Electronic trading major IG Group Holdings plc (LON:IGG) today announced its results for the six months ended 30 November 2023 (“H1 FY24”).

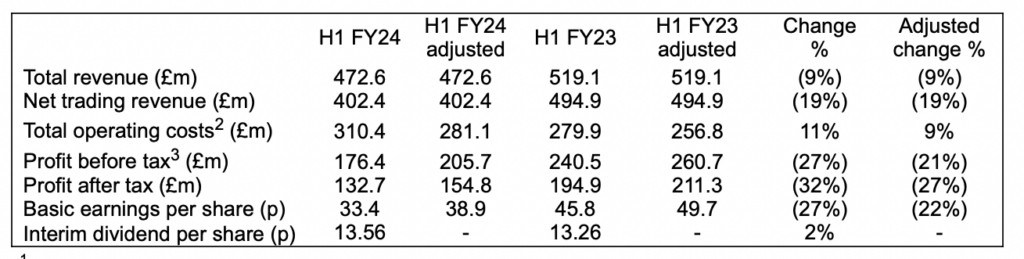

Total revenue was £472.6 million in H1 FY24, down 9% on H1 FY23. OTC derivatives total revenue was £352.6 million, down 17% reflecting softer market conditions in the period, and lower levels of client activity.

Exchange traded derivatives total revenue was £99.7 million, up 19% on the prior period. This includes tastytrade total revenue of £94.3 million, up 21%, benefitting from both increased interest rates and higher cash balances, offset by a reduction in net trading revenues, down 5%.

Stock trading and investments total revenue was £20.3 million, up 63% on H1 FY23, benefitting from increased interest rates, while net trading revenue remained flat.

Non-OTC revenue made up 25% of total revenue in H1 FY24, up from 19% in H1 FY23 reflecting the continued focus and successful delivery of revenue diversification.

Net trading revenue was £402.4 million, 19% lower than H1 FY23 primarily due to lower levels of client activity as clients found fewer opportunities to trade in subdued market conditions.

Net interest income of £70.2 million (H1 FY23: £24.2 million) increased significantly, driven by higher interest rates across all markets.

The number of active clients was 296,300, compared with 312,000 a year earlier, while new clients acquired were 33,800 (H1 FY23: 37,500).

Adjusted total operating costs of £281.1 million (H1 FY23: £256.8 million), were up 9% on H1 FY23, but down 1% against H2 FY23. Statutory total operating costs of £310.4 million (H1 FY23: £279.9 million) increased 11%.

Adjusted profit before tax of £205.7 million (H1 FY23: £260.7 million) was down 21%. Statutory profit before tax of £176.4 million (H1 FY23: £240.5 million). Adjusted profit before tax margin remains attractive at 43.5% (H1 FY23: 50.2%).

Adjusted basic EPS was 38.9p (H1 FY23: 49.7 pence). Statutory basic EPS was 33.4 pence (H1 FY23: 45.8 pence).

IG expects to reduce headcount by approximately 300, which represents around 10% of the total workforce at the end of FY23. Alongside other efficiency measures, including expanding the use of IG’s global centres of excellence, the broker expects to deliver full run rate cost savings of £50 million per year. These initiatives are expected to drive operating margin expansion over the medium term.

IG says it is on track to deliver structural savings of £10 million in FY24, £40 million in FY25 and £50 million in FY26. The company anticipates non-recurring costs to achieve these savings of approximately £18 million with the majority incurred in FY24 and the remainder in FY25. £10 million of execution costs were incurred in H1 FY24.

In addition to the structural savings, in FY24 specifically, variable costs will be reduced by an additional £10 million reflecting the softer market conditions in the first half of the year.