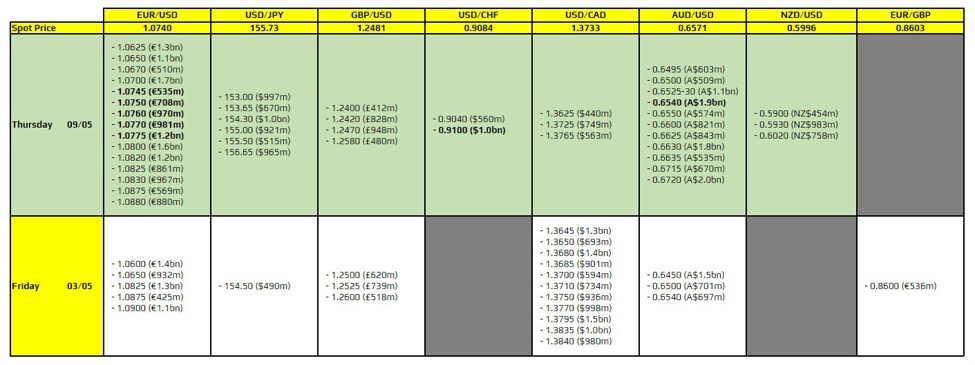

There are a couple to take note of on the day, as highlighted in bold.

The first is a range of expiries for EUR/USD from 1.0745 through to 1.0775. That is likely to help lock price action from running too far to the topside on the day. That alongside the 100-hour moving average at 1.0758 currently. The pair is trading rangebound in between that and its 200-hour moving average at 1.0730 for now.

Then, there is one for USD/CHF at the 0.9100 level. That could help to keep price action more compact as well, with the overall dollar mood at least still more tepid for now.

And lastly, there is one for AUD/USD at the 0.6540 level. That said, it isn’t one that holds much technical significance. The 100-day moving average for the pair at 0.6576 remains the one to watch on the daily chart. But the pair is also seeing its 200-hour moving average at 0.6563 being a key near-term support level in play. That was what held the drop yesterday and will be one to watch in the session ahead as well.

However, should AUD/USD break below that, we could see the expiries layered around 0.6525-40 help to limit any downside – at least before rolling off later in the day.

For more information on how to use this data, you may refer to this post here.