By RoboForex Analytical Department

The GBP/USD pair is currently consolidating, hovering around the 1.2631 mark. This consolidation phase follows recent reports highlighting a slowdown in the expansion plans of British businesses for workforce and wage growth, raising concerns about future economic dynamics and inflationary pressures.

A key report from the Lloyds Bank Business Barometer indicates a noticeable dip in the hiring outlook among companies. The differential between firms looking to hire and those planning cuts fell to 27% from a peak of 36% in February. This level is only slightly above the long-term average of 22%. Moreover, there has also been a marginal decline in the proportion of businesses anticipating wage increases in the next year.

Despite these trends, Bank of England (BoE) data provides a somewhat optimistic outlook, showing that British borrowers manage the high-interest environment relatively well. The incidence of problematic debt remains significantly lower than levels seen following the 2008 financial crisis, underscoring the resilience of the UK’s economic system and indicating signs of GDP recovery.

Catherine Mann, a member of the BoE’s Monetary Policy Committee, has called for a more realistic assessment of monetary policy expectations, suggesting that market predictions for substantial interest rate cuts by the BoE might be overly optimistic. Current market sentiment suggests a high probability of a rate reduction at the BoE’s August meeting.

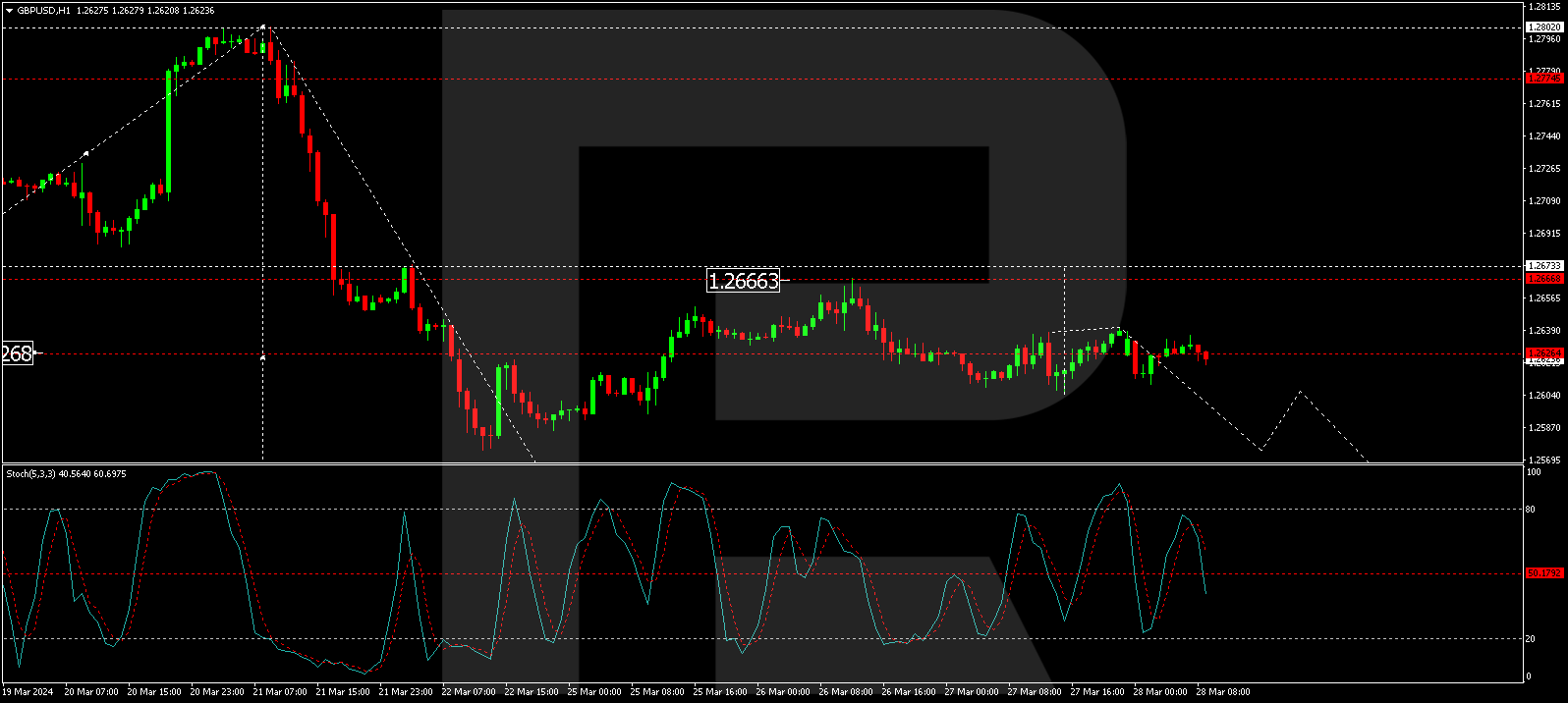

Technical analysis of GBP/USD

The H4 chart analysis for GBP/USD shows ongoing consolidation around 1.2626. A breakout above this range could signal a potential corrective rise to 1.2700. Conversely, a move below this level may indicate a downward trend towards 1.2450 as an initial target. A potential correction to 1.2626 could follow, with a possible further decline to 1.2355. The MACD oscillator’s position below zero supports the possibility of continued downward movement.

On the H1 chart, the pair is forming a consolidation range around 1.2626, with no definitive trend. An upward breakout might lead to a corrective move towards 1.2676, while a downward breakout could signal the continuation of a decline to 1.2545 and potentially to 1.2450. The Stochastic oscillator, currently below 80 and trending downwards, aligns with the likelihood of a continued decline.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- GBP Consolidates Amid Concerns Over Economic Growth and Wage Trends Mar 28, 2024

- The Australian and German indexes set all-time highs. The Reserve Bank of South Africa kept the rate at 8.25% Mar 28, 2024

- Target Thursdays: EURGBP, GBPUSD & Crude hit targets! Mar 28, 2024

- EURSEK: Hits fresh 2024 high at 200-day SMA Mar 27, 2024

- Australia has seen a decline in inflationary pressures. Japan may conduct currency intervention shortly Mar 27, 2024

- Australian Dollar Slides to Three-Week Low Mar 27, 2024

- Trade restrictions between the US and China are intensifying. Japan’s currency diplomats talk about possible intervention to support the yen Mar 26, 2024

- Japanese Yen Awaits Intervention Amid Weakness Mar 26, 2024

- NETH25 index chasing new record highs! Mar 26, 2024

- Stocks: What to Make of All This Insider Selling Mar 25, 2024