Cash pouring into India from its watershed inclusion into key global bond indexes is already reshaping markets in a country long keen to insulate itself from hot money flows.

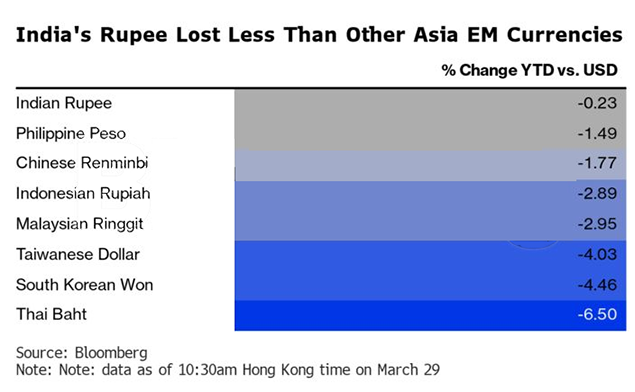

Foreign investors have pumped roughly 780 billion rupees ($9.4 billion) into eligible sovereign bonds since JPMorgan Chase & Co’s landmark announcement in September and are beginning to climb up the ownership list. Corporate bonds are outperforming peers, foreign exchange reserves hit a record high and the rupee has shrugged off the impact of a broad strengthening in the dollar.

Here are some charts showing the state of play in Indian markets ahead of the key index change at the end of June.

“This is a significant event. The long-awaited inclusion of India in the index should open the door for increased participation by foreign investors,” said Chidu Narayanan, head of the macro strategy Asia-Pacific at Wells Fargo & Co. Inflows of roughly $25 billion for Indian bonds by the middle of next year are set to support the rupee, he said.

The flood of money has helped Indian Fully Accessible Route bonds, known as FAR for short and set to join the gauges, to return 2.76% this year in dollar terms, data compiled by Bloomberg show. They have outperformed a global index of emerging sovereign debt as well as a gauge of corporate and sovereign notes in emerging Asia.

The inflows have helped make them one of the best performers in local currency emerging market government debt in 2024.

“You’re seeing a bit of frontrunning,” ahead of the June deadline, said Radhika Rao, senior economist at DBS Group Holdings Ltd. “The bulk of the flows is still to come, which we think will come as the inclusion starts” and when the JPMorgan index reflects the full 10% weight for India toward the end of the year.

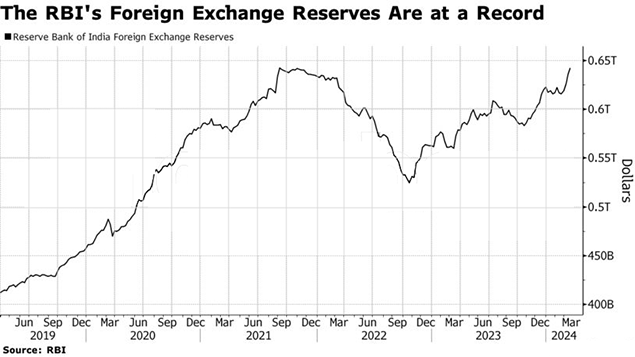

One outcome of the big inflows has been accelerated intervention by the Reserve Bank of India, which has been buying the incoming dollar flows, resulting in its foreign reserves rising to a record $642.5 billion. The intervention is largely aimed at shielding the rupee from volatile moves.

The Reserve Bank of India stepped up purchases in recent weeks, buying a total of $20 billion since the start of February, according to Bloomberg Economics.

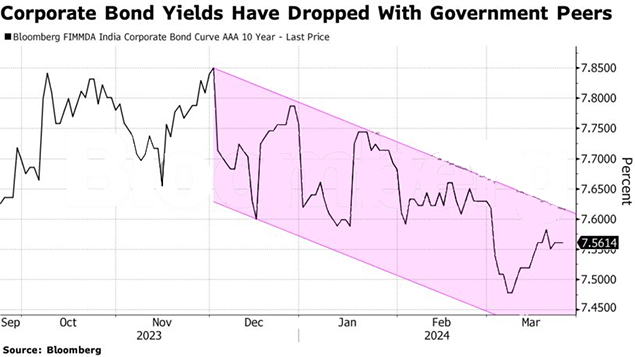

Corporate bonds have also benefited from flows into government debt as the former is largely priced off sovereign notes. The yield on top-rated 10-year notes has declined about 30 basis points since the index announcement.

Bloomberg Index Services Ltd will also include some Indian bonds in its emerging market local currency index starting next year. Bloomberg LP is the parent company of Bloomberg Index Services Ltd, which administers indexes that compete with those from other service providers.