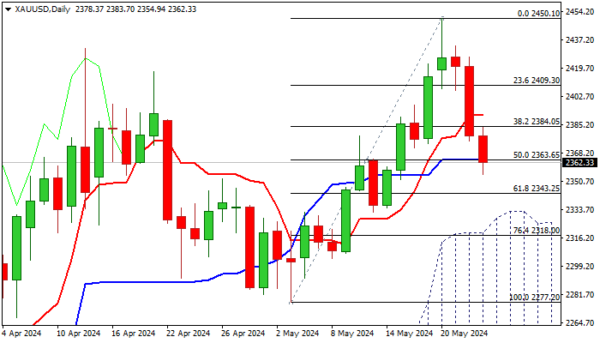

Gold price remains in red for the third straight day and fell to the lowest since May 15 during early European session on Thursday, in extension of Wednesday’s 1.75% drop.

Fed minutes, released late Wednesday, showed that the US central bank believes that inflation will cool further over the time, but left the door open for possible further tightening, if conditions worsen.

Markets saw the latest message from the US policymakers as hawkish signal, which raised demand for dollar and deflated the yellow metal’s price.

Fresh dips weakened near-term structure, but overall picture remains overall bullish on daily chart and suggesting that pullback from new record high ($2450, posted on May 20) would mark a healthy correction before bulls regain full control.

Strong supports at $2343/32 (Fibo 61.8% of $2277/$2450 upleg / top of thick daily Ichimoku cloud) should contain dips and keep near-term action biased higher, though return above pivots at $2391/$2400 (daily Tenkan-sen / psychological) will be required to confirm.

Conversely, loss of $2343/32 handles would open way for deeper correction and expose next targets at $2318/$2300 (Fibo 76.4% / psychological) guarding key near-term supports at $2277/72 (May 3 low and floor of recent consolidation range (Fibo 38.2% of $1984/$2450 uptrend).

Only firm break here would sideline larger bulls and generate initial reversal signal on completion of a double-top pattern ($2431/50).

Res: 2391; 2400; 2413; 2433.

Sup: 2343; 2332; 2300; 2277.