- GBPUSD generates fresh 2024 peak

- But declines sharply towards the 50-day SMA

- Momentum indicators weaken significantly

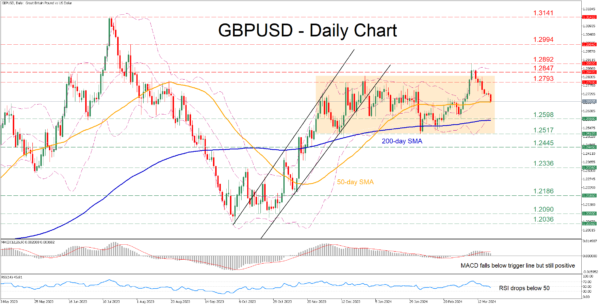

GBPUSD has been stuck in a rangebound pattern since mid-November, unable to adopt a clear directional impetus. Although the pair exploded higher and posted a fresh seven-month high after conquering the 50-day simple moving average (SMA), it quickly reversed back within its neutral structure.

Should bearish pressures persist, the pair could violate the 50-day SMA and challenge the March support of 1.2598, which lies very close to the 200-day SMA. A dive below that region could open the door for the 2024 low of 1.2517. Further declines could then cease at 1.2445, a region that provided both support and resistance throughout 2023.

On the flipside if the pair reverses back higher, the December resistance of 1.2793 could prove to be the first barricade for the price to overcome. Surpassing that zone, the price may test the June 2023 peak of 1.2847. Even higher, the recent seven-month peak of 1.2892 could come under scrutiny.

In brief, GBPUSD remains a prisoner within its sideways range as its latest upward spike encountered solid resistance. Therefore, the technical picture could deteriorate further in case of a downside violation of the 50-day SMA.