Exchange-traded currency derivatives thrived in India for over a decade, fueled by retail investors and proprietary traders. Then the central bank broke up the party.

Until recently, traders were betting freely on the rupee’s rise and fall without holding underlying assets. A rule that allowed transactions of up to $100 million without providing proof of an actual foreign-currency exposure had been interpreted by them as tacit acceptance of speculative trade by the authorities.

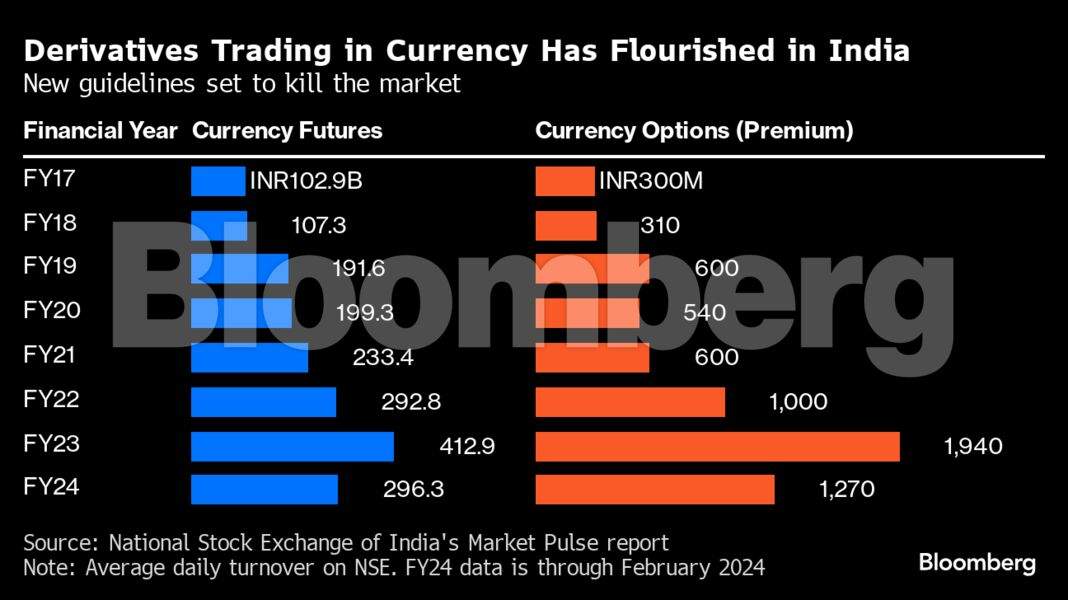

A booming market where volumes had reached $5 billion per day was dealt a body blow by the Reserve Bank of India late March after it reaffirmed a rule that permits the use of rupee forex derivatives only for the purpose of hedging. The directive effectively ousts traders and speculators who comprise the bulk of the volume.

The episode highlights the uncertainty around regulations and their interpretation in India, and undermines the nation’s image as a hot investment destination. Foreigners have been flocking to the country’s equities, lured by its high-growth prospects, and have been putting billions in sovereign debt ahead of the inclusion in global bond indexes.

“There seems to be some disconnect between what the regulator thought was very clearly mentioned in the laws and how the market perceived it,” said Smrithi Nair, partner at Juris Corp., a legal advisory firm. “This sort of confusion creates a negative image at a global level for India as a jurisdiction.”

The RBI contends that its regulations have always required participants in the exchange-traded currency derivatives market to have an actual exposure. Deputy governor Michael Patra, in unusually strong comments on April 5, said that some users have been “misusing” the facility.

Traders argue that the market’s understanding was that underlying exposure wasn’t required for deals below $100 million.

Unhedged trades continued even after a January circular by the RBI asked exchanges to inform traders that they must ensure the existence of a valid contract for all trades and be prepared to produce it when required. The circular had set April 5 as the date for the new rules to kick in.

The directive didn’t sink in until later. Only at the last minute did most brokers and industry bodies rush to seek clarification from regulators and exchanges.

The markets watchdog didn’t receive any formal representation from the industry until late March, according to a person familiar with the matter. It forwarded a petition from the brokers’ association to the RBI as the latter oversees foreign-exchange management, the person said.

The exchanges reaffirmed the RBI’s January circular on April 1 — days before the deadline — catching several traders offguard with unhedged positions.

Open interest in the rupee currency futures has shrunk by more than half since end-March, while premiums on some contracts in the options market surged more than 200%.

Zerodha Broking Ltd. warned its clients to close open positions and cautioned about liquidity drying up. The RBI has delayed the implementation of the rule to May 3, while saying there’s no change in its regulatory approach.

The authority hasn’t spelt out the intent behind the move, but some analysts say it aligns with the broader aim of reducing swings in the currency market. The RBI has used its record forex reserves to keep the rupee’s volatility the lowest in emerging markets.

“It’s a surprise move when the country’s economy is the fifth largest, has robust forex reserves and the currency volatility is well managed,” said Ashish Barua, a former banker and a trader in rupee derivatives on the National Stock Exchange, India’s largest bourse.

Barua said he was forced to exit his positions at a loss, and now plans to shift to equity and commodity derivatives.

While currency derivatives are overseen jointly by the markets regulator and the RBI, it’s unclear how the gap between the market’s interpretation of the rules and the regulator’s assertion of them persisted for so long, given that proprietary deals made up two-thirds of the volumes on the NSE.

“I would say it’s misunderstanding on the part of the market participants because of the way Indian foreign exchange management works,” NSE’s Chief Executive Officer Ashish Kumar Chauhan told Bloomberg Television on April 8. “And there are lots and lots of circulars and everything needs to be read together.”

Still, the unintended consequence could be the drying up of volumes, leaving genuine hedgers with fewer counterparties and likely driving them to costlier over-the-counter markets.

“Any market requires all kinds of participants including arbitrageurs, speculators and hedgers,” said Narinder Wadhwa, chief executive at SKI Capital, who was leading the Commodity Participants Association of India’s communication with the RBI. “These players give you good liquidity and create a market for hedgers. There is nothing bad about it.”