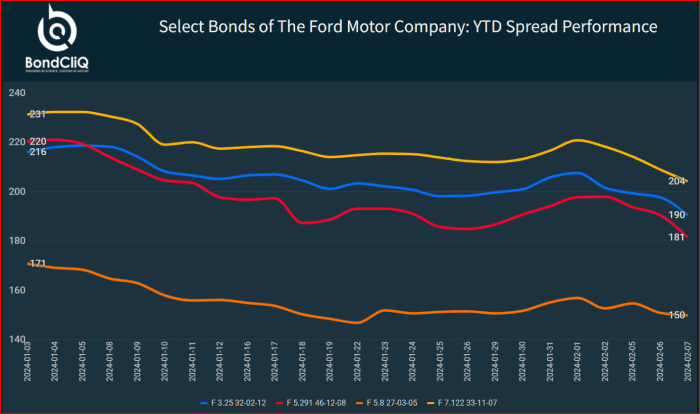

The bonds have performed well in the year to date, with spreads tightening anywhere from 16 basis points to 39 basis points. On Wednesday alone, spreads tightened by five to 10 basis points.

Select bonds issued by Ford Motor Co.: Year-to-date spread performance.

BondCliq Media Services

The bonds have actually seen net buying over the last 10 days heading into the earnings report.

Most active Ford Motor Co. issues with net customer flow (last 10 days).

BondCliQ Media Services

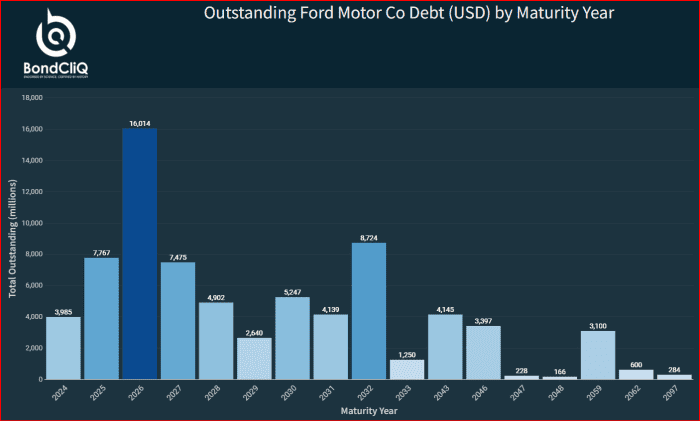

Ford’s outstanding debt totals about $143 billion, while the unsecured portion — Ford plus Ford Motor Credit — stood at $92 billion as of November, with maturities that stretch out to 2097.

Outstanding Ford Motor Co. debt (USD) by maturity year.

BondCliQ Media Services

Ford returned to the investment-grade market last November and pulled about $67 billion out of the high-yield market in a single day.

That came after S&P Global Ratings joined Fitch in upgrading the credit to investment grade.

See also: General Motors wows investors with quarterly revenue that’s about $4 billion above consensus