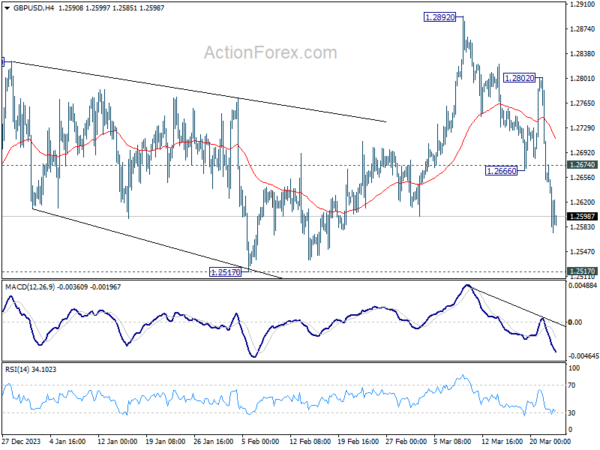

GBP/USD’s fall from 1.2892 accelerated lower last week, despite interim rebound. Initial bias stays on the downside this week for 1.2517 support. Decisive break there will suggest that rise from 1.2036 has completed at 1.2892 already, and turn near term outlook bearish On the upside, above 1.2674 minor resistance will turn intraday bias neutral first.

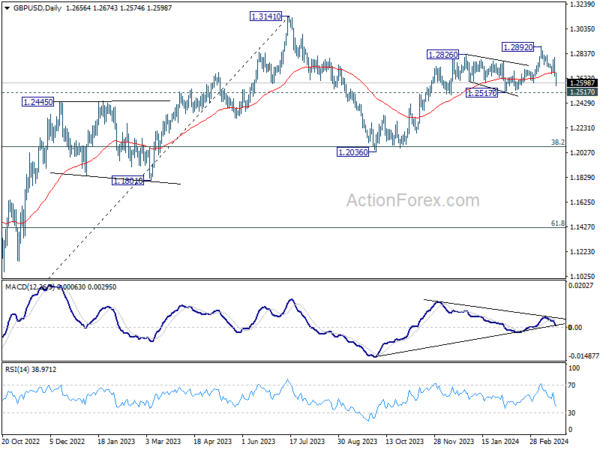

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which might still be in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

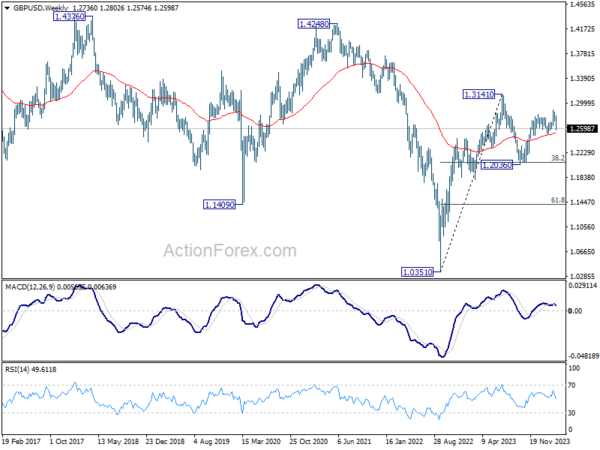

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.