Identifying a singular driving theme proves challenging In today’s forex market. Japanese Yen made an attempt to rebound following BoJ Governor Kazuo Ueda’s post-meeting press conference, where he hinted at the potential of a future rate hike. However, this rebound was short-lived, and Yen soon reverted to its familiar tight trading range, indicating that the market is uncertain on when the anticipated rate move would happen. Dollar, despite being lower on the performance chart, is showing signs of gaining momentum against European majors as the market enters into the US session.

Australian Dollar is have broad gains, partly fueled by reports that China is considering a stock market rescue package. Though, Aussie remains confined within yesterday’s range against most currencies, except Euro and Canadian Dollar.

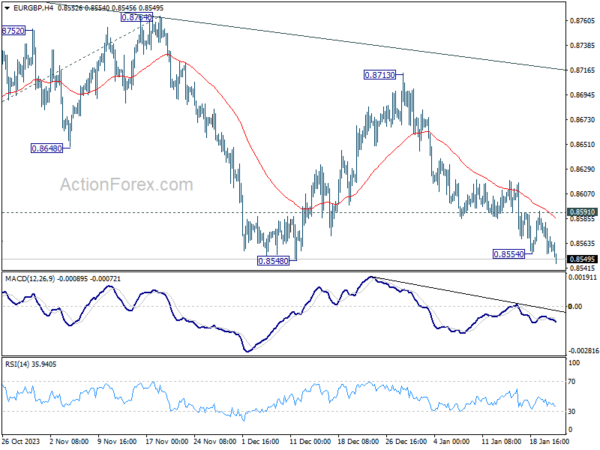

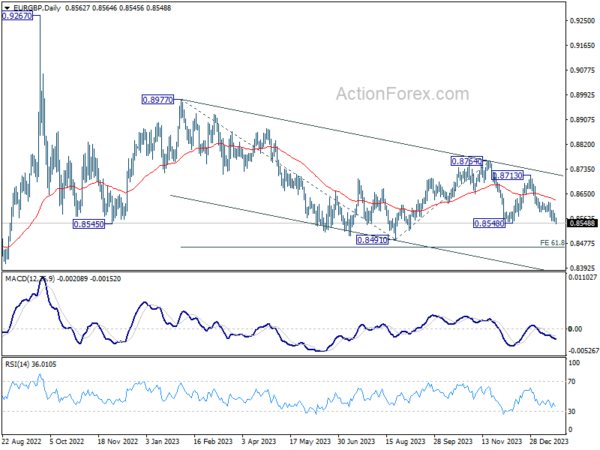

A more significant movement is observed in EUR/GBP, which has broken through last week’s low, extending its recent downtrend. This move could indicate that traders are positioning themselves ahead of tomorrow’s PMI data from Eurozone and UK, anticipating potential shifts in contrasting economic outlooks.

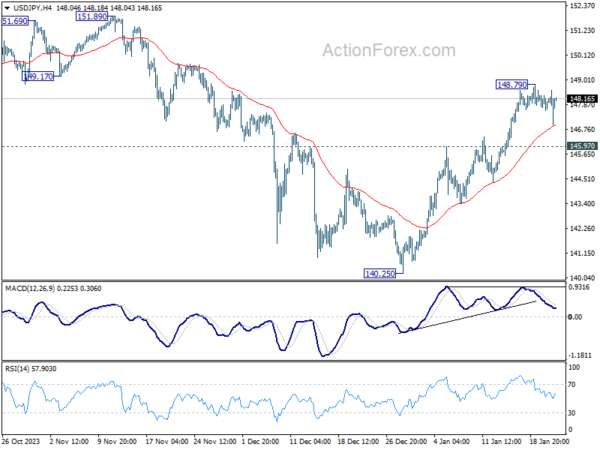

Technical, Yen pairs are seen as staying in consolidations only, despite today’s pull back. Near term outlook of Yen remains generally bearish. This view will continue to hold as long as 145.97 support in USD/JPY, 158.55 support in EUR/JPY, and 186.14 support in GBP/JPY hold.

In Europe, at the time of writing, FTSE is up 0.08%. DAX is up 0.08%. CAC is down -0.18%. UK 10-year yield is up 0.046 at 3.965. Germany 10-year yield is up 0.018 a 2.312. Earlier in Asia, Nikkei fell -0.08%. Hong Kong HSI rose 2.63%. China Shanghai SSE rose 0.53%. Singapore Strait Times fell -0.44%. Japan 10-year JGB yield fell -0.0168 at 0.637.

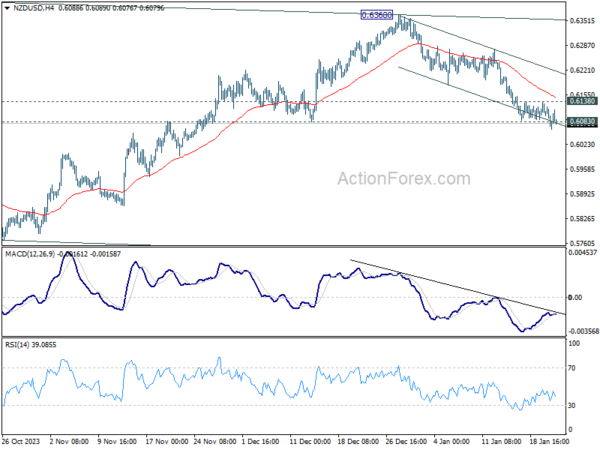

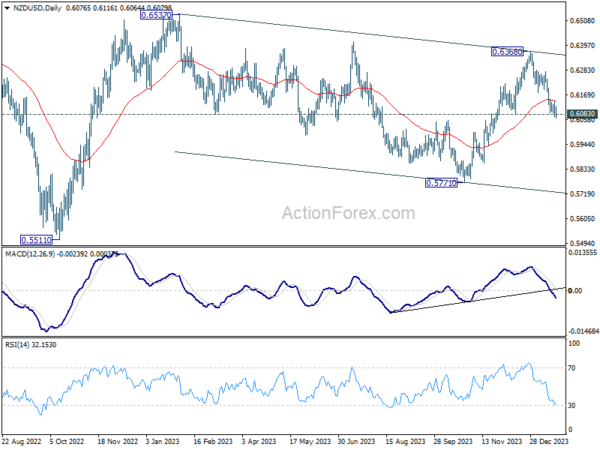

NZD/USD losing downside momentum as NZ CPI awaited

One of the spotlights will turn to New Zealand’s inflation data in the upcoming Asian session. Market are expecting quarterly CPI to rise 0.5% qoq in Q4, slowed from Q3’s 1.8% qoq. Annually, CPI is expected to fall from 5.6% yoy to 4.7% yoy.

Should these predictions materialize, the results would fall significantly below RBNZ’s forecast from the November Monetary Policy Statement, which projected 0.8% qoq and 5.0% yoy, although the annual rate remains well above 1-3% target band.

There is a divergence of opinions regarding RBNZ’s interest rate path this year. While some economists hold the view that OCR will remain at 5.50% through 2024, 2-year swap market is fully pricing in an OCR cut as early as May. Therefore, the inflation data set to be released tomorrow is poised to play a critical role in reshaping these rate cut expectations.

NZD/USD’s fall from 0.6368 lost much momentum after breaching 0.6083 support, but there is no sign of a rebound yet. Sustained break of 0.6083 will strengthen the case that this decline is the third leg of the corrective pattern from 0.6537, and target 0.5771 support next. Nevertheless, break of 0.6138 minor resistance will neutralize immediate bearishness, and bring recovery first.

BoJ’s Ueda elaborates on inflation and wages, hinting at future policy shifts

During his post-meeting news conference, BoJ Governor Kazuo Ueda confirmed that the economy is aligning with the central bank’s inflation projections, adding “our core-core inflation forecast is at 1.9%, very close to our 2% target”. This closeness, he explained, significantly contributes to BoJ’s growing confidence in sustainably achieving its price target.

However, Ueda acknowledged the challenges in quantifying the exact progress towards this goal. He pointed out that recent movements in service prices have been influenced by several one-off factors and that consumption weakness is impacting these prices. BoJ is analyzing these trends by separating such factors, and Ueda believes that, despite these complexities, “service inflation is gradually accelerating as a trend.”

Ueda also addressed the timing of monetary policy adjustments in relation to wage negotiations. He suggested that waiting for the outcome of wage talks across all firms, including smaller ones, would be impractical due to the extended timeframe this would require. BoJ, therefore, intends to use various economic indicators and data from hearings to predict wage trends. Ueda emphasized the influence of larger firms’ wage negotiations on smaller firms and the availability of data on smaller firms’ profit outlooks as potential early indicators.

BoJ holds steady, with CPI core-core projected at 1.9% in next two fiscal years

BoJ left monetary policy unchanged as widely expected. The forecast for fiscal 2024 CPI core was downgraded, whereas fiscal 2025 CPI core forecast saw a slight upgrade. Notably, CPI core-core forecasts for fiscal 2024 and 2025 were left unchanged at 1.9%, indicating a steady path towards achieving Japan’s 2% inflation target sustainably.

Under Yield Curve Control, BoJ kept short-term policy interest rate unchanged at -0.1%. Additionally, target for 10-year JGB yield remains around 0%, with an allowance for fluctuation below 1.0% upper bound. These decisions were made by unanimous vote.

BoJ noted, “Consumer inflation is likely to increase gradually toward the BoJ’s target as the output gap turns positive, and as medium- to long-term inflation expectations and wage growth heighten.” The central bank also acknowledged the growing “likelihood” of realizing this outlook, albeit with an emphasis on the continued “high uncertainties” surrounding future developments.

In the median economic projections:

- Fiscal 2023 GDP growth at 1.8% (down from October’s 2.0%).

- Fiscal 2024 GDP growth at 1.2% (up from 1.0%).

- Fiscal 2025 GDP growth at 1.0% (unchanged).

On the inflation front:

- Fiscal 2023 CPI core at 2.8% (unchanged).

- Fiscal 2024 CPI core at 2.4% (down from 2.8%).

- Fiscal 2025 CPI core at 1.8% (up from 1.7%).

- Fiscal 2023 CPI core-core at 3.8% (unchanged).

- Fiscal 2024 CPI core-core at 1.9% (unchanged).

- Fiscal 2025 CPI core-core at 1.9% (unchanged).

Australia’s NAB business confidence rises to -1 amidst slowing price growth

Australia NAB Business Confidence fell rose from -8 to -1 in December. However, Business Conditions fell from 9 to 7. The decline was observed across several key areas: Trading conditions dropped from 13 to 10, while Employment conditions also decreased slightly from 8 to 7. Profitability conditions remained steady at 6.

NAB Chief Economist Alan Oster noted that “confidence and conditions are softest in manufacturing, retail and wholesale,” attributing this to consumers cutting back on spending over time. Although there was a pickup in confidence within the retail sector in December, Oster expressed caution, stating that “it remains to be seen if this will be maintained.”

Another significant development was the sharp decline in price and cost growth. Labor cost growth eased to 1.8% in quarterly equivalent terms, down from 2.3%. Purchase cost growth also declined from 2.5% to 1.6%. Overall price growth slowed from 1.2% to 0.9%, with notable decrease in retail price growth from 1.8% to 0.6%.

Oster highlighted the significance of this decline in retail price growth, attributing it in part to the sales periods around Black Friday and Christmas. He remarked, “The marked fall in retail price growth in December… is nonetheless an encouraging sign that inflation may have eased at the end of the quarter.”

New Zealand BNZ services falls to 48.8, back in contraction

New Zealand BusinessNZ Performance of Services Index fell from 51.1 to 48.8 in December, back into contraction territory. This downturn also brings the index below long-term average of 53.4. The increase in negative sentiment is evident, with the proportion of negative comments rising from 54.0% to 58.7%. The primary concerns expressed by businesses revolve around seasonal factors, increasing costs of living, and an overall economic slowdown.

Breaking down the PSI, several key components showed declines. Activity and sales dropped from 48.7 to 47.1, employment fell from 50.6 to 47.5, and new orders/business dipped from 52.2 to 51.2. Additionally, stocks and inventories decreased from 55.0 to 51.5, while supplier deliveries also saw a reduction from 52.8 to 50.5.

Stephen Toplis, BNZ’s Head of Research noted that the softening in PSI, combined with the previously reported weakness in Performance of Manufacturing Index, paints a concerning picture for New Zealand’s near-term economic growth and employment. While tourism has been a critical driver for the services sector and is expected to continue supporting the economy, Toplis emphasized that it cannot solely bear the burden of economic revitalization.

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8550; (P) 0.8568; (R1) 0.8580; More…

EUR/GBP’s break of 0.8548/54 indicates down trend resumption. Intraday bias is back on the downside. Next target is 0.8491 low, and then 0.8464 projection level. On the upside, above 0.8591 minor resistance will turn intraday bias neutral and bring consolidations again.

In the bigger picture, fall from 0.8764 is seen as another leg in the whole down trend from 0.9267 (2022 high). Outlook will stay bearish as long as 0.8713 resistance holds. Break of 0.8491 will target 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Dec | 48.8 | 51.2 | 51.1 | |

| 00:30 | AUD | NAB Business Conditions Dec | 7 | 9 | ||

| 00:30 | AUD | NAB Business Confidence Dec | -1 | -9 | ||

| 03:09 | JPY | BoJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Dec | 6.8B | 11.2B | 13.4B | 12.8B |

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.00% | 0.00% | -0.20% | |

| 15:00 | EUR | Eurozone Consumer Confidence Jan P | -14 | -15 |